Home Sales Soften

Good Monday Morning!

Home sales nationally have softened. Maybe it is time for the Fed to revisit its policy of interest rate hikes. The yield curve, which can predict recession has changed negatively and could be pointing towards tougher economic times. It might be time for the Fed to halt interest rates hikes and abandon its agressive approach. Could it be time for the Fed to even lower rates again? Here is an article from Realtor.com that addresses the current national home sales slump.

Sales of previously owned U.S. homes posted their largest annual decline since 2014 in October, as the housing market continues to sputter due to higher mortgage rates that are reducing home affordability.

The latest data offered a mixed picture of a market that isn’t in free fall but also is far from robust. Existing-home sales edged up 1.4% in October from the previous month to a seasonally adjusted annual rate of 5.22 million, the National Association of Realtors said Wednesday. That broke a six-month streak when sales declined compared with a month earlier.

Sales, however, posted a sharp 5.1% drop compared with a year earlier, indicating the market is likely to end the year on a sluggish note.

Lawrence Yun, the trade group’s chief economist, said the annual decline signals softness in the housing sector that is likely to persist in the months to come.

“There is some feeling that the market could actually go even lower than what it is now in terms of sales,” Mr. Yun said.

When sales began slowing this spring, economists initially blamed a shortage of inventory, which has plagued the housing market throughout the recovery. But rising mortgage rates are playing a bigger role in slowing buyer demand than many economists had expected, shaking confidence that now is a good time to buy a home, according to recent surveys.

Mr. Yun said higher interest rates appear to be choking off buyer demand, and said the Federal Reserve should consider pausing its rate increases to give the housing sector time “to be on firmer ground.”

Mike Fratantoni, chief economist at the Mortgage Bankers Association, said recent declines in the stock market are also causing fresh unease. “The level of volatility in the stock market is reflecting a lot of uncertainty about where we are with the broader economy. There is a little bit of increased anxiety about how much things are going to slow,” he said.

The good news for buyers is that conditions are becoming friendlier to them, as mortgage rate and home-price increases slow and inventory of homes for sale is growing compared with last year.

The rate for a 30-year fixed rate mortgage averaged 4.81% this week, down from 4.94% a week earlier, according to data released by Freddie Mac on Wednesday. Rates are still up significantly from a year ago, when they averaged 3.92%.

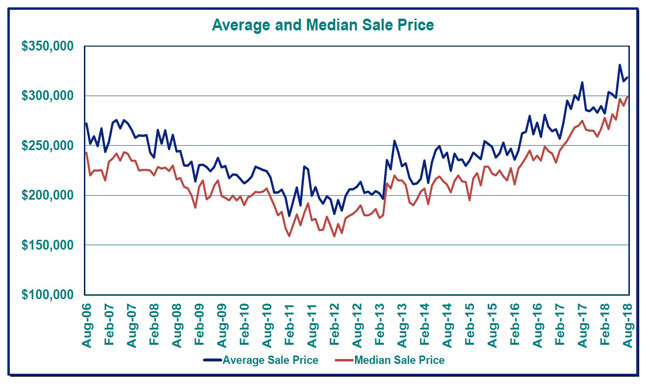

The median sale price for an existing home in October was $255,400, up 3.8% from a year earlier. That shows a cooling from a year ago, when prices rose about 5.5%.

There was a 4.3-months’ supply of homes on the market at the end of October, based on the current sales pace, down from 4.4 months in September but up from 3.9 months a year ago.

Mr. Fratantoni said the combination of more muted price growth and a greater number of homes for sale could boost the housing market in the spring, especially if wages continue to rise.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

Price: $319,000 Beds: 3 Baths: 2 Sq Ft: 1344

Wonderful updates in this N. Gilham home! Great Rm layout, hickory cabinets, granite counters, engineered wood flr, recessed lights, stone gas fireplace, vinyl windows & French drs w/ built-in blinds. Kitchen w/ under-mount sink, island & eating bar. Master ste w/ slider. Laundry/mud rm. Fenced yard, shed, covered deck & patio, plus RV parking. Located in highly desirable area, on bus route & only 6 min drive to shops, schools & park.

There can be some confusion in the minds of the average consumer about interest rates, especially as it relates to the Federal Open Market Committee, or FOMC, meetings. About every six weeks, the FOMC meets to discuss the current state of the economy with an eye toward the future. One important task is to monitor and adjust the cost of funds. In general, the “Fed” tries to keep inflation in check and in theory raise or lower the cost of funds. They do so by adjusting the Federal Funds rate and this is the rate that gets so much press each time the FOMC meets.

There can be some confusion in the minds of the average consumer about interest rates, especially as it relates to the Federal Open Market Committee, or FOMC, meetings. About every six weeks, the FOMC meets to discuss the current state of the economy with an eye toward the future. One important task is to monitor and adjust the cost of funds. In general, the “Fed” tries to keep inflation in check and in theory raise or lower the cost of funds. They do so by adjusting the Federal Funds rate and this is the rate that gets so much press each time the FOMC meets. 825 SAND AVE

825 SAND AVE A loan program that was popular several years ago is making a comeback and many lenders are now offering options for a mortgage loan program called "the Piggyback mortgage".

A loan program that was popular several years ago is making a comeback and many lenders are now offering options for a mortgage loan program called "the Piggyback mortgage".

6997 GLACIER DR

6997 GLACIER DR  Before you can

Before you can  6997 GLACIER DR

6997 GLACIER DR

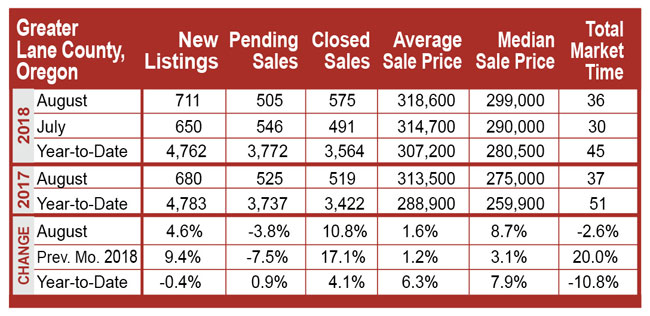

Lane County saw some gains in closings and new listings this August. Closings, at 575, outpaced August 2017 (519) by 10.8% and July 2018 (491) by 17.1%. It was the strongest August for closings in Lane County on the RMLSTM record, dating to 2001!

Lane County saw some gains in closings and new listings this August. Closings, at 575, outpaced August 2017 (519) by 10.8% and July 2018 (491) by 17.1%. It was the strongest August for closings in Lane County on the RMLSTM record, dating to 2001!

84305 Derbyshire Lane

84305 Derbyshire Lane