Good Monday Morning!

In the Eugene and Springfield area, the housing market has become very tight for first-time home buyers. Lack of inventory, rising home prices, and now, increased mortgage interest rates have made the home search for first-time buyers even more difficult than it has over the past several years. This trend is not something that is just specific to Eugene and Springfield. The following article from "Realtor.com" addresses this national problem.

Soaring home prices and the shortage of properties on the market are taking a toll on buyers, particularly first-time buyers.

The share of first-time homeowners fell to just 29% of all existing home buyers in January, according to the most recent National Association of Realtors® report. That's down from 32% in December and 33% in January 2017.

The share of first-time homeowners fell to just 29% of all existing home buyers in January, according to the most recent National Association of Realtors® report. That's down from 32% in December and 33% in January 2017.

"First-time buyers are typically people with a tighter budget," says realtor.com® Senior Economist Joseph Kirchner, who worries this could further depress homeownership rates down the line. "They're looking for homes on the more affordable end of the market, but that is where the lack of homes is most severe."

Nationally, the dearth of inventory also drove down the number of existing homes sold, 5.38 million overall, in January. (Existing homes have previously been lived in.) Monthly sales dropped 3.2%, while annual sales decreased 4.8%.

(Realtor.com looked only at the seasonally adjusted numbers in the report. These have been smoothed out over 12 months to account for seasonal fluctuations.)

“There’s plenty of demand, but people just cannot find a home on the market that meets their needs and they can afford," Kirchner says. "It’s not a good start for the spring market. The shortage will continue.”

Across the country, there were 15.5% fewer existing homes in January selling for $250,000 or less compared with a year ago. Meanwhile, there were 25% more selling for $500,000 or more.

In January, sales of single-family homes, which are often the most sought-after properties, hit 4.76 million. That's a 3.8% fall from December and 4.8% from the same month a year earlier.

Condos and co-ops fared a bit better, as they're generally priced a little lower than single-family homes, with the number of monthly sales rising 1.6% in January to hit about 620,000. But that's down 4.6% from January 2017.

The median existing home price was $240,500 in January. That was a 2.4% drop from December but represented a 5.8% jump from January of the previous year. However, the cost was still substantially less than the median price of a newly constructed abode.

New homes cost a median $335,400 in December, according to the most recent joint report by the U.S. Census Bureau and U.S. Department of Housing and Urban Development. That's nearly 39.5% more than an existing home.

Around the country, higher prices and the lack of inventory took its toll. In January, the South had the most existing home sales, at about 2.26 million. However, that was still down 1.3% from December and was a 1.7% drop from January 2017.

The Midwest had the second most home sales, at 1.25 million, in January. That was down 6% from December and 3.8% lower than the same month last year.

There were 1.14 million existing homes sold in the West. That was a 5% drop from the previous month and a 9.5% fall from the previous year.

The Northeast had the fewest existing home sales, at just 730,000. That was also down, both by 1.4% month-over-month and 7.6% year-over-year.

Meanwhile, prices of existing homes were up in every region. They were the most expensive in the West, at a median $362,600 in January. That was a 8.8% jump over January 2017.

In the Northeast, median prices hit $269,100, up 6.8% annually. In the South, they were $208,200, up 4.3%, and in the Midwest, they were $188,000, up 8.7%.

In January, sales of single-family homes, which are often the most sought-after properties, hit 4.76 million. That's a 3.8% fall from December and 4.8% from the same month a year earlier.

Condos and co-ops fared a bit better, as they're generally priced a little lower than single-family homes, with the number of monthly sales rising 1.6% in January to hit about 620,000. But that's down 4.6% from January 2017.

The median existing home price was $240,500 in January. That was a 2.4% drop from December but represented a 5.8% jump from January of the previous year. However, the cost was still substantially less than the median price of a newly constructed abode.

New homes cost a median $335,400 in December, according to the most recent joint report by the U.S. Census Bureau and U.S. Department of Housing and Urban Development. That's nearly 39.5% more than an existing home.

"It’s very clear that too many markets right now are becoming less affordable and desperately need more new listings to calm the speedy price growth," NAR Chief Economist Lawrence Yun said in a statement.

Have an awesome week!

