Finally, some relief with mortgage rates.

Good Monday Morning!

Finally, some relief with mortgage rates. The question is, will this trend continue? It's no secret that high mortgage interest rates have created a huge slowdown in home sales across the nation. Expected rate cuts this year by the Fed turned into disappointment as inflation numbers continue to climb, and the Fed determined that lower rates would only fuel this fire. There are many opinions out there as to what lies ahead; the following is from a recent article from "Realtor.com."

Mortgage rates finally fell for the first time in five weeks, with the average rate for a 30-year fixed home loan dropping from 7.22% last week to 7.09% for the week ending May 9, according to Freddie Mac.

“After a five-week climb, mortgage rates ticked down following a weaker than expected jobs report,” Sam Khater, Freddie Mac’s chief economist, said in a statement.

Despite this welcome bit of news, overall, high mortgage rates have put a damper on the spring market, discouraging both buyers and sellers from entering what is often the busiest season of the year.

“An environment where rates continue to hover above seven percent impacts both sellers and buyers,” Khater noted in his statement. “Many potential sellers remain hesitant to list their home and part with lower mortgage rates from years prior, adversely impacting supply and keeping house prices elevated. These elevated house prices add to the overall affordability challenges that potential buyers face in this high-rate environment.”

In her recent analysis, Realtor.com® economist Jiayi Xu agrees that, for now, “homebuyers and sellers are likely to experience a slow spring, characterized by fewer transactions, as the elevated mortgage rates deter many from pursuing housing plans.”

She adds that so far, “many sellers who are also prospective buyers opted to defer their selling plans, resulting in a notable slowdown in listing activities. Alongside the scarcity of fresh listings, the increasing buying costs propelled by rising mortgage rates may leave many homebuyers feeling disheartened.”

Here’s what the latest real estate data means for homebuyers and sellers in our most recent installment of “How’s the Housing Market This Week?”

The latest mortgage rate outlook

The U.S. Federal Reserve has not lowered interest rates for six consecutive months, despite earlier talk of three rate cuts in 2024. (While the Fed does not directly influence mortgage rates, the two numbers usually move in tandem.)

“In Wednesday’s meeting, the FOMC voted to hold rates steady and Chair Powell emphasized, once again, that future rate decisions will be dependent on incoming inflation and employment data,” explains Realtor.com senior economic research analyst Hannah Jones. “Recent data reflects a surprisingly resilient economy, which means rate cuts expectations have pushed out further into the back half of the year.”

Yet that does not mean all hope is lost for buyers and sellers looking to make real estate moves this year.

“The cooler labor market data in May signaled that mortgage rate relief could be on the horizon,” says Xu. “The inflation is still far from the 2% target, but persistent inflation improvements and subsequent mortgage rate drops could pave the way for an unseasonably active summer and fall.”

Home prices are falling

There’s good news for homebuyers this week as well, with home prices slipping by 0.2% for the week ending May 4 compared to the same week last year. (The median-priced home cost $430,000 in April.)

“Smaller, more affordable listings are taking the pressure off of the overall median price, which is good news for shoppers looking for these types of homes,” says Xu.

Buyers looking for a bargain should head South, where sellers are listing these budget-friendly homes (often condos, semiattached homes or townhouse) priced between $200,000 and $350,000.

New listings are dwindling

While fresh listings were up by 3.6% for the week ending May 4 compared to the year prior, this growth is slowing considerably under the weight of high mortgage rates.

“Although the number of new listings kept rising, the rate of increase slowed considerably compared to the double-digit surges seen in recent weeks,” says Xu. “As mortgage rates breach 7% once more, numerous home sellers may be inclined to postpone their selling endeavors.”

If mortgage rates continue to rise, that may “continue to suppress listing activities,” says Xu.

While homebuyers might not have a ton of fresh listings to peruse, the number of homes for sale overall—both new listings and old—grew by 35.1% for the week ending May 4 compared to the year prior.

“For the 26th straight week, there were more homes listed for sale versus the prior year, giving homebuyers more options,” says Xu.

Homes are still selling fast

Despite sticky mortgage rates, buyers are still out there making offers. The typical property spent one fewer day on the market for the week ending May 4 compared to the same period last year. (The typical home spent 47 days on the market in April.)

“While the surge in mortgage rates might postpone certain buyers’ decisions, it could also intensify competition as some homebuyers rush to lock in favorable rates before they rise further,” says Xu.

Savvy home shoppers may also take advantage of high mortgage rates to offer less on a home—and sellers are listening.

Have An Awesome Week!

Stay Healthy! Stay Safe! Remain Positive! Trust in God!

THIS WEEKS HOT HOME LISTING!

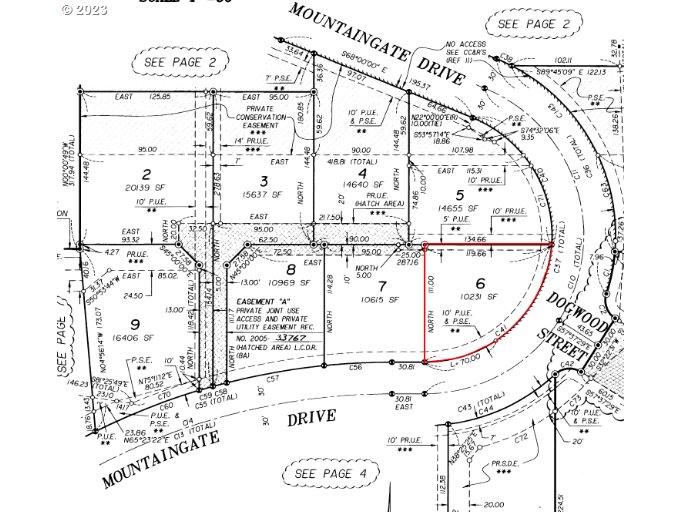

4927 Morely Loop, Eugene, OR

Price: $340,000 Beds: 3 Baths: 2.0 SqFt: 1518

This updated home is on its own lot & doesn't have any HOA fees. It's located on a quiet street with a treed view in the backyard. Open floor plan with vaulted ceilings, skylight in the kitchen, laminate flooring and vinyl windows. Sliding French ba... View this property >>