Happy New Year!

Wishing you all a wonderful 2018! Happy New Year!!!

Galand Haas

Displaying blog entries 291-300 of 848

Wishing you all a wonderful 2018! Happy New Year!!!

Good Monday Morning!

The month of November saw another strong showing for home sales in the Eugene and Springfield area. The inventory of homes for sale remained very low with just two months of inventory. Remember, 6 months of inventory is considered a very healthy market situation. Here are the November 2017 home sales statistics for Lane County from RMLS.

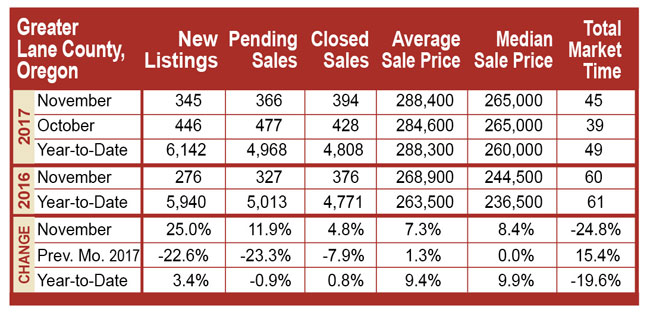

November Residential Highlights

Lane County saw gains this November compared to November 2016, despite some cooling from last month. New listings, at 345, ended 25.0% ahead of November 2016 (276) and were the best November for new listings in the county since 2009, when 355 were recorded.

Pending sales, at 366, outpaced November 2016 (327) by 11.9% despite a 23.3% decrease from October 2017 (477). Similarly, closed sales (394) saw a 4.8% increase over November 2016 (376) but a 7.9% decrease compared to last month in October 2017 (428).

Inventory in Lane County held steady in November at 2.0 months, with total market time increasing slightly to 45 days.

Year to Date Summary

Comparing the first eleven months in 2017 to the same period in 2016, new listings (6,142) have increased 3.4% and closed sales (4,808) have increased 0.8%, while pending sales (4,968) have decreased 0.9%.

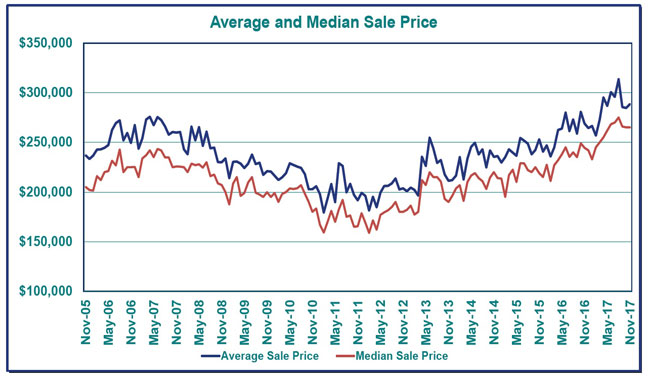

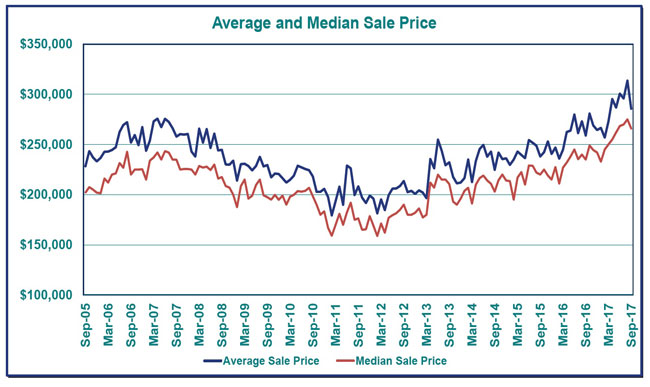

Average and Median Sale Prices

Comparing 2017 to 2016 through November of each year, the average sale price rose 9.4% from $263,500 to $288,300. In the same comparison, the median sale price rose 9.9% from $236,500 to $260,000.

Have An Awesome Week!

THIS WEEK'S HOT HOME LISTING!

Rustic Tuscan country-style charm! Terra Cotta tile, wood flr, rustic dr & window wood trim, steel beams, large windows. Remodeled kitchen w/ ship lap feature wall, galvanized metal backsplash, butchers block countertop & eating bar. Kitchen opens t...View this property >>

|

Good Morning!

