Good Morning!

Homeownership has always been the "great American dream". Here is an article from "Realty Times", that talks about some real monetary advantages of home ownership.

To foster and encourage this dream, Congress has consistently enacted tax legislation which favors homeowners. Indeed, much has been written that our tax laws discriminate against renters, by giving unfair and unequal tax benefits to those who own homes.

Every four years, some candidate for high political office tries to focus our attention on equalizing the tax laws, and repealing the homeowner benefits, but these arguments have consistently fallen on deaf ears. And this coming election year is no different.

For those of us who own homes, here is a list of the itemized tax deductions available to the average homeowner. Every year, you are permitted to deduct the following expenses:

TAXES. Real property taxes, both state and local, can be deducted. However, it should be noted that real estate taxes are only deductible in the year they are actually paid to the government. Thus, if in year 2015, your lender held in escrow moneys for taxes due in 2016, you cannot take a deduction for these taxes when you file your 2015 tax return.

Mortgage lenders are required to send an annual statement to borrowers by the end of January of each year, reflecting the amount of mortgage interest and real estate taxes the homeowner paid during the previous year.

MORTGAGE INTEREST. Interest on mortgage loans on a first or second home is fully deductible, subject to the following limitations: acquisition loans up to $1 million, and home equity loans up to $100,000. If you are married, but file separately, these limits are split in half.

You must understand the concept of an acquisition loan. To qualify for such a loan, you must buy, construct or substantially improve your home. If you refinance for more than the outstanding indebtedness, the excess amount does not qualify as an acquisition loan unless you use all of the excess to improve your home. However, any other excess may qualify as a home equity loan.

Let us look at this example: Several years ago, you purchased your house for $150,000 and obtained a mortgage in the amount of $100,000. Last year, your mortgage indebtedness had been reduced to $95,000, but your house was worth $300,000.

Because rates were low last year, you refinanced and were able to get a new mortgage of $175,000. Your acquisition indebtedness is $95,000. The additional $80,000 that you took out of your equity does not qualify as acquisition indebtedness, but since it is under $100,000, it qualifies as if it was a home equity loan.

Several years ago, the Internal Revenue Service ruled that one does not have to take out a separate home equity loan to qualify for this aspect of the tax deduction. However, if you had borrowed $200,000, you would only be able to deduct interest on $195,000 of your loan -- the $95,000 acquisition indebtedness, plus the $100,000 home equity.

The remaining interest is treated as personal interest, and is not deductible.

POINTS. When you obtain a mortgage loan, some lenders will allow you to pay one or more points to get that loan. The more points you pay, the lower your mortgage interest rate should be. Whether referred to as "loan origination fees," "premium charges," or "discounts," these are still points. Each point is one percent of the amount borrowed; if you obtain a loan of $170,000, each point will cost you $1,700.

The IRS has also ruled that even if points are paid by sellers, they are still deductible by the homebuyer. Points paid to a lender when you refinance your current mortgage are not fully deductible in the year they are paid; you have to allocate the amount over the life of the loan. For example, you paid $1700 in points for a 30 year loan. Each year you are permitted to deduct only $56.66 ($1700 divided by 30); however, when you pay off this new loan, any remaining portion of the points you have not deducted are then deductible in full.

Needless to say, if you have any questions about these tax benefits, discuss them with your financial and legal advisors.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

5151 & 5153 Trevon St

5151 & 5153 Trevon St

Price: $235,000 Beds: 4 Baths: 2 Sq Ft: 1879

Wonderful updated duplex! Each unit has 2 bedrooms and 1 bath, vinyl windows, garage with roll-up door and large fenced backyard with patio. This 0.23 acre lot located on the corner of a culdesac is within 2 miles of schools, shopping and bus route....

View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!

