Mortgage Interest Rates & Their Impact on Your Monthly Payment

Good Monday Morning!

Do you ever wonder how mortgage interest rates effect your ability to purchase a home, your home payment and what you actually pay over the term of the home loan? The following will give you an idea as to just how much impact mortgage interest rates have.

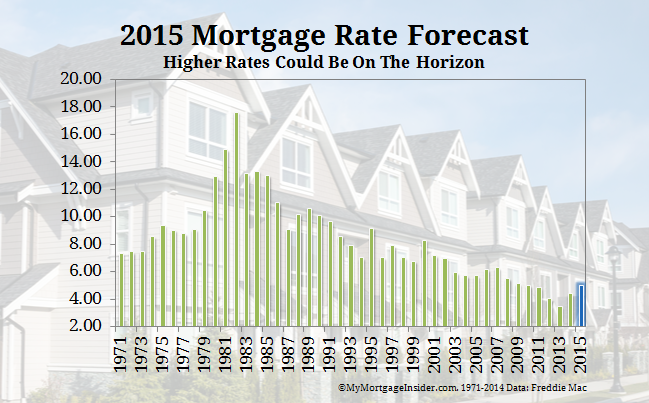

National average 30-year fixed rate mortgage interest rates have been under five percent for over five years. They should stay low forever, right?

Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers.

Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers.

To illustrate changing mortgage interest rates and their impact on your monthly payment, consider what a difference even a small dip and rise in interest rates means to you.

In December 2014, the median-priced home in the U.S. was $209,500, according to the National Association of REALTORS®. If you purchased this home for $200,000 and with 20 percent down and a benchmark fixed-rate mortgage with the December national average commitment rate of 3.86 percent (Freddie Mac), your payment would be $751.01 a month.

You'll make 360 total payments of $270, 362.59, with $110,362.59 in interest over the term of the loan.

The same home with the same loan on February 5 would be very different. The national average commitment rate is 3.59 percent, your payment is 726.53 and your total payments add up to $261,552.16 and 101,552.16 in interest.

The difference isn't much -- just under $25 a month and $8,810 in round numbers.

But what if interest rates go up as economists predict? The January 2015 outlook by Kiplinger's predicts that interest rates could go as high as 4.9 percent. What would your monthly payments look like then?

Your monthly payment would be $849.16, for a total of $305,698.59, and interest payments of $145,698.59, a difference of $122.63 monthly and $44,146.43 in interest by the end of the loan.

If you're interested in buying a home, mortgage rates are unlikely to stay low much longer. If you would like to see just how affordable a home purchase might be with the current low mortgage interest rates, please contact us. We would be more than happy to furnish you with a complete home purchase analysis. This costs nothing and there is certainly no obligation.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

48808 MCKENZIE HWY

48808 MCKENZIE HWY

Price: $225,000 Beds: 2 Baths: 2 Sq Ft: 1034

Riverfront retreat on 1.65 Acres! Enjoy river views spanning entire south side of property from large deck overlooking an island. Privacy from every direction! Sunlight floods into this updated home with 3 french doors. Relax in the master suite jet...

View this property >>