As we approach the Holidays, many people are focused on other things besides buying and selling homes. This can certainly work in your favor if you are a home buyer. The following is an article from "realtor.org" that will gives you some reasons why you should think about getting serious with your home shopping in December.

As we approach the Holidays, many people are focused on other things besides buying and selling homes. This can certainly work in your favor if you are a home buyer. The following is an article from "realtor.org" that will gives you some reasons why you should think about getting serious with your home shopping in December.

Many home shoppers don’t think about purchasing a house during the holiday months—many even put their home search on hold. But Desare Kohn-Laski, broker-owner of Skye Louis Realty in Coconut Creek, Fla., offers some points to pass on to your clients, letting them know this is one of the best times of the year to shop for a house.

Less Competition, Better Prices.

Let your clients know that the holiday months work in their favor. “Instead of competing with hungry buyers, eager to move in before the school year begins, the dip in demand actually drives prices down, and can create a mini buyers’ market,” Kohn-Laski says. In her experience, buyers often fare better in the negotiation process during the winter months.

More Time to (Home) Shop.

Time off around the holidays gives many buyers the opportunity to do some careful house hunting. Instead of giving up an entire weekend to open houses and showings, buyers can more leisurely tour homes during the week, Kohn-Laski suggests.

Tax Benefits.

We still don’t know how the House and Senate tax reform bills will shake out in conference committee; however, if your clients purchase in 2017, they can still deduct property taxes, mortgage interest, and other costs. Learn more about how you can influence tax reform.

Move-In Ready Weather.

For a large part of the country, winter is a favorable season to move. The heavy lifting of furniture and home improvement projects are easier to perform without the heat of the summer months, Kohn-Laski says.

“There are numerous benefits and added perks to buying a house during the holiday season that make December arguably the best time to buy,” Kohn-Laski says.

Have An Awesome Week!

THIS WEEK'S HOT HOME LISTING!

Horse property only 5 mins from town! Nearly 6 level acres, backs up to canal & great for trail riding along Amazon. Wonderfully updated home with 2-car garage. 1 bedroom guest house w/ carport has income producing potential. 2 barns w/ 11 stalls, i...View this property >>

|

Good Monday Morning!

If you are considering a home purchase, your credit score is a huge part of this process. You credit score also impact many part of your financial life from what you pay for car insurance to your ability to get credit. The following is an article from "Realty Times' that goes over some great ideas on how to obtain the best credit score.

If you are considering a home purchase, your credit score is a huge part of this process. You credit score also impact many part of your financial life from what you pay for car insurance to your ability to get credit. The following is an article from "Realty Times' that goes over some great ideas on how to obtain the best credit score.

Getting ready to buy a house or just thinking about it? Where to buy, what to buy, and how you'll afford it are probably top of mind. But if you're not also concentrating on your credit score - and by concentrating on, we mean actively trying to raise your scores as much as possible - you're not looking at the whole homebuying picture.

Not only can does your credit score factor greatly into what you'll pay for your house, it can keep you from being able to buy one, period. "Your credit history determines what loans you will qualify for and the interest rate you will pay," said eloan. "A credit score provides an easy way for lenders to numerically judge your credit at a point in time. It gauges how likely you are to repay your loan in a timely manner. The better your history appears, the more attractive you become as a loan customer."

Thankfully, your credit score is not static; it can (and does) change all the time, and there are all kinds of ways to improve it, some better than others. We're running down the smartest options to boost your score in the new year.

Shoot for perfection

850 is the best score you can possibly get, and, while it may seem completely out of reach, there are people who actually crest that credit mountain and reach the top. "It's the Holy Grail of all credit scores: 850. On the widely used FICO credit score scale, approximately one in every 200 people achieves perfection, at least as of a 2010 estimate by the Fair Isaac Corporation," said The Motley Fool. Careful budgeting and detailed attention to every aspect of their financial picture are the umbrella tactics they use to get and maintain that score - and they're ones you should be using, too.

