10 Things to Avoid When Selling Your Home

With the housing marketing beginning to heat up again in the Eugene and Springfield market area, the climate for selling a home has never been better. If yoiu are considering putting your home on the market, there are a few things controlled by you that can make a huge difference on how long it takes your home to sell and at what price your home sells at. The following is an article from "Realty Times" that goes over some home selling dont's.

With the housing marketing beginning to heat up again in the Eugene and Springfield market area, the climate for selling a home has never been better. If yoiu are considering putting your home on the market, there are a few things controlled by you that can make a huge difference on how long it takes your home to sell and at what price your home sells at. The following is an article from "Realty Times" that goes over some home selling dont's.

When you're selling your home, you need every advantage you can get. And there are few homes that are magically market ready without a little help. If your home needs a touch more than a little help, it's time to get focused. After all, listing your home when it's not in the right condition to sell will probably only end in frustration. And, in this case, frustration means: your home sitting on the market for months with no offers or the errant, offensive, lowball.

If you want to make sure you get your home sold quickly and for the right price, you'll want to avoid listing it with the following.

1. Excessive Damage

Maybe the home you're selling was used as a rental and trashed by frat boy tenants, or maybe you just haven't kept it up as you should. Either way, those holes in the wall that look like the living room was used as a boxing gym, the scratched-up wood floors on which dinosaurs have clearly been racing, and the yard that's barren except for those two-foot-tall patches of weeds are not what buyers are looking for. Unless you're planning to offer your house for a price that will make buyers emphasize the good and ignore the bad and the ugly, it's going to need some attention.

2. Carpet in the bathroom

It's just gross. And everyone who walks into that bathroom is thinking one of two things: 1) There's gotta be mold under there; 2) There's gotta be pee on the floor around that toilet. This is one update you'll want to do before you list. Or, if you're already listed and your home's not selling.

3. Big, nasty stains

A buyer shouldn't know where your dog likes to mark or where your kids spilled the entire bowl of holiday punch. If the stains on your carpet are that bad, potential buyers will stroll in and run right back out. No one wants to buy a pigsty. Invest a few bucks in new carpet. You'll make the money back since you won't have to drop your sales price.

4. Pet smells

Speaking of pets…they smell. You probably don't notice since you live with them everyday, but buyers will, and it might be enough to turn them off. Deep clean the carpets and the upholstery, invest in some air fresheners, and remove cat boxes from the house for showings. The last thing you want is a potential buyer referring to your house as "the stinky one."

5. Loud dogs who bark every time someone approaches the home

One last word on pets. Barking happens, whether it's your dog or one that belongs to a neighbor. But you don't need that on the day of your open house. Offering to pay for doggie day care for a neighbor's pooch can eliminate the issue and help create the serene setting buyers want.

6. Your dead lawn

Lack of curb appeal won't necessarily kill a deal. In many cases, you won't even get potential buyers to get out of the car. If the front yard is a mess, buyers will naturally think the mess continues inside.

7. A bad agent

Face it. Not all of them are winners. If your agent is: rude, uninformed, lazy, uncommunicative, belligerent, or unwilling to take your opinions into consideration, get a new one. An agent who isn't giving their client the right type of attention probably isn't going to get the job done.

8. Your sloppiness

Those drawers and cabinets you shoved everything into when you cleaned off your kitchen and bathroom cabinets could be a deal breaker for picky buyers. We all know buyers open stuff. They look in drawers, they open cabinets, they examine closets. If these spaces are messy and overstuffed, they may assume there's not enough storage space.

9. Unreasonable sellers

Big problems in your house can be deal killers, but they can also be deal sealers, if you are reasonable. If your inspection uncovers plumbing, electrical, or roofing problems (or all three!) and you're unwilling to negotiate, you can kiss that sale goodbye.

10. Bad Taste

Your poor decorating choices and failure to keep up with trends from this year—or century—may haunt you when it's time to sell. If it's true that many buyers have no vision—and all you have to do is watch House Hunters and observe a buyer getting hung up on a paint color to know that's true—then you are really in for it with your crowded house full of ugly, outdated crap. A few simple updates can help it to look fresh and give buyers something to fall in love with. Not sure where to start? Check out FrontDoor's 15 Updates That Pay Off and HGTV's 10 Best-Kept Secrets For Selling Your Home

THIS WEEKS HOT HOME LISTING!

