Here's Why You Don't Want To Wait

Good Monday Morning!

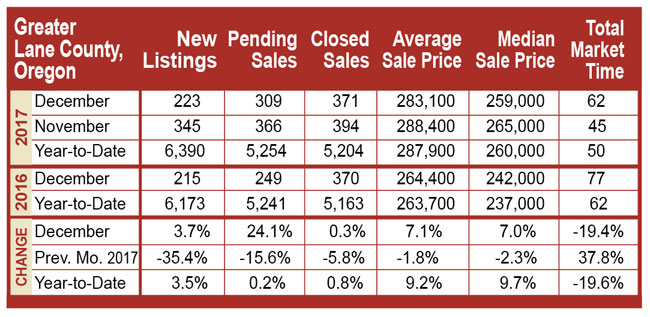

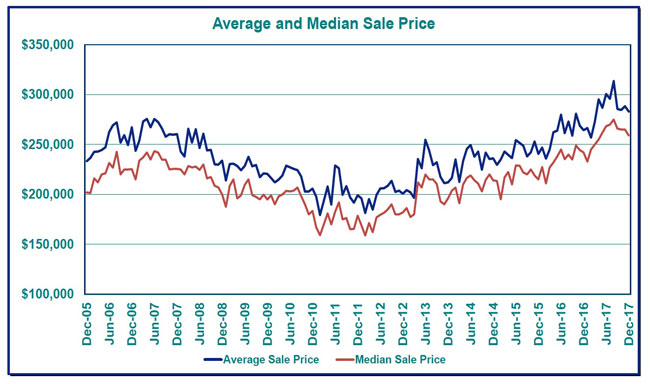

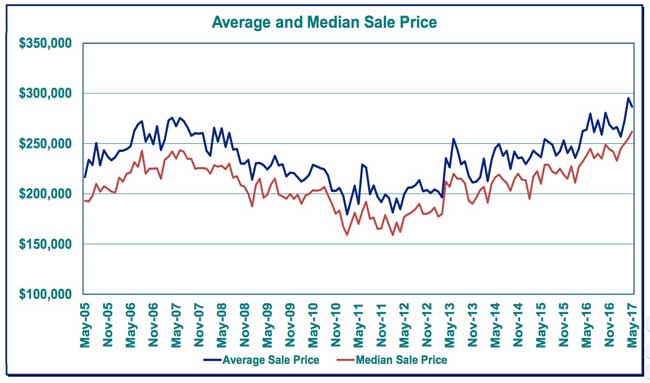

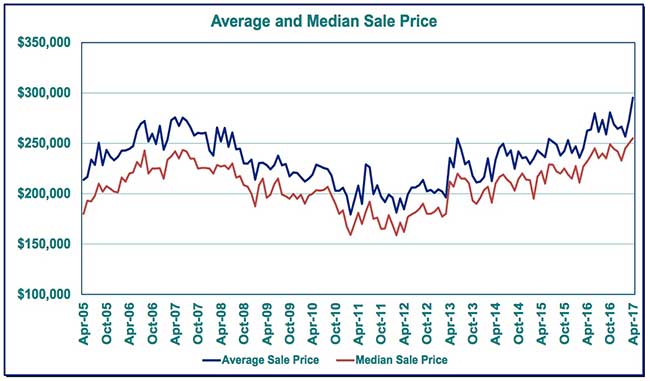

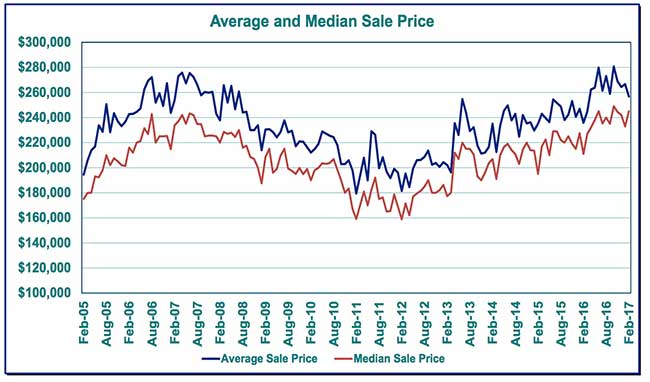

Both the national and local housing markets are very interesting to watch right now. Mortgage interest rates have just recently taken a large drop and are now hovering at just over 4%. Mortgage rates are predicted to stay low and we may even see a further decline in rates ahead. Typically, a decrease in mortage rates is followed by an increase in home sales activity. This could take place, but nationally we saw a significant decrease in the number of home sales in Febraury. Home sales have been trending downwards and the mortgage interest rate decline could slow or even put a stop to the home sale trend. Locally, home sales have slowed and the housing market in the Eugene and Springfield area feels to be very fragile. One of the largest concerns for our local market is the continued lack of home supply. The number of active homes for sale remains extremely low and this situation does not seem to be easing. The lack of inventory over the past several years has fueled home prices and now home affordability has become a huge factor in our local market. Could we actually see a market with very low inventory and low demand as well. This is quite possible and the next several months will certainly tell the story.

My advice to anyone thinking about selling a home in the Eugene and Springfield area in 2019 is to get your home on the market right now. By waiting until late Spring or even Summer to sell your home, you are gambling with what price your home might sell for. Right now the inventory of homes for sale in most local areas remains extremely low, especially in the $350,000 range and below. Buyer demand in most price ranges other than the upper tier ranges remains good. This however could change as we move through the year. Right now just may be your best opportunity to sell at higher price

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

2945 Ava Street

2945 Ava Street

Price: $350,000 Beds: 3 Baths: 2.0 Sq Ft: 1570

New Construction. this home is sure to impress. Open Living, Dining, & Kitchen. Great for entertaining. Master suite with walk-in closet and master bath. Two additional bedrooms are on opposite side of house. This home includes a Laundry room and a...View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!

1471 BARRINGTON AVE

1471 BARRINGTON AVE