Or, shoot for 750

If 850 is out of reach within a reasonable timeframe (reasonable being the maximum amount of time you want to wait before buying a home), try for 750. This is the magic number for many lenders and creditors. "It puts the ball completely in the corner of the consumer rather than the lender, said The Motley Fool. "You'll often have lenders fighting for your business, and in nearly all instances, you'll be offered the best interest rate by lenders, meaning you'll have the lowest possible long-term mortgage and loan costs of any consumer."

Talking to your lender about the items on your credit report that have the best chance of raising your score is key. You may think that paying off that old unpaid account from six years ago is an easy way to get a score bump, but is it about to fall off of your report on its own?

Set up automatic payments

According to CreditCards.com, a good 35 percent of your credit score is taken from your payment history. You may have missed payments in the past that you need to deal with now, but you certainly don't want to make another mistake while you're trying to get homebuyer-ready. Almost every creditor, from your utilities to your car payment to any outstanding student loans you may have, offers the option of automatic payments. This is the easiest way to ensure you never miss a payment because you got busy or spaced on the due date.

But, just remember to make sure there is enough cash in your account to cover the payments on the day the money will be coming out. If you have been busy moving funds into savings for your down payment, you'll want to set a reminder to put money back into whatever account your auto payments are attached to.

Ask before you shut down credit cards

The amount of credit you have is a factor in qualifying - or not - for a mortgage. Too much debt is a bad thing. But, long-term credit use that has been managed properly can be helpful to your score. If your lender does recommend getting rid of some of your available credit, it likely won't be older cards. "Length of credit history is considered when determining your score - so the longer you've had a credit card, the better," said CNN Money.

Also beware that closing any card triggers a change in your "utilization," and that might not be a positive. Be sure to consult with your lender first.

Watch your credit limits

Banks don't look kindly on those who have used all of their available credit because it gives the appearance that you're not living within your means. "The amount of available credit you use is the second most important factor in your score," said NerdWallet. "Experts recommend you keep your balance on each card below 30% of your limit — if your limit is $5,000, your balance should be under $1,500."

Of course, even lower is better. Get to 20% or even 10%, and you'll be in great shape. But don't go below that. While it may seem like a zero balance would indicate that you are financially savvy, banks like to see responsible credit management. That means using your cards and paying down the balance to a reasonable level every month.

Pay down your debt…but check with your lender first

If you're trying to weigh the best tactics for improving your credit and you don't have the funds to take care of every outstanding wrinkle on your credit report and pay down your existing debt at the same time, you definitely want to check with your lender before you make any move. Every dollar is important, and while NerdWallet notes that your credit score will "soar" as you "pay off your debt as aggressively as possible without acquiring more," it could be that your lender has a strategy that places more importance on other credit issues in your report, or has structured your credit repair according to a different timeline.

This underscores the importance of working with a lender who is skilled and experienced in credit repair. Using the tools our lender gave us, we were able to improve our score by almost 100 points in four months, allowing us to qualify for the home we wanted and get a great interest rate.

Don't be afraid to refinance

You may end up buying a home before you get your credit score exactly where you want it to be. If you're in an appreciating market, which much of the country is, and your score continues to rise after you close escrow, you might be in a position to refinance sooner than you think. Especially if you buy your home with an FHA loan, their streamline refinance program can potentially lower your rate without an appraisal, a credit check, or job/income verification.

Have An Awesome Week!

THIS WEEK'S HOT HOME LISTING!

|

3155 PORTLAND ST

Gorgeous East Eugene home with valley views. Lower level has separate living potential with full kitchen, bedrooms, bath and laundry. Decks, privacy, RV parking,very light and bright. Super close to U of O and shopping areas. New roof and gas firepl...

|

Good Monday Morning!

If you are renting a home or apartment and you would like to become a home owner, instead of supporting your landlord, you should start planning now on how to make this happen. Yes, home values are up in the Eugene and Springfield area, but mortgage interest rates remain extremely affordable. Many times, home payments will be far less than rents and also have some great tax advantages. Here is an article from "Realty Times" that gives some ideas on how to get ready for your first home purchase.

If you are renting a home or apartment and you would like to become a home owner, instead of supporting your landlord, you should start planning now on how to make this happen. Yes, home values are up in the Eugene and Springfield area, but mortgage interest rates remain extremely affordable. Many times, home payments will be far less than rents and also have some great tax advantages. Here is an article from "Realty Times" that gives some ideas on how to get ready for your first home purchase.