THIS WEEK'S HOT HOME LISTING!

Vineyard Hill Dr

Vineyard Hill Dr

Price: $230,000 Type: Bare Land Acres: 5

In The Vineyards! Gated entry, paved access, gorgeous views with meadow and trees. Great solar exposure potential for vineyard ground. Additional 6 acres to be deeded upon completion of approval for adjacent property.... View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!

6997 GLACIER DR

6997 GLACIER DR

6997 GLACIER DR

6997 GLACIER DR

Home buyers looking for a bargain should brace themselves for some serious disappointment.

Home buyers looking for a bargain should brace themselves for some serious disappointment.

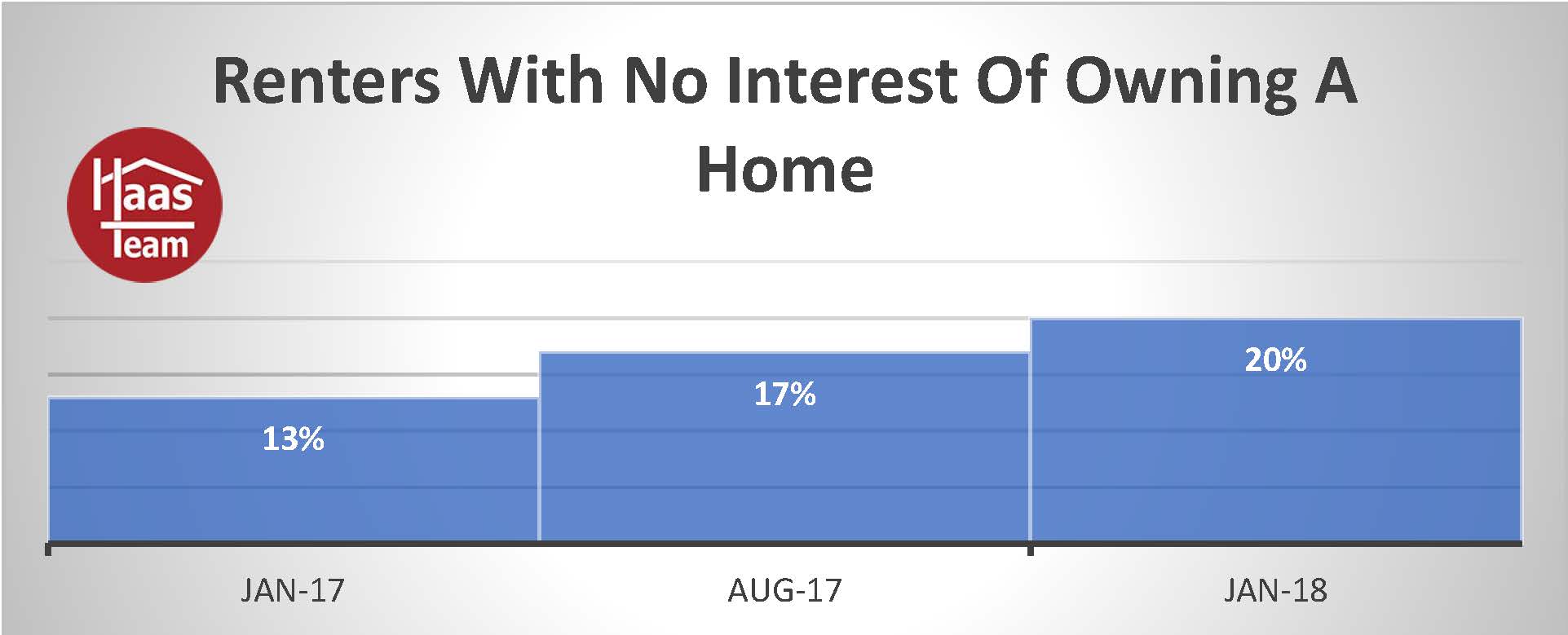

