Good and Bad News For Current Home Sales

Good Morning!

Here in the Eugene and Springfield area and nationally, new home sales are down. This has contributed to the current national and local shortage of available homes for sale. The following is an article from "Realtor.com" that will give you more information on why the inventory of homes for sale is so low at this time.

Here’s the good news: Sales of newly constructed homes rose in the beginning of the year. The bad news? It wasn’t enough to ease the housing shortage that is frustrating would-be home buyers across the nation.

Here’s the good news: Sales of newly constructed homes rose in the beginning of the year. The bad news? It wasn’t enough to ease the housing shortage that is frustrating would-be home buyers across the nation.

Buyers purchased about 3.7% more new homes in January than in December, according to a joint report by the U.S. Census Bureau and U.S. Department of Housing and Urban Development. The January purchases were also 5.5% above where they had been a year earlier. (Realtor.com® looked only at the seasonally adjusted numbers, which have been smoothed out over 12 months to account for seasonal fluctuations.)

Sounds good, right? Well, not exactly.

“New-home sales should be growing much more than they are,” says Chief Economist Jonathan Smoke of realtor.com. “We should be seeing twice the volume of new-home sales, and we’re not.”

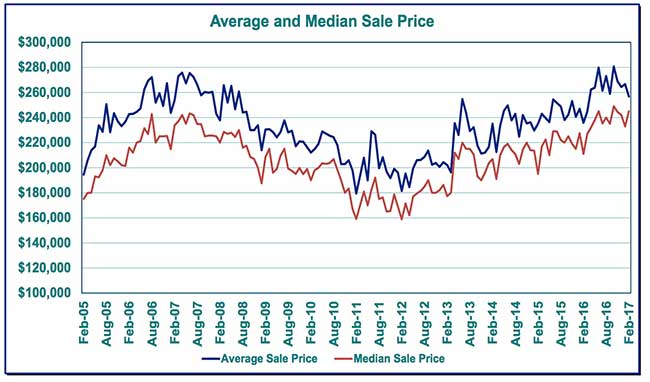

The reason is that there aren’t enough buyers who can afford the median $312,900 price tag of one of those new homes, often decked out with the latest appliances and finishes. They are nearly 37% more expensive than the median $228,900 price for an existing home in January, according to the most recent National Association of Realtors® data.

Prices on those new homes dipped 1% from December—but were nearly 7.5% higher than in January 2016.