Becoming a first-time homeowner takes a lot more than a desire to buy a house. It takes a lot of effort on your part to save up a down payment — which is usually a pretty good sized chunk of change — research neighborhoods, get pre-approved for a loan and other steps. Fortunately, it is quite possible to say goodbye to renting and hello to homeownership, especially when homeowners-to-be consider the following tips:

Focus on the Down Payment

In order to leave the land of rent, you are going to need a down payment — plain and simple. While it is common to put down 20 percent, some lenders now allow a much smaller amount, and first-time home buyer programs may go as low as 3 percent. While a smaller down payment may sound enticing, a 5 percent down payment on a $200K home is still $10,000 — not exactly a small sum. If saving money does not come naturally for you, don’t worry. With some relatively minor lifestyle changes you can speed up the down payment savings process. Come up with a savings plan to determine how much you need to set aside every week or month and then find ways to “find” that money in your budget. Using the $10,000 example from before, if you are determined to buy a home in two years, you’ll have to come up with about $415 a month to stash into your down payment account. Take a close look at your monthly bills and determine what you can pare down or eliminate — maybe you are paying $75 a month for a gym membership you rarely use, or you pay $40 extra for premium satellite channels that no one watches. These services can be cancelled and the money can go directly into your savings account. Eat out less, have Starbucks twice a week instead of every day and if you need to, consider a side hustle on the weekends to reach this magical monthly amount of $415.

Avoid Identity Theft

Unfortunately, the chances of becoming a victim of identity theft increase when you are buying and moving into a new home. The stacks of documents that are part of buying a home and that are filled with your personal information may accidentally fall into the wrong hands, and once you move, mail may not be routed correctly and thieves may steal your mail and your identity from your old mailbox. Prevent this situation from happening by purchasing an identity theft protection program; find a trusted company that will help safeguard your personal data. In addition to letting you know when a bank pulls your credit report and asking if you have authorized this inquiry, certain services will monitor your financial activity and alert you if anything is amiss.

Check Your Credit Report

When you start the pre-approval process for a loan and then move on to the Big Kahuna of applying for an actual mortgage, your credit report will be pulled numerous times. Your credit score will then be used to determine if you are approved for a loan, and what type of interest rate you will get. Please do not wait until you have the down payment saved and you are champing at the bit to go look at houses to check your FICO score — check your credit as early in the process as you can. If you have a credit card that has been issued through your bank, give them a call and see if they can run your report for you for free; in the cases of some credit cards, they also offer a free monthly FICO score check. Read through the report and check for any errors; this includes credit lines you never opened and delinquent payments that you know were made on time. Dispute any mistakes that you find and look for ways to boost your credit score, like paying down credit card bills and setting up automatic bill pay so you are never late with your payments.

Have An Awesome Week!

THIS WEEK'S HOT HOME LISTING!

|

36946 PARSONS CREEK RD

Rustic Tuscan country-style charm! Terra Cotta tile, wood flr, rustic dr & window wood trim, steel beams, large windows. Remodeled kitchen w/ ship lap feature wall, galvanized metal backsplash, butchers block countertop & eating bar. Kitchen opens t...

|

Good Monday Morning!

October home sales in the Eugene and Springfield are were down seasonally, but remain strong and above October 2016 home sales. Here are the October 2017 statistics.

