New Homes Built Lag While Demand Rises

Good Monday Morning!

Sales of new homes have lagged over the recent upswing in home sales not only locally, but nationally. In the Eugene and Springfield area the problem is simply that we are out of affordable land for home sites. The local government has put a halt on expansion of the urban growth boundary and the amount of land that is available for building has all but gone away. This has not only driven up building lot prices, but it has made it difficult for home builders to find lots suitable for buidling new homes. Also the recession has not been forgotten by many builders and they are wary of building spec homes. This also has created a decrease in the numbers of news home being built and on the market. Here is an article from Realtor.com that addresses this situation nationally.

Sales of new homes have lagged over the recent upswing in home sales not only locally, but nationally. In the Eugene and Springfield area the problem is simply that we are out of affordable land for home sites. The local government has put a halt on expansion of the urban growth boundary and the amount of land that is available for building has all but gone away. This has not only driven up building lot prices, but it has made it difficult for home builders to find lots suitable for buidling new homes. Also the recession has not been forgotten by many builders and they are wary of building spec homes. This also has created a decrease in the numbers of news home being built and on the market. Here is an article from Realtor.com that addresses this situation nationally.

Despite the hordes of frenzied home buyers hoping to take advantage of very low mortgage interest rates and sign on the dotted lines for their dream homes, builders still aren’t putting up nearly enough residences to appease the rising demand.

There was no monthly change in the number of newly constructed homes that went under contract—54,000, to be exact—from May to June, according to a new residential construction report from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development. But compared with June 2015, sales of the brand-new properties were up 22.7%.

The numbers were not seasonally adjusted, which means they weren’t smoothed out over a 12-month period to account for the ups and downs of home buying at different times of the year.

“[Builders aren’t] taking any risks. They aren’t starting homes without buyers,” says Jonathan Smoke, chief economist of realtor.com®. Builders are taking orders for the bulk of new abodes, he says, instead of building them on spec. And “they’re not offering homes in more affordable price points.”

New homes, complete with brand-new appliances, typically cost more than existing residences. For example, the median price of the new homes was $306,700 in June, according to the report. That was up nearly 6.2% from May and almost 6.1% from the same month a year earlier.

Meanwhile, the median price of an existing home reached an all-time high of $247,700 in June—still a relative bargain selling for a whopping 23.8% less than a new home, according to National Association of Realtors® data.

In June, just 3,000 new homes costing less than $150,000 were sold, according to the government report. Buyers closed on an additional 12,000 selling for between $150,000 and $199,999. But the bulk of sales were in the $200,000 to $499,999 range. About 33% of the sales were in the $200,000 range, 21% were in the $300,000 range, and 18% were in the $400,000 range.

“[Builders either aren’t] trying or they’re not capable, in this environment, of offering lower price points,” Smoke says.

Across the country, monthly sales of new homes remained virtually unchanged from May to June, according to the report.

The West was the only region to see a monthly uptick as buyers signed on the dotted line on 14,000 new residences—up nearly 7.7% from 13,000 the previous month. They were also up almost 27.3% from the same time a year earlier.

Sales were up annually 50% in the Northeast, with 3,000 homes purchased in June. They rose 33.3% year over year in the Midwest, with 8,000 sales, and 20.8% year over year in the South, with 29,000 sales.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

Price: $549,900 Beds: 5 Baths: 3 Sq Ft: 3756

Luxurious and grand! Great room with surround sound speakers, Brazilian cherry hardwood floor & gas fireplace. Huge theater/bonus room prewired for surround sound. Open kitchen with cherry stained cabinets, island, LED under & above cabinets & toe k...View Home for Sale >>

It is not common knowledge, but homeownership in the United States is at a 51 year low. This is a frightening fact because the idea of homeownership is the foundation of the American Dream. There are many factors that have contributed to this fall off on homeownership. There is currenlty a large difference in what our two presidential candidates plan to do to stimulate the housing industry. Do your homework and vote wisely. It is a very dangerous situation if homeownership continues to falter. Here is a recent article from Realtor.com that talks about some of the conditions that are having an impact on homeownership.

It is not common knowledge, but homeownership in the United States is at a 51 year low. This is a frightening fact because the idea of homeownership is the foundation of the American Dream. There are many factors that have contributed to this fall off on homeownership. There is currenlty a large difference in what our two presidential candidates plan to do to stimulate the housing industry. Do your homework and vote wisely. It is a very dangerous situation if homeownership continues to falter. Here is a recent article from Realtor.com that talks about some of the conditions that are having an impact on homeownership. 425 W 28th Ave

425 W 28th Ave

1615 Taney St

1615 Taney St The 2016 election season has been one of the most divisive presidential races in this country's history and unfortunately, that unrest has been something of a wet blanket on the housing market nationally. While many areas in the nation have enjoyed a boom market, the sense of unease and nervousness has convinced many Americans to wait before buying or selling a home. This is not a new scenario for our country, even in years with less chaos and uncertainty, Realtor associations nationwide have noted that consumers tend to be more cautious during an election year. The question is:

The 2016 election season has been one of the most divisive presidential races in this country's history and unfortunately, that unrest has been something of a wet blanket on the housing market nationally. While many areas in the nation have enjoyed a boom market, the sense of unease and nervousness has convinced many Americans to wait before buying or selling a home. This is not a new scenario for our country, even in years with less chaos and uncertainty, Realtor associations nationwide have noted that consumers tend to be more cautious during an election year. The question is: 3686 Yogi Way

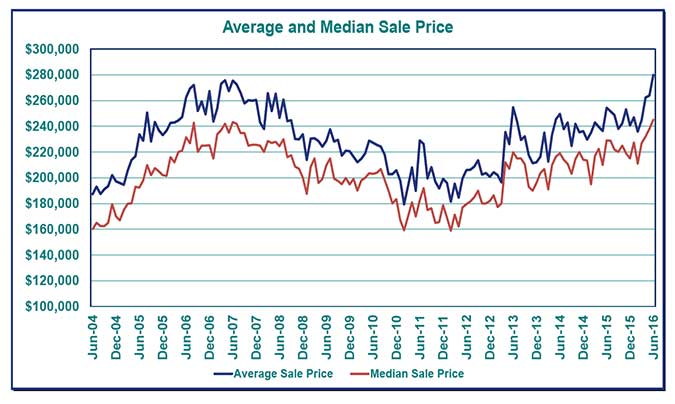

3686 Yogi Way It is not just the Eugene and Springfield area that is having a hot Real Estate market. Nationally, the housing market has been robust and just as in Eugene and Springfield, home prices are on the rise as well. Here is a short and informative article about the national housing market from Realtor.com.

It is not just the Eugene and Springfield area that is having a hot Real Estate market. Nationally, the housing market has been robust and just as in Eugene and Springfield, home prices are on the rise as well. Here is a short and informative article about the national housing market from Realtor.com.

1760 Sweetbriar Ln

1760 Sweetbriar Ln