3097 Summit Sky Blvd

Price: $750,000 Beds: 4 Baths: 4 Half Baths: 1 Sq Ft: 4338

Price: $750,000 Beds: 4 Baths: 4 Half Baths: 1 Sq Ft: 4338

Elegant upper end home on 1.06 acres in SW Hills! Maple hardwood flrs, granite, travertine, 3 suites, 2 fireplaces, 2 balconies, family room, library/office, formal dining, bonus room, media room. Gourmet kitchen with cherry cabs, wine fridge, doubl...

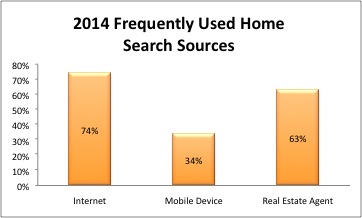

The most useful information for sellers and their agents is to be found in the section on the home search process. While the survey results are not significantly different from those of recent years, the trends continue. For example, this year 74 percent of buyers said that they used the internet frequently during the search process. In 2003 that number was only 42%. This past year 34% of buyers said that they frequently used a mobile or tablet application. That is a newer and growing phenomenon. 63% of buyers said that they frequently relied on a real estate agent for information.

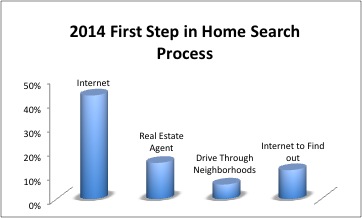

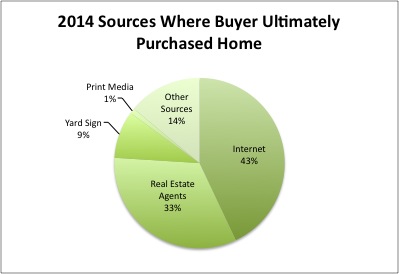

The most useful information for sellers and their agents is to be found in the section on the home search process. While the survey results are not significantly different from those of recent years, the trends continue. For example, this year 74 percent of buyers said that they used the internet frequently during the search process. In 2003 that number was only 42%. This past year 34% of buyers said that they frequently used a mobile or tablet application. That is a newer and growing phenomenon. 63% of buyers said that they frequently relied on a real estate agent for information. Forty-three percent of buyers went to the internet as the first step in the home search process. 15% contacted a real estate agent first, and 6% began by driving through neighborhoods looking for homes for sale. 12% first went online to find out about the process.

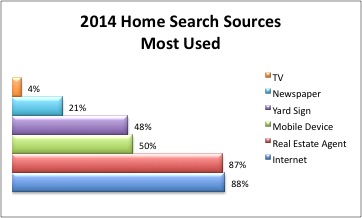

Forty-three percent of buyers went to the internet as the first step in the home search process. 15% contacted a real estate agent first, and 6% began by driving through neighborhoods looking for homes for sale. 12% first went online to find out about the process. Buyers use multiple sources of information in the process of looking for a home. Far and away the most used sources are on-line websites (88%) and real estate agents (87%). Mobile or tablet applications (50%) have replaced yard signs as the third most used source of information. Still though, 48% of buyers indicate that yard signs are one of their sources of information. Only 21% of buyers indicate that they used newspaper ads as an information source. A mere 4% garnered information from television.

Buyers use multiple sources of information in the process of looking for a home. Far and away the most used sources are on-line websites (88%) and real estate agents (87%). Mobile or tablet applications (50%) have replaced yard signs as the third most used source of information. Still though, 48% of buyers indicate that yard signs are one of their sources of information. Only 21% of buyers indicate that they used newspaper ads as an information source. A mere 4% garnered information from television.

These days, universal design features are an everyday fact of life for many households, with architects and other professional designers adding universal design ideas as a matter of course.

These days, universal design features are an everyday fact of life for many households, with architects and other professional designers adding universal design ideas as a matter of course.