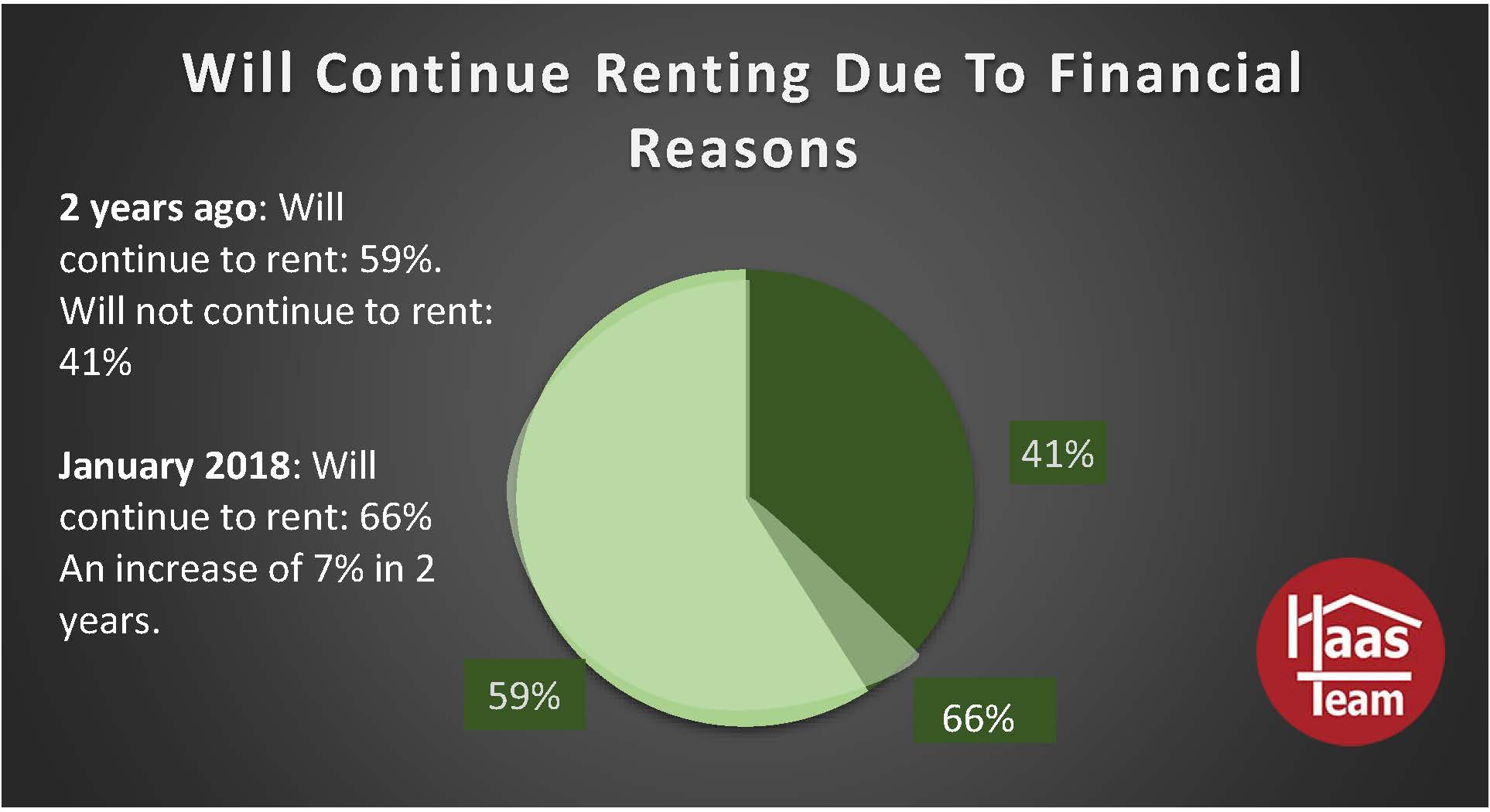

Rents have crept up in most communities just as home prices have. In fact in many areas rents have increased at a higher rate than home prices. I find today that many of the renters are paying more money to rent than they would be spending on a home payment. By renting they are also losing out on some great opportunities such as depreciation and interest tax deductions. Renters are also just making the landlords payments and not building equity. Long term the buidling of equity in a home is one of the greatest wealth building opportunities for most people. The followng is an article from "Realtor.com" on a recent study of the current trend towards renting.