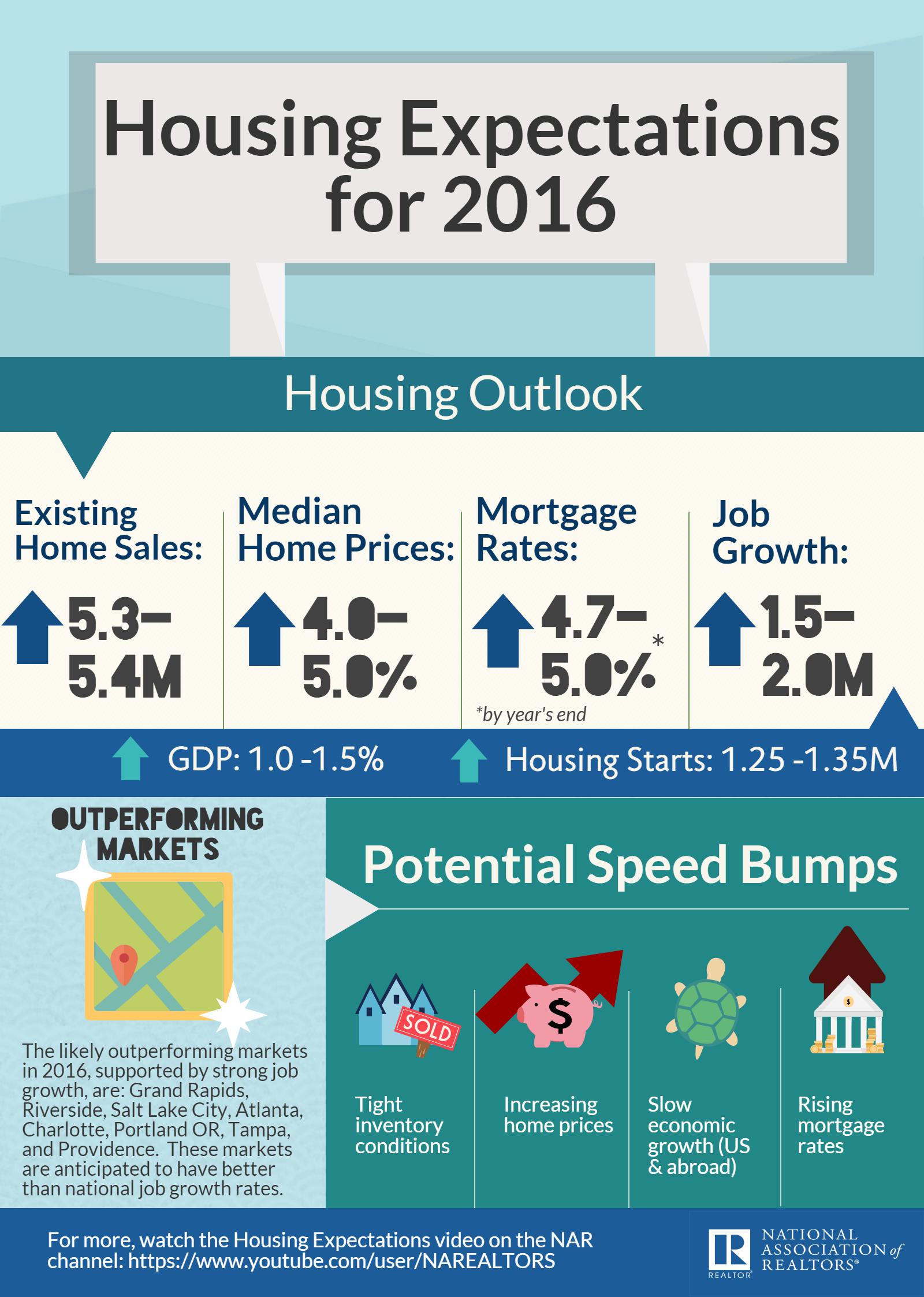

Many would-be homeowners are still choosing to rent instead of buying a home. Home buyer confidence remains low nationally, even though mortgage interest rates are at historic low levels. Here is an article from Realtor.com that gives some ideas as to why consumer confidence remains low among potential home buyers.

