The Federal Open Market Committee and How Mortgage Rates Are Determined

Good Morning!

There can be some confusion in the minds of the average consumer about interest rates, especially as it relates to the Federal Open Market Committee, or FOMC, meetings. About every six weeks, the FOMC meets to discuss the current state of the economy with an eye toward the future. One important task is to monitor and adjust the cost of funds. In general, the “Fed” tries to keep inflation in check and in theory raise or lower the cost of funds. They do so by adjusting the Federal Funds rate and this is the rate that gets so much press each time the FOMC meets.

There can be some confusion in the minds of the average consumer about interest rates, especially as it relates to the Federal Open Market Committee, or FOMC, meetings. About every six weeks, the FOMC meets to discuss the current state of the economy with an eye toward the future. One important task is to monitor and adjust the cost of funds. In general, the “Fed” tries to keep inflation in check and in theory raise or lower the cost of funds. They do so by adjusting the Federal Funds rate and this is the rate that gets so much press each time the FOMC meets.

The Federal Funds rate is the rate banks can charge one another for short term lending. Short term as in overnight. Why does a bank need to borrow money on such a short notice? Banks are required to keep a certain amount of liquid capital, in other words “cash,” at the end of each business day. These funds are essentially demand funds. When a consumer wants to withdraw some cash either at the bank or at any automated teller, there needs to be cash available to meet those withdrawal requests. If the bank sees their reserves to meet these requests do not meet the reserve requirements, banks seek out a short term loan from another depository institution to meet the reserve requirements. This is what the Fed adjusts, the overnight lending rate. But the Fed doesn’t directly impact the everyday 30 year conforming fixed rate mortgage.

When lenders set their rates each day, they refer to a specific mortgage bond. For example, with a 30 year fixed conforming loan underwritten to Fannie Mae standards, the lender will review the current yield on the FNMA 30-yr 3.0 mortgage bond. Just like any bond, with the price of the bond goes up, the yield will fall. And when the price goes down, the yield will rise. Investors buy bonds, all types of bonds, as a safe place to park cash. When the economy appears to falter, investors can get a little skittish and pull some funds from the stock market and transfer those funds into bonds, including mortgage bonds. If on the other hand the economy is healthy and improving, the opposite will occur.

When the Fed makes an announcement at the end of their two-day meetings, investors are anxious to hear if the Fed raised, lowered or kept rates the same. If the Fed announces they decided to raise the cost of funds by 0.25%, it can tell investors the FOMC decided the economy is doing rather well but to hold of any potential inflation, it will raise the cost of funds that banks will pay for short term lending. It’s not a direct affect on mortgage rates, but definitely an indirect one.

Have an awesome week!

THIS WEEK'S HOT HOME LISTING!

825 SAND AVE

825 SAND AVE

Price: $550,000 Beds: 3 Baths: 2 Sq Ft: 2344

Grand very well-maintained home! Light filled vaulted open layout w/ large windows & skylights. Living rm w/ gas fireplace opens to dining area. Office/bonus rm w/ exterior entrance & Shoji sliding dr/rm divider. Massive kitchen w/ cook island, pant...View this property >>