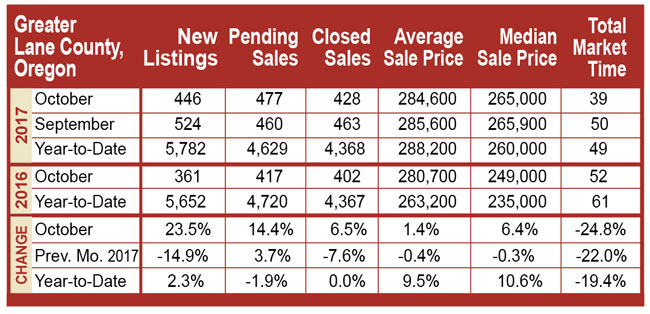

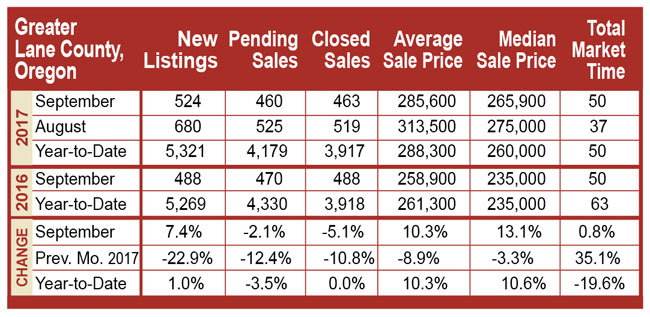

October Residential Highlights

Lane County saw some mixed activity in October, but numbers are up across the board compared to October 2016. Pending sales (477) showed a 14.4% increase over October 2016 (417) and a 3.7% increase compared to last month in September 2017 (460). It was the strongest October for pending sales in Lane County since at least 2001!

New listings, at 446, increased 23.5% compared to October 2016 (361) but fell 14.9% short of the 524 new listings entered just last month in September 2017.

Closed sales fared similarly—at 428 in October, closings increased 6.5% from October 2016 but decreased 7.6% from last month in September 2017.

Year to Date Summary

Comparing the first ten months in 2017 to the same period in 2016, new listings (5,782) have increased 2.3%, closed sales (4,368) have remained steady, and pending sales (4,629) have decreased 1.9%.

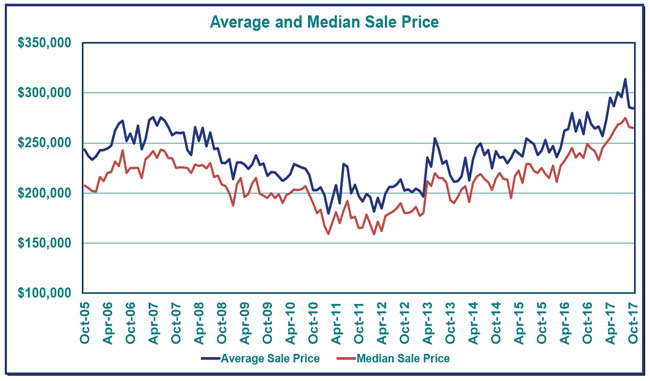

Average and Median Sale Prices

Comparing 2017 to 2016 through October of each year, the average sale price rose 9.5% from $263,200 to $288,200. In the same comparison, the median sale price rose 10.6% from $235,000 to $260,000.

HAVE AN AWESOME WEEK!

Horse property only 5 mins from town! Nearly 6 level acres, backs up to canal & great for trail riding along Amazon. Wonderfully updated home with 2-car garage. 1 bedroom guest house w/ carport has income producing potential. 2 barns w/ 11 stalls, i...View this property >>

|

Good Morning!

There are many questions about the new tax plan currenty beeing looked at by the Senate. How will it affect all of us? There is much debate ahead and mostly likely many changes ahead before a bill is passed. The following is an article from "Realtor.com" that goes over what is currently being discussed.

After months of internal debate among Republicans, the House Ways and Means Committee released the details of its plan to overhaul the U.S. tax code for businesses and individuals. The highlights include lower rates for many individual households but not the highest earners; fewer individual tax brackets; a larger standard deduction for households who don’t itemize their tax bills; trimmed-back deductions for state and local taxes; eventual repeal of the estate tax; and much lower rates for corporate profits and profits for individuals on unincorporated business income. Here is a look at all of the details.

After months of internal debate among Republicans, the House Ways and Means Committee released the details of its plan to overhaul the U.S. tax code for businesses and individuals. The highlights include lower rates for many individual households but not the highest earners; fewer individual tax brackets; a larger standard deduction for households who don’t itemize their tax bills; trimmed-back deductions for state and local taxes; eventual repeal of the estate tax; and much lower rates for corporate profits and profits for individuals on unincorporated business income. Here is a look at all of the details.

New tax brackets and rates

Tax treatment for the wealthy is among the hottest issues. The House Republican tax plan will preserve a top individual tax rate of 39.6%. Republicans last year had been discussing a top rate of 33%, and then moved to 35% earlier this year.

