This Could Be The Strongest Market We See This Year

Good Monday Morning!

Home sales, both locally and nationally, are slowing again. After a short spurt of strong activity in our local Eugene and Springfield area, activity levels have once again slowed due to rising mortgage interest rates, high inflation, and a very sluggish economy. Even with all of this negativity, home sales remain better than you would anticipate. This certainly gives hope for a strong rebound if mortgage rates decline again and the economy strengthens. If you are considering a home sale, don't hesitate. Right now, this could be the strongest housing market we see this year. The following is a national housing market report from "Realtor.com."

Home sales slipped in March as mortgage rates rose.

Total existing-home sales dropped 4.3% from February, to a seasonally adjusted annual rate of 4.19 million in March, the National Association of Realtors® reported on Thursday. The March sales figure represented a 3.7% drop from one year ago. (Existing homes exclude new construction.)

A pullback in sales had been widely expected after mortgage rates ticked up, discouraging buyers.

Prices also kept climbing. The median price for existing homes was $393,500 in March, up 4.8% from the previous year to the highest it’s ever been for that month. Prices rose in all U.S. regions, climbing 9.9% in the Northeast, 7.5% in the Midwest, 6.7% in the West, and 3.4% in the South.

But in a silver lining for prospective homeowners, the number of existing homes for sale jumped 4.7% from February to 1.11 million units at the end of March, according to the report. The number of existing homes on the market was up 14.4% from a year ago.

Although high prices and rising interest rates remain challenges for homebuyers, any boost to housing inventory could provide some relief in a tight market where limited supply has been a persistent issue.

“More inventory is always welcomed in the current environment,” said NAR Chief Economist Lawrence Yun in a statement. “There are nearly six million more jobs now compared to pre-COVID highs, which suggests more aspiring home buyers exist in the market.”

It is still a “great time to list” as home prices continue to rise overall and sellers of midpriced properties still frequently receive multiple offers, Yun said.

Existing-Home Sales

Sales of existing homes pulled back in March, after interest rates climbed in late February.

First-time buyers made gains in March

First-time buyers were responsible for 32% of sales in March, up from 26% in February and 28% from a year ago, according to the NAR report.

The resurgence of first-time buyers could be due to a recent influx of lower-priced homes for sale, says Realtor.com® Chief Economist Danielle Hale.

"Despite climbing sales and list prices, Realtor.com data show that sellers are approaching the housing market with more realistic expectations this spring even as we approach the week that Realtor.com has identified as the best time to sell a home," says Hale.

Cash sales also declined last month, perhaps giving first-time buyers a better shot at seeing their offer accepted. All-cash sales accounted for 28% of transactions in March, down from 33% in February. But these sales were up from 27% one year ago.

Investors, who frequently pay all-cash, made up a smaller share of buyers last month. Individual investors or second-home buyers purchased 15% of homes in March. That was down from 21% in February and 17% in March 2023.

Mortgage rates poised to remain higher for longer

Thomas Ryan, a property economist with Capital Economics, says that March's sales slump "didn’t come as a huge surprise" given that mortgage applications and pending home sales both fell in the early months of the year due to rising mortgage rates.

"The fall in existing home sales in March was triggered by mortgage rates climbing," Ryan said in a note.

Mortgage rates averaged 6.82% in March for 30-year fixed loans, according to Freddie Mac.

They rose to 7.1% for 30-year fixed loans in the week ending April 18 after hotter-than-expected inflation data for March tempered expectations of a Federal Reserve rate cut anytime soon.

"Prospective home buyers face a challenging—and confusing—housing market. Mortgage rates, which had been expected to fall in 2024, have inched up close to 7% and seem poised to remain higher for longer," said Bright MLS Chief Economist Lisa Sturtevant in a market commentary. "Inventory has started to increase, but the market is still competitive with sellers still getting multiple offers."

Sturtevant projected that "home sales activity could remain a bit downbeat this spring." However, she anticipates sales will likely pick up over the rest of the year.

Have An Awesome Week!

Stay Healthy! Stay Safe! Remain Positive! Trust in God!

THIS WEEKS HOT HOME LISTING!

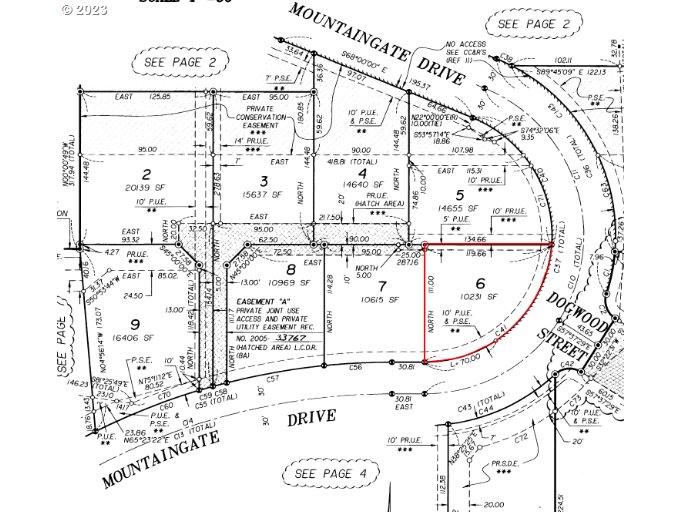

766 S 47th Pl, Springfield, OR

Price: $899,900 Beds: 3 Baths: 2.5 Sq Ft: 2840

This beautifully updated home is nestled on a private ? acre lot with filtered views through the trees. Designed for either main level living or a great setup for separation of space with additional bedrooms and a bonus room upstairs and a large fam...View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!