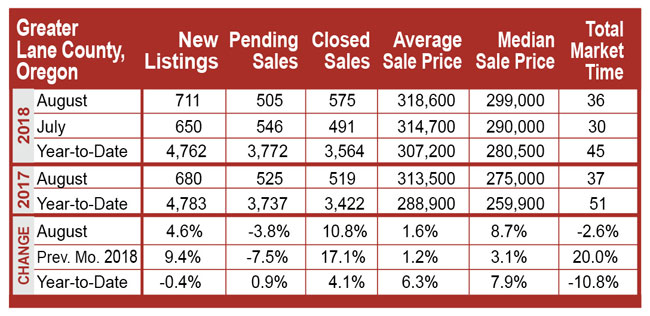

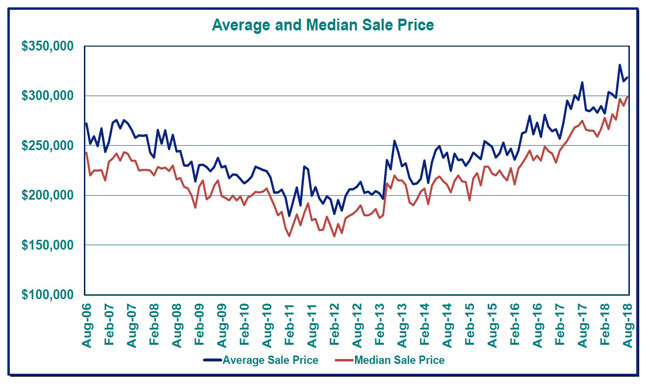

Lane County saw some gains in closings and new listings this August. Closings, at 575, outpaced August 2017 (519) by 10.8% and July 2018 (491) by 17.1%. It was the strongest August for closings in Lane County on the RMLSTM record, dating to 2001!

Lane County saw some gains in closings and new listings this August. Closings, at 575, outpaced August 2017 (519) by 10.8% and July 2018 (491) by 17.1%. It was the strongest August for closings in Lane County on the RMLSTM record, dating to 2001!

84305 Derbyshire Lane

84305 Derbyshire Lane 84305 DERBYSHIRE LN

84305 DERBYSHIRE LN

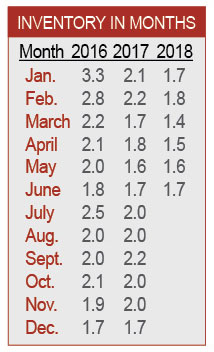

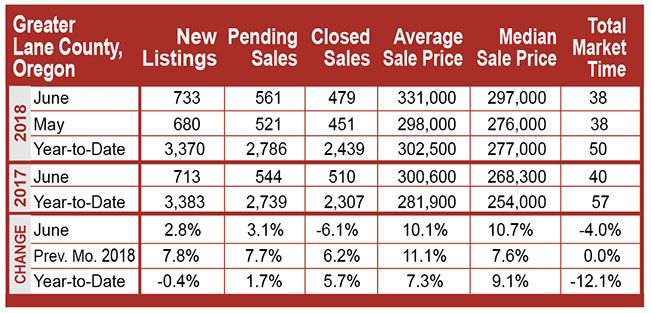

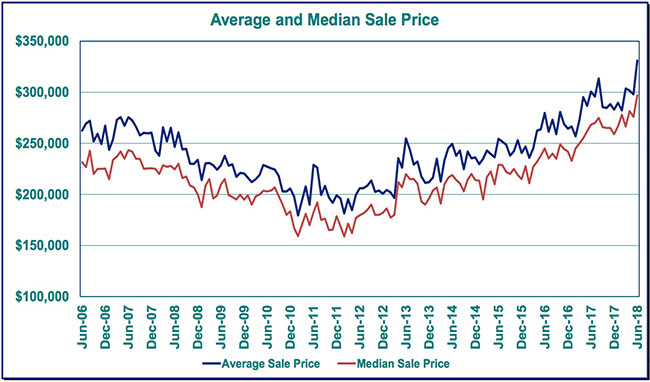

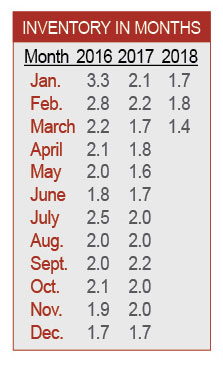

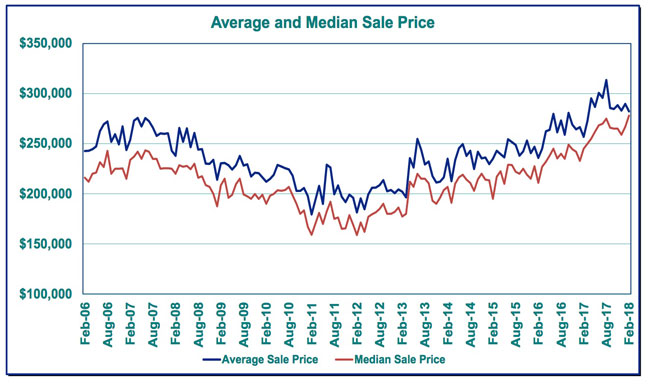

The numbers are in and Lane County had another strong month of home sales for June of 2018. The primary thing to note is that the average home sales price continues to increase and is now over $300,000 as you will see. One has to wonder how long this trend can continue in a market with a wage scale that does not support this high of an average home price? Here are the numbers for June of 2018.