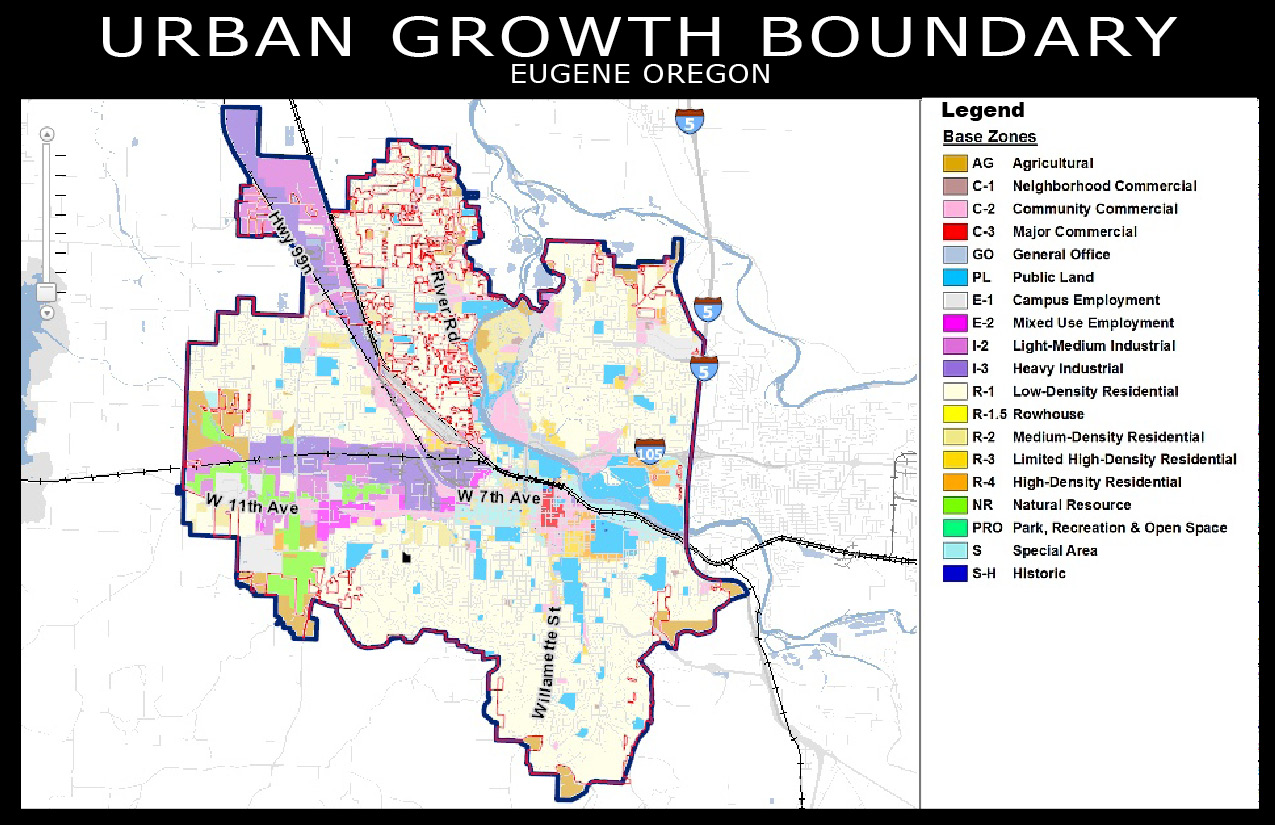

New residences cost more because they’re expensive to build, with increased local red tape, high land and material costs, and a shortage of construction workers. So builders are going to erect only what they’re sure they can sell, Smoke says.

“It effectively limits who can buy the new homes and how many new homes can be built and sold,” Smoke says.

For example, about 55% of the new homes sold in January cost more than $300,000, according to the report.

Just 5% were under $150,000 and only 9% were between $150,000 and $199,999—the price categories that are most likely to fit into the typical first-time buyer’s budget.

The bulk of sales, about 30%, were between $200,000 and $299,999, and 27% were between $300,000 and $399,999.

Most of the home purchases were in the South—about 290,000—where prices are typically lower. The purchases were up 4.3% from December, but down 1% from January 2016.

The West, the country’s most expensive region, saw the second-most sales, at about 151,000. Monthly sales dropped 4.4% but rose 16.2% annually.

In the Midwest, new-home sales were up 14.8% from December and 4.5% from the same month a year earlier. There were about 70,000 sales in the region.

Meanwhile, the Northeast saw the largest surge in home purchases. Sales of the roughly 44,000 homes were up 15.8% from the previous month and rose 22.2% from a year earlier.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

Price: $295,000 Beds: 4 Baths: 2 Sq Ft: 1868

Tranquil & spacious property! Beautifully landscaped 0.41 acre lot provides seclusion & great entertaining spaces. Remodeled home offers updated kitchen & baths, large living rm w/ gas fp, formal dining, large windows+skylight. Private master ste w/...View Home for Sale >>

1471 BARRINGTON AVE

1471 BARRINGTON AVE 114 Hayden Bridge Way

114 Hayden Bridge Way Eugene's recent housing market is currently seeing record low number of homes on the market for sale. In fact, the inventory right now is less than two months and second lowest in the nation. The price range of homes that is hardest hit by this shortage is those that are at or below the median sales price of around $265,000. This is the price range that most young families and first time home buyers are in. The housing shortage has created some severe problems in our area as the shortage continues to drive home prices higher, making them less affordable. Home price increases have outpaced the increase in income for our local area and as a result have actually pushed many first time home buyers completely out of the market or pushed them into price prices where there are low inventory and high demand.