The retention of the 39.6% individual tax rate marks a shift in the way Republicans think about tax policy. For years, they had focused on driving down that top tax rate. President Trump says he is instead focused on middle-income cuts and large changes to the business tax code, which he argues will boost growth and hiring.

Effect on deductions and credits

The plan aims to increase the standard deduction, while adjusting several other deduction and credits.

House Republicans had planned to release the bill Wednesday but delayed it until Thursday to finish technical work on the legislation and address thorny issues such as how to treat deductions for state and local taxes. Party leaders want to repeal the deduction, but that has sparked a rebellion from lawmakers in high-tax states like New York and New Jersey and set off a scramble for compromise, centered on keeping the deduction for property taxes.

Standard Deduction

• Current law for 2017: $12,700 (married); $9,350 (head of household); $6,350 (single)

• Proposed for 2018: $24,400 (married); $18,300 (head of household); $12,200 (single)

Personal Exemption

• Current law for 2017: $4,050

• Proposed: Repealed Child Tax Credit

• Current law: $1,000

• Proposed: $1,600 plus $300 each for the taxpayer, a spouse and any non-child dependents

State and Local Taxes

• Current law: Itemized deduction

• Proposed: Deduction capped at $10,000 for property tax only

Charitable Donations

• Current law: Itemized deduction

• Proposed: Unchanged

Mortgage Interest Deduction

• Current law: Itemized deduction on loans up to $1 million

• Proposed: Itemized deduction for loans up to $500,000 on new home purchases

Alternative Minimum Tax

• Current law: Parallel tax that disallows personal exemptions and state deductions• Proposed: Repealed

Retirement Accounts

• Current law: 401(k) plans allow pretax deferral of up to $18,000

• Proposed: Minor changes

Have An Awesome Week!

THIS WEEK'S HOT HOME LISTING!

|

927 S. 58th Street

Beautiful brand new home from builder Gary Konold. One level home features CORETec floors, granite counters, vaulted/high ceilings, gas fireplace & Great Room. Dining area w/ slider, kitchen w/ SS appliances, recessed lighting & peninsula with eatin...

|

|

Good Morning!

So you've decided to list your home this winter. Perhaps you've had a job change, need to relocate out of the area, or have financial or family reasons for moving. No matter what is driving the move, you may be concerned about selling at this time of year. But just because you missed the boat on the spring selling season doesn't mean you can't get your home sold quickly, and for a profit. A few tips can help get it moving. Take photos early... or late If you can take photos before the trees become barren and the grass goes dormant, do so! The last thing you want is for your home to look blah and depressing in photos. If you can capture a snowy day (with perfectly scraped walkways, of course), that works, too. It never hurts to have your home looking like a winter wonderland. Go easy on the holiday décor "Deck the halls, but don't go overboard," said HGTV. "Homes often look their best during the holidays, but sellers should be careful not to overdo it on the decor. Adornments that are too large or too many can crowd your home and distract buyers. Also, avoid offending buyers by opting for general fall and winter decorations rather than items with religious themes." Always mind your curb appeal Just because it's winter doesn't mean you can let things slide out front. Potential buyers won't give you a pass on chipping paint, a fence that needs repair, or a front door that's seen better days just because it's frigid outside. Safety matters Shoveling the walk from the street to your home is necessary to make it reachable, make it inviting, and also make it safe. The last thing you want is a slip and fall that could result in an injury, and a lawsuit. "Continually shovel a path through the snow, especially if snowflakes are still falling," said the balance. "Footprints on freshly fallen snow will turn to ice if the temperature is low enough, so scrape the walk. Sprinkle a layer of sand over the sidewalk and steps to ensure your buyers' stable footing. Remember to open a path from the street to the sidewalk so visitors aren't forced to crawl over snowdrifts." Get a good indoor mat Perhaps you never use a mat for indoors or yours is grubby or tattered from 10 straight years of winter wear. This one super easy move may not be noticed by visitors - but it sure will if it's missing or not in good shape. Little things like a $10 mat can give buyers the impression that your whole house is well cared for, or just the opposite. Clear the front door clutter If you live in a climate where there is likely to be snow or rain, there are a few more steps you'll probably have to take in order to keep your house looking great inside. How does your coat closet look? If it's stuffed with jackets, scarves, boots, and gloves, relocating some to make room for potential buyers to put their stuff away while touring your home is a good idea - plus, a tidy coat closet gives the impression that there is plenty of storage space in the home. It goes without saying that winter wear and shoes that tend to stack up in the entry should be banished while your house is on the market. Make sure everything is functional Imagine you live in a climate that stays relatively temperate year-round, and then you have a cold spell. You turn on the heater for the first time the night before your first showing, and…nothing. Same for the fireplace in the living room. Your freezing cold house is probably not going to make a great impression on buyers. As soon as you decide you're going to sell your home, go through it room by room, checking all major appliances and home functions and looking for little things that may escape notice on an everyday basis - cracked light switches, chipped baseboards, light bulbs that need to be replaced - so your home is perfect for showings. Light it up Shorter days with earlier sunsets limit the amount of natural light in your home. Turning on all the lights before showings is more important than ever. Think about the exterior when it comes to lights, too. If you only have a porch light, you might want to consider adding some landscaping lighting, which will help accentuate your outdoor space. Listen to your REALTOR® when it comes to price Will you be able to command top dollar for your home and get the same price you would have had you listed in spring or summer? That depends on so many things, including your neighborhood, the available inventory, the condition of the home, and, of course, your listing price. A trusted real estate agent will take all mitigating factors into consideration and use comparables in your area to develop a pricing strategy. When it comes to offers, remember this tidbit from Realtor.com: "Just because your home's on the market during the slow, chilly months doesn't mean you have to accept a lowball offer. If you make your home attractive in all the right ways, qualified buyers will come." Have An Awesome Week! THIS WEEKS HOT HOME LISTING!

