All Cash Buyers In Our Market

Good Monday Morning!

The monthly Realtors Confidence Index is an essential measure of what real estate professionals are seeing in their local markets and how the market is evolving on a monthly basis. The National Association of Realtors Research Group has produced the index since 2008, a time of turbulence in the real estate market.

One such measure is who is entering the market. Since October of 2022, the share of buyers who are purchasing their home without a mortgage has been more than one quarter of the market. The share is collected monthly in the Realtors Confidence Index and includes buyers who purchased primary homes, vacation homes and investors.

These all-cash homebuyers are happily avoiding the higher mortgage interest rates, which touched 7% in the fall of 2022 before trending down to the current rate of 6.28%. While spring of 2022 saw a similar share of all-cash homebuyers, one needs to look back to 2014 before seeing similar shares.

Then, the mortgage interest rates were in the low-4% range. In the months before the COVID-19 pandemic, the share of all-cash buyers hovered in the teens. While mortgage rates may be one component, they do not tell the full story. So what happened and who is paying all cash for homes?

One factor at play is the multiple-bid scenarios that took place throughout the COVID-19 pandemic. Homebuyers placed competitive offers on homes while inventory grew increasingly difficult to find. In March of 2022, sellers received an average of 5.5 offers.

Today, the average is 2.7 offers. As buyers wanted to find the perfect property, before interest rates rose, they were willing to offer all cash to sellers so their offer was not contingent on financing.

Additionally, buyers migrated to more affordable locations in low-density areas, allowing them to purchase a home with all cash, if they had housing equity from their past property. Thus, the typical homeowner, who owned their home for a decade, had more than $200,000 in housing equity to make a trade.

The share of non-primary residence buyers is now at 18% from a high of 22% in January 2022. At that time, housing inventory dropped to historic lows making the environment ripe for investors. Investors joined the market to hold properties as short-term or long-term rentals, or to flip the home.

As these all-cash buyers and non-primary residence buyers are finding success in today’s housing market, what is notably lacking are first-time homebuyers. Unfortunately, the share of first-time buyers remained suppressed at just 27% last month. While it is not the high seen during the First-time Home Buyer Tax Credit in 2010, it is also not the historical norm of 40% seen in the annual Profile of Home Buyers and Sellers report.

Notably, during the time frame of the First-time Home Buyer Tax Credit, there was significantly more inventory than seen today. Unfortunately, the hope of seeing more first-time buyers in the market this year due to the lower competition has yet to materialize as higher mortgage interest rates have suppressed the share who can afford to purchase a home.

First-time buyers today need more housing inventory to improve affordability. The low mortgage interest rates of 3% are not going to be seen any time in the near future. For buyers to afford to enter the market comfortability and sustainably, new construction, office conversion, and reimagining existing spaces such as vacant schools could hold the key.

Have An Awesome Week!

Stay Healthy! Stay Safe! Remain Positive! Trust in God!

THIS WEEKS HOT HOME LISTING!

260 54th Street, Springfield, OR

Price: $405,000 Beds: 4 Baths: 2.0 SqFt: 2048

Great opportunity for a multi-family investment property. Both units are townhouse style with attached garages & separated backyards. Vinyl windows, newer flooring & spacious bedrooms. Convenient location near shopping & the bus line. Strict tenant...View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!

260 54th Street, Springfield,

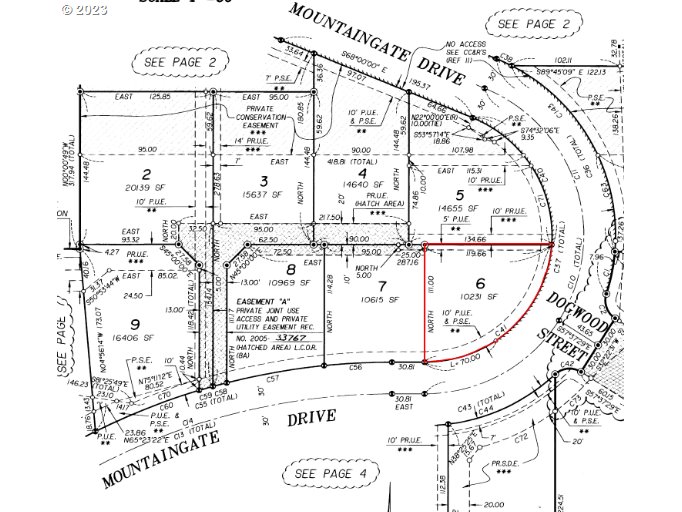

260 54th Street, Springfield, 320 Mountaingate Dr, Springfield,

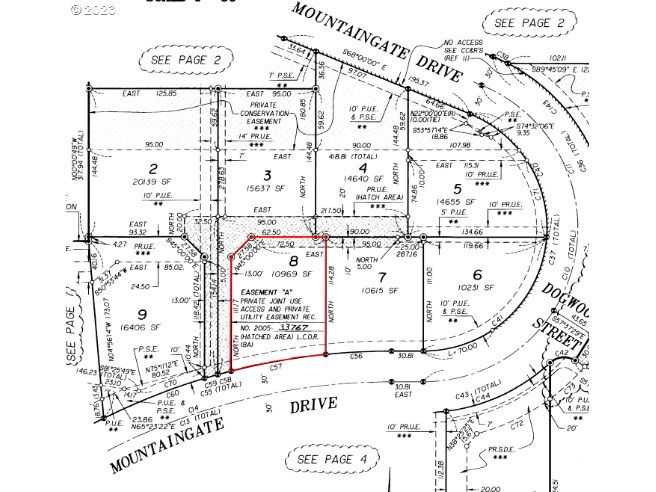

320 Mountaingate Dr, Springfield, 340 Mountaingate Dr, Springfield,

340 Mountaingate Dr, Springfield, 91710 Burton Dr, Mckenzie Bridge,

91710 Burton Dr, Mckenzie Bridge,