Many would-be homeowners are still choosing to rent instead of buying a home. Home buyer confidence remains low nationally, even though mortgage interest rates are at historic low levels. Here is an article from Realtor.com that gives some ideas as to why consumer confidence remains low among potential home buyers. 1014 Yew St

1014 Yew St

The Federal Reserve recently raised interest rates, U.S. stocks are tumbling and new worries about the Chinese economy seem to emerge daily. So go ahead and buy that house you’ve been looking at.

The Federal Reserve recently raised interest rates, U.S. stocks are tumbling and new worries about the Chinese economy seem to emerge daily. So go ahead and buy that house you’ve been looking at. 3759 Westleigh St

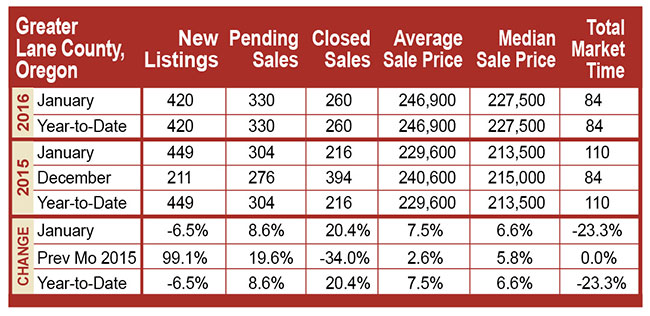

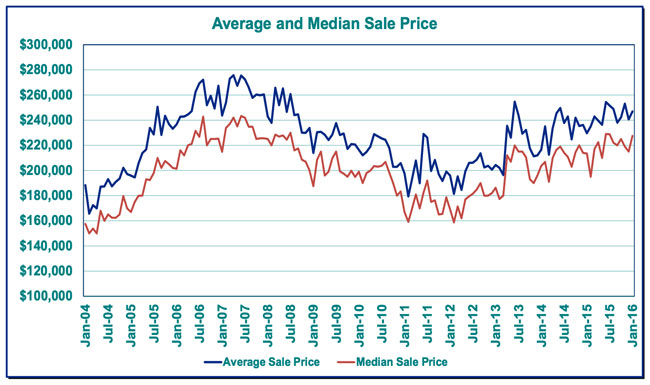

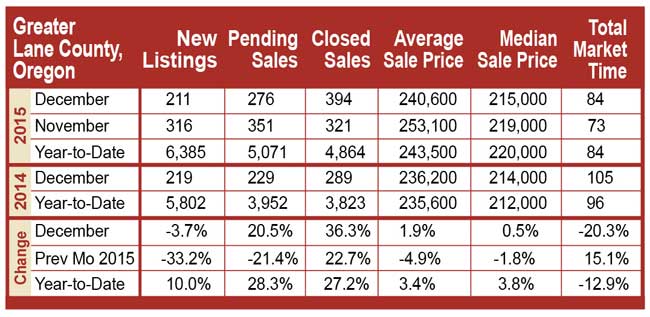

3759 Westleigh St One thing that has always been true, Eugene and Springfield Oregon have a Real Estate market that does not always follow the flow of the rest of the country. Sometimes this can be good and sometimes it might not be so good. Our local market never seems to have the abrupt ups and downs that even close market areas like Portland experience. This can be discouraging when we see other markets values jumping well above our local values, but when the market turns and those markets that had the steep gains begin the cycle down, Eugene typically does not decline as rapidly. This is good!

One thing that has always been true, Eugene and Springfield Oregon have a Real Estate market that does not always follow the flow of the rest of the country. Sometimes this can be good and sometimes it might not be so good. Our local market never seems to have the abrupt ups and downs that even close market areas like Portland experience. This can be discouraging when we see other markets values jumping well above our local values, but when the market turns and those markets that had the steep gains begin the cycle down, Eugene typically does not decline as rapidly. This is good! 2231 Sandy Drive

2231 Sandy Drive

3628 Westleigh St

3628 Westleigh St

5151 & 5153 Trevon St

5151 & 5153 Trevon St