The numbers are in and Lane County had another strong month of home sales for June of 2018. The primary thing to note is that the average home sales price continues to increase and is now over $300,000 as you will see. One has to wonder how long this trend can continue in a market with a wage scale that does not support this high of an average home price? Here are the numbers for June of 2018.

6997 Glacier Drive

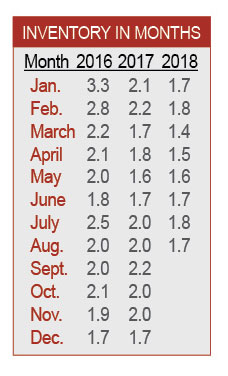

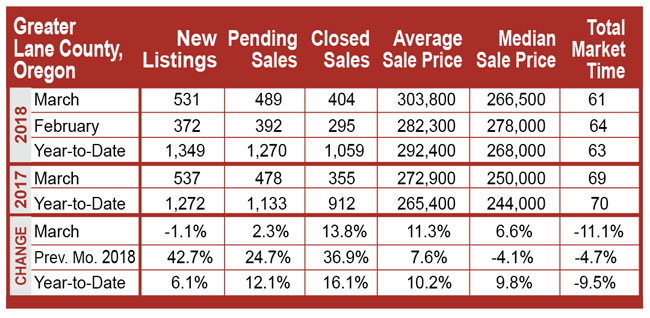

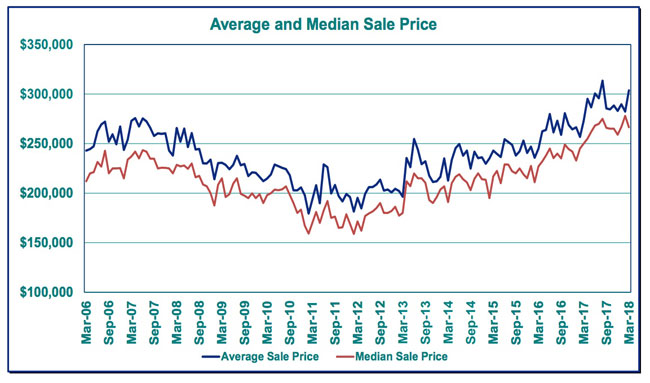

6997 Glacier Drive  March home sale numbers are in for the Eugene and Springfield area and the sellers market trend continues. The inventory of homes for sale actually decreased from February, which is not normal and home prices continue to increase. This is not the best news for homebuyers, but continued good news for homesellers. My caution here is that with mortgage interest rates up and the continued increase in home prices, there will be a point where this market will shift and make a correction. That time could be sooner than later. Here is the March 2018 homes sales report.

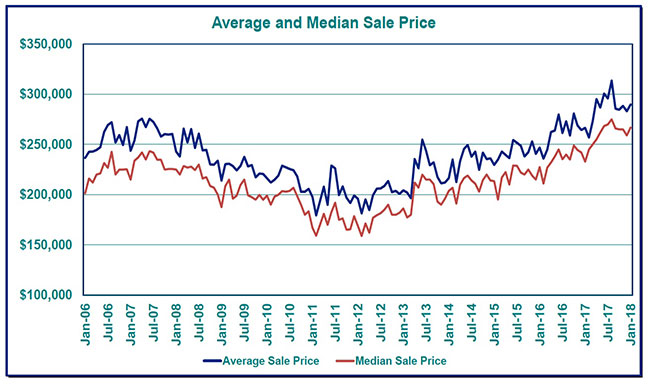

March home sale numbers are in for the Eugene and Springfield area and the sellers market trend continues. The inventory of homes for sale actually decreased from February, which is not normal and home prices continue to increase. This is not the best news for homebuyers, but continued good news for homesellers. My caution here is that with mortgage interest rates up and the continued increase in home prices, there will be a point where this market will shift and make a correction. That time could be sooner than later. Here is the March 2018 homes sales report.

