The Federal Open Market Committee and How Mortgage Rates Are Determined

Good Morning!

There can be some confusion in the minds of the average consumer about interest rates, especially as it relates to the Federal Open Market Committee, or FOMC, meetings. About every six weeks, the FOMC meets to discuss the current state of the economy with an eye toward the future. One important task is to monitor and adjust the cost of funds. In general, the “Fed” tries to keep inflation in check and in theory raise or lower the cost of funds. They do so by adjusting the Federal Funds rate and this is the rate that gets so much press each time the FOMC meets.

There can be some confusion in the minds of the average consumer about interest rates, especially as it relates to the Federal Open Market Committee, or FOMC, meetings. About every six weeks, the FOMC meets to discuss the current state of the economy with an eye toward the future. One important task is to monitor and adjust the cost of funds. In general, the “Fed” tries to keep inflation in check and in theory raise or lower the cost of funds. They do so by adjusting the Federal Funds rate and this is the rate that gets so much press each time the FOMC meets.

The Federal Funds rate is the rate banks can charge one another for short term lending. Short term as in overnight. Why does a bank need to borrow money on such a short notice? Banks are required to keep a certain amount of liquid capital, in other words “cash,” at the end of each business day. These funds are essentially demand funds. When a consumer wants to withdraw some cash either at the bank or at any automated teller, there needs to be cash available to meet those withdrawal requests. If the bank sees their reserves to meet these requests do not meet the reserve requirements, banks seek out a short term loan from another depository institution to meet the reserve requirements. This is what the Fed adjusts, the overnight lending rate. But the Fed doesn’t directly impact the everyday 30 year conforming fixed rate mortgage.

When lenders set their rates each day, they refer to a specific mortgage bond. For example, with a 30 year fixed conforming loan underwritten to Fannie Mae standards, the lender will review the current yield on the FNMA 30-yr 3.0 mortgage bond. Just like any bond, with the price of the bond goes up, the yield will fall. And when the price goes down, the yield will rise. Investors buy bonds, all types of bonds, as a safe place to park cash. When the economy appears to falter, investors can get a little skittish and pull some funds from the stock market and transfer those funds into bonds, including mortgage bonds. If on the other hand the economy is healthy and improving, the opposite will occur.

When the Fed makes an announcement at the end of their two-day meetings, investors are anxious to hear if the Fed raised, lowered or kept rates the same. If the Fed announces they decided to raise the cost of funds by 0.25%, it can tell investors the FOMC decided the economy is doing rather well but to hold of any potential inflation, it will raise the cost of funds that banks will pay for short term lending. It’s not a direct affect on mortgage rates, but definitely an indirect one.

Have an awesome week!

THIS WEEK'S HOT HOME LISTING!

825 SAND AVE

825 SAND AVE

Price: $550,000 Beds: 3 Baths: 2 Sq Ft: 2344

Grand very well-maintained home! Light filled vaulted open layout w/ large windows & skylights. Living rm w/ gas fireplace opens to dining area. Office/bonus rm w/ exterior entrance & Shoji sliding dr/rm divider. Massive kitchen w/ cook island, pant...View this property >>

6997 GLACIER DR

6997 GLACIER DR

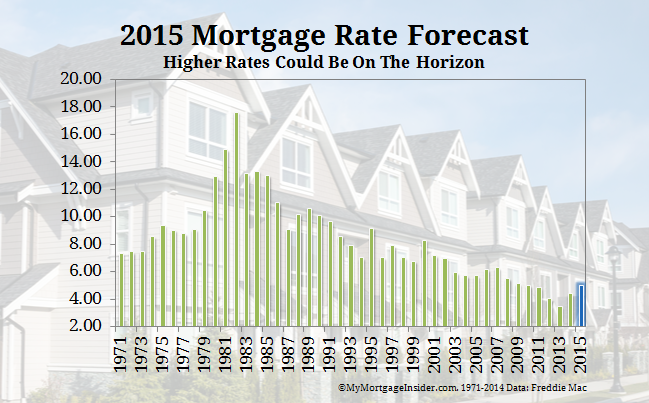

Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers.

Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers. 48808 MCKENZIE HWY

48808 MCKENZIE HWY