|

|

Good Morning! Change could be on the horizon for the national Real Estate market. Nationally, home sales dipped last month and the cost of housing also followed suit. After a very long run of escalating home sales and prices, this could signal a slow down. There is no question that flat markets or dips occur after hot markets. Whether this will be a long term trend or just a temporary blip in the market is yet to be seen. Have An Awesome Week! Video Link: http://eugeneoregonhomesforsale.com/video/This-Month-In-Real-Estate-October-2017 THIS WEEKS HOT HOME LISTING! |

|

36946 PARSONS CREEK RD

Rustic Tuscan country-style charm! Terra Cotta tile, wood flr, rustic dr & window wood trim, steel beams, large windows. Remodeled kitchen w/ ship lap feature wall, galvanized metal backsplash, butchers block countertop & eating bar. Kitchen opens t... View this property >>

|

Good Monday Morning!

September home sales in the Eugene and Springfield market area cooled slightly, but the overall home sale market remains good. The inventory of homes for sales remains low at just 2.1 months of inventory. Even with the onset of Fall, the Real Estate market remains favorable for sellers and maybe slightly improved for homebuyers. Here are the statistics for September 2017.

Lane County saw some cooler numbers this September, but new listings did gain compared to last year. At 524, new listings rose 7.4% compared to September 2016 (488) despite cooling 22.9% compared to last month in August 2017 (680).

Pending sales, at 460, decreased 2.1% compared with the accepted o ers recorded last year in September 2016 (470) and 12.4% compared with accepted offers recorded last month in August 2017 (525).

Closed sales, at 463 in September, ended 5.1% below the 488 closings in September 2016 and 10.8% below the 519 closings last month in August 2017.

Inventory rose slightly to 2.2 months in September, and total market time rose to 50 days in the same period.

Year to Date Summary

Comparing the first nine months in 2017 to the same period in 2016, new listings (5,321) have increased 1.0%, closed sales (3,917) have remained steady, and pending sales (4,179) have decreased 3.5%.

Average and Median Sale Prices

Comparing 2017 to 2016 through September of each year, the average sale price rose 10.3% from $261,300 to $288,300. In the same comparison, the median sale price rose 10.6% from $235,000 to $260,000.

Have An Awesome Week!

THIS WEEK'S HOT HOME LISTING!

|

927 S. 58th Street

Beautiful brand new home from builder Gary Konold. One level home features CORETec floors, granite counters, vaulted/high ceilings, gas fireplace & Great Room. Dining area w/ slider, kitchen w/ SS appliances, recessed lighting & peninsula with eatin...View this property >>

|

Displaying blog entries 291-300 of 848