Wedgewood Dr

Wedgewood Dr

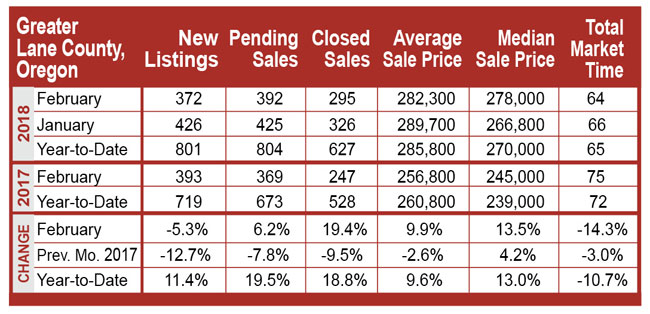

Lane County saw mixed activity this February, but most measures were ahead of February 2017. Closed sales (295) outpaced February 2017 (247) by 19.4% but fell 9.5% short of the 326 closings recorded last month in January 2018. It was the strongest February for closings in Lane County since 2007, when 305 were recorded.

Lane County saw mixed activity this February, but most measures were ahead of February 2017. Closed sales (295) outpaced February 2017 (247) by 19.4% but fell 9.5% short of the 326 closings recorded last month in January 2018. It was the strongest February for closings in Lane County since 2007, when 305 were recorded.

798 70th St

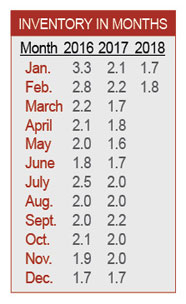

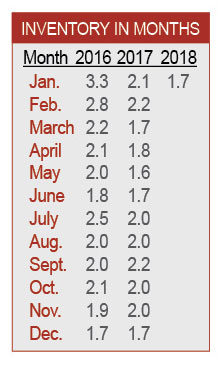

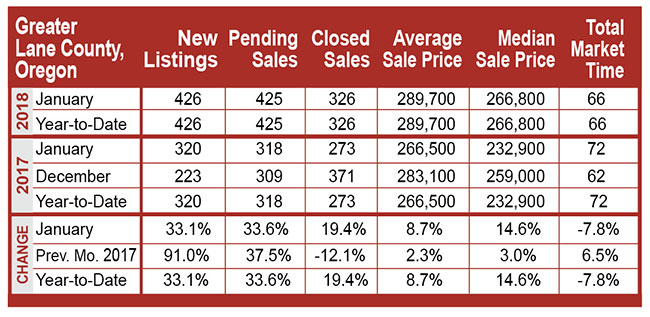

798 70th St  The Real Estate market in the Eugene and Springfield area was stronger in January of 2018 than in January of 2017. Both sales and new listings were up. The inventory of homes on the market remains low at 1.7 months and critically low in the first time buyer price ranges of $250,000 and below. Here are the home sale statistics for January 2018.

The Real Estate market in the Eugene and Springfield area was stronger in January of 2018 than in January of 2017. Both sales and new listings were up. The inventory of homes on the market remains low at 1.7 months and critically low in the first time buyer price ranges of $250,000 and below. Here are the home sale statistics for January 2018.

2018 has started out to be a challenging year for homebuyers in the Eugene and Springfield market area. The issue with the current market is certainly not demand. Our current home market problem stems from lack of inventory of homes for sale. This is especially true in the price ranges of below $300,000, where the high demand for housing exists. With a current inventory of less that 1.6 months, this shortage has left hundreds of would-be home buyers out in the dark. The lack of inventory and high demand has created such a shortage that when a home comes on the market that is priced well in the price range of high demand, there is typically a bidding war taking place. This of course is leading to the situation where many homes are now selling for above asking price. If this trend continues in 2018, it could be a challenging market for buyers.

2018 has started out to be a challenging year for homebuyers in the Eugene and Springfield market area. The issue with the current market is certainly not demand. Our current home market problem stems from lack of inventory of homes for sale. This is especially true in the price ranges of below $300,000, where the high demand for housing exists. With a current inventory of less that 1.6 months, this shortage has left hundreds of would-be home buyers out in the dark. The lack of inventory and high demand has created such a shortage that when a home comes on the market that is priced well in the price range of high demand, there is typically a bidding war taking place. This of course is leading to the situation where many homes are now selling for above asking price. If this trend continues in 2018, it could be a challenging market for buyers.