Rents have crept up in most communities just as home prices have. In fact in many areas rents have increased at a higher rate than home prices. I find today that many of the renters are paying more money to rent than they would be spending on a home payment. By renting they are also losing out on some great opportunities such as depreciation and interest tax deductions. Renters are also just making the landlords payments and not building equity. Long term the buidling of equity in a home is one of the greatest wealth building opportunities for most people. The followng is an article from "Realtor.com" on a recent study of the current trend towards renting. “Housing is becoming less and less affordable. Renting is perceived to be the more affordable housing option,” said David Brickman, an executive vice president at Freddie Mac and head of its multifamily division.

“Housing is becoming less and less affordable. Renting is perceived to be the more affordable housing option,” said David Brickman, an executive vice president at Freddie Mac and head of its multifamily division. 88107 Keola Ln

88107 Keola Ln The share of first-time homeowners fell to just 29% of all existing home buyers in January, according to the most

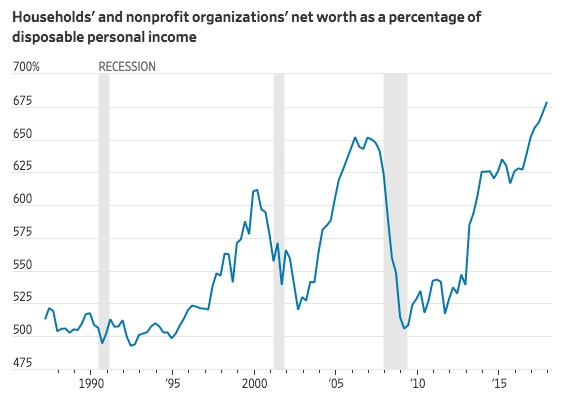

The share of first-time homeowners fell to just 29% of all existing home buyers in January, according to the most  Yes, our national economy is taking off. Wages are up, employment is up and many economists say that this is just the beginning of a long improvement. The value of homes across the nation have steadily increased since the recession and have added to a large increase in national wealth.

Yes, our national economy is taking off. Wages are up, employment is up and many economists say that this is just the beginning of a long improvement. The value of homes across the nation have steadily increased since the recession and have added to a large increase in national wealth.

One of the largest problems that comes about during a home sale is the fact that there are typically seller paid repairs that need to be done. The majority of buyers are going to want both a pest and dry rot inspection and a whole home inspection completed as part of their purchase due diligence. From this inspection, there are typically some repair items that will come about and in most cases the buyer will want many of them taken care by the seller prior to the close of escrow. Negotiating these repairs during escrow can be nerve racking and can also sometimes create delays with closing. My suggestion to all of my sellers is to have their home inspected before we go on the market. This gives us a heads up for any potential issues and also allows the seller to repair major problems. Typically, this creates a much easier sale process. The followiong is and article from "US News" on why having a professional inspection prior to selling is a good thing to do.

One of the largest problems that comes about during a home sale is the fact that there are typically seller paid repairs that need to be done. The majority of buyers are going to want both a pest and dry rot inspection and a whole home inspection completed as part of their purchase due diligence. From this inspection, there are typically some repair items that will come about and in most cases the buyer will want many of them taken care by the seller prior to the close of escrow. Negotiating these repairs during escrow can be nerve racking and can also sometimes create delays with closing. My suggestion to all of my sellers is to have their home inspected before we go on the market. This gives us a heads up for any potential issues and also allows the seller to repair major problems. Typically, this creates a much easier sale process. The followiong is and article from "US News" on why having a professional inspection prior to selling is a good thing to do. As we approach the Holidays, many people are focused on other things besides buying and selling homes. This can certainly work in your favor if you are a home buyer. The following is an article from "

As we approach the Holidays, many people are focused on other things besides buying and selling homes. This can certainly work in your favor if you are a home buyer. The following is an article from "

Why would sellers deliberately sabotage their chances of selling their homes? It doesn't make any sense, yet it happens all the time.

Why would sellers deliberately sabotage their chances of selling their homes? It doesn't make any sense, yet it happens all the time. Price: $529,000 Beds: 4 Baths: 4 Half Baths: 1 Sq Ft: 5,568

Price: $529,000 Beds: 4 Baths: 4 Half Baths: 1 Sq Ft: 5,568