A Very Dangerous Situation if Homeownership Continues to Falter

Good Morning!

It is not common knowledge, but homeownership in the United States is at a 51 year low. This is a frightening fact because the idea of homeownership is the foundation of the American Dream. There are many factors that have contributed to this fall off on homeownership. There is currenlty a large difference in what our two presidential candidates plan to do to stimulate the housing industry. Do your homework and vote wisely. It is a very dangerous situation if homeownership continues to falter. Here is a recent article from Realtor.com that talks about some of the conditions that are having an impact on homeownership.

It is not common knowledge, but homeownership in the United States is at a 51 year low. This is a frightening fact because the idea of homeownership is the foundation of the American Dream. There are many factors that have contributed to this fall off on homeownership. There is currenlty a large difference in what our two presidential candidates plan to do to stimulate the housing industry. Do your homework and vote wisely. It is a very dangerous situation if homeownership continues to falter. Here is a recent article from Realtor.com that talks about some of the conditions that are having an impact on homeownership.

Buying a home is hard enough these days as wannabe homeowners have to contend with a shortage of residences in some markets—along with ever-rising prices and plenty of drag-down, no-holds-barred competition. But guess what? It’s about to get even worse.

Builders and developers applied for fewer new-home construction permits in June, according to the U.S. Department of Commerce’s monthly new residential construction report. So get ready for a continuing decrease in the supply of new homes later this year and into the next. (It takes about six to nine months to complete a residence once a permit is secured.)

And, yes, that’s expected to drive prices up even higher.

The number of permits issued were down 15.4%, to just 114,000, in June compared with the same month a year earlier, according to the report. But before panic sets in, it’s helpful to realize that this was actually a 5.8% bump from May.

The numbers were not seasonally adjusted, meaning they weren’t smoothed out over a 12-month period to account for fluctuations.

The reason builders are holding off on putting up more homes is because they’re worried the number of buyers could drop off if the economy falters, says Jonathan Smoke, chief economist of realtor.com®.

“The presidential election poses a big wild card,” Smoke says. “At the same time, the world is teetering on entering a recession due to a number of factors, including most recently Brexit.”

It’s also important to note that those newly built abodes, often with state-of-the-art appliances and electronic systems, cost more than those which have been lived in—so developers have lots to lose if those properties don’t sell.

For example, the median price of a new home was $290,400 in May, according to the most recent Commerce data available. Existing (i.e., not new) homes went for a median of $239,700 in May, according to the National Association of Realtors®.It wasn’t just permits to build single-family homes that were down. Permits to put up sorely needed condo and apartment buildings, with five units or more, also dropped year over year by about 39.2%, to just 36,600 in June. But, on the bright side, the number was up nearly 4.9% from May.

“This environment is good for the landlord and property owner, but not so much for virtually everybody else,” Smoke says. “It’s going to be even harder to find an affordable place to rent than it has been.”

In a welcome bit of good news, June saw the completion of the greatest number of new residences over the past year, according to the report.

The number of finished abodes surged 16.5%, hitting 99,500 residences, in June compared with a year earlier, according to the report. It was also up 19% from May.

In addition, the number of completed condo and apartment buildings, with five units or more, were also up 14.5% from a year ago and 46.5% from May, according to the report.

But with permits down, the number of new homes hitting the market simply can’t—and won’t—continue.

“We’re just not seeing the growth in new construction that would be necessary to improve the shortage of apartments for rent and homes for sale,” Smoke says. So “we’re likely to see continued rent and home price increases.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

Price: $279,000 Beds: 3 Baths: 2 Sq Ft: 1586

Serene and secluded! Various beautiful trees provide privacy and great views. Features hardwood floor, two fireplaces, vinyl windows, ductless heat pump, built-in storage/shelves in home and in garage. Upstairs main level offers seclusion and mounta...View Home for Sale >>

1471 Barrington Ave

1471 Barrington Ave Home-buying is multi-tasking on steroids. Are you up for the challenge?

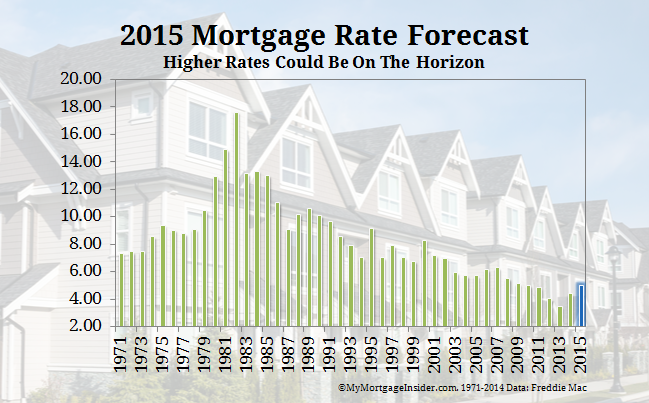

Home-buying is multi-tasking on steroids. Are you up for the challenge? For people who are in the process of buying a house, our best advice is to lock in your rate now. “This is the last call before the bar closes at these historically low levels,” said Jonathan Smoke, chief economist at realtor.com®.

For people who are in the process of buying a house, our best advice is to lock in your rate now. “This is the last call before the bar closes at these historically low levels,” said Jonathan Smoke, chief economist at realtor.com®. 775 N 8TH ST

775 N 8TH ST You're ready to make an offer on the home of your dreams. But before you do, make sure you're really ready. Ask yourself and your household members if this is the home for the next five or so years. Make sure everyone is on board with commitments to make it work, from putting off the dream vacation to putting in the elbow grease to clean, paint and do the yard work.

You're ready to make an offer on the home of your dreams. But before you do, make sure you're really ready. Ask yourself and your household members if this is the home for the next five or so years. Make sure everyone is on board with commitments to make it work, from putting off the dream vacation to putting in the elbow grease to clean, paint and do the yard work.  33970 VAN DUYN RD

33970 VAN DUYN RD Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers.

Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers. 48808 MCKENZIE HWY

48808 MCKENZIE HWY For most first-time buyers, it's better to accept that for dreams to come true, you have to do the groundwork. Yes, you will be far more independent than you would as a renter, but you will still have some very real responsibilities to make homeownership work. Here are the top three responsibilities you'll have as a homeowner.

For most first-time buyers, it's better to accept that for dreams to come true, you have to do the groundwork. Yes, you will be far more independent than you would as a renter, but you will still have some very real responsibilities to make homeownership work. Here are the top three responsibilities you'll have as a homeowner.