Eugene's recent housing market is currently seeing record low number of homes on the market for sale. In fact, the inventory right now is less than two months and second lowest in the nation. The price range of homes that is hardest hit by this shortage is those that are at or below the median sales price of around $265,000. This is the price range that most young families and first time home buyers are in. The housing shortage has created some severe problems in our area as the shortage continues to drive home prices higher, making them less affordable. Home price increases have outpaced the increase in income for our local area and as a result have actually pushed many first time home buyers completely out of the market or pushed them into price prices where there are low inventory and high demand.

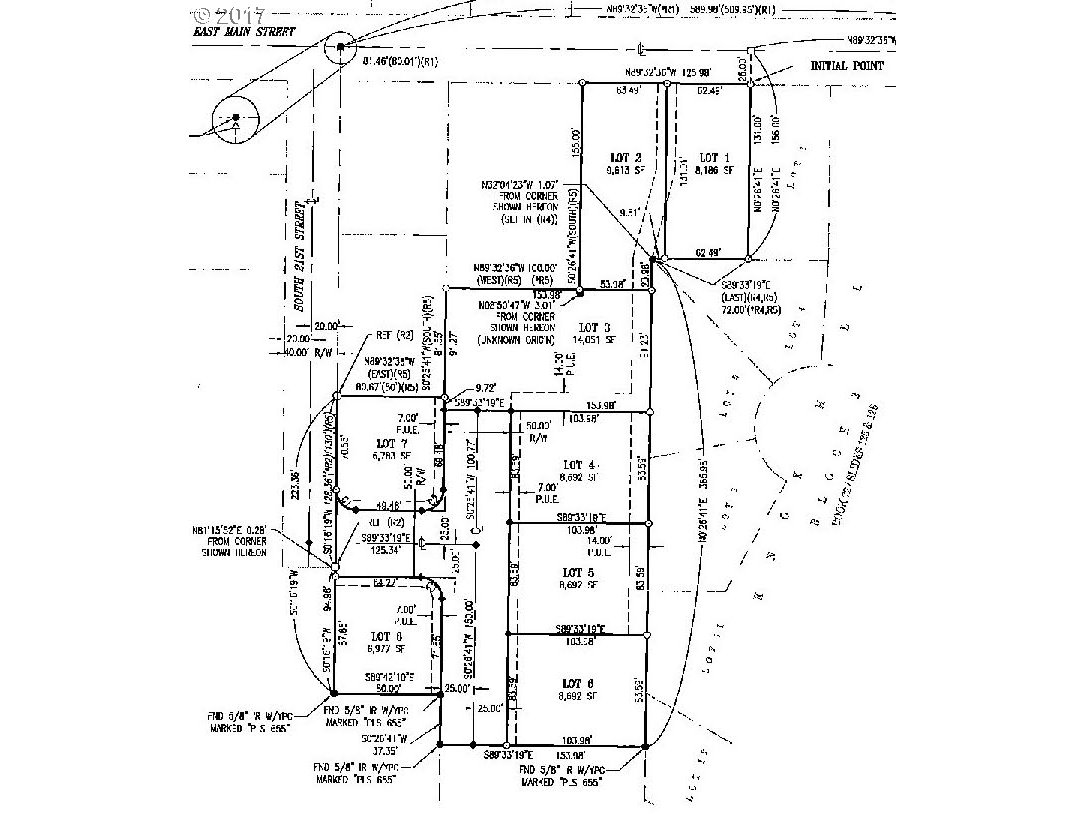

Hilltop Drive #1

Hilltop Drive #1