Mortgage Interest Rates Remain Around 7%

Good Monday Morning!

At the beginning of this year, national financial experts were mostly in agreement that the Fed would go through a series of interest rates drops in 2024. They thought that with inflation numbers predicted to decline, the Fed would need to do this to get the economy back on track. So far, the Fed has failed to drop rates and has even made it look as if a rate decline program is not in the picture any time soon. Recent unfavorable inflation rates could be putting a stranglehold on Fed rates declining any time soon. With that reality, mortgage interest rates remain around the 7% mark. This is a lower level than a year ago, but this rate remains higher than what many home buyers feel they want to deal with. Many would-be buyers are sitting and waiting for mortgage interest rates to drop, but is that the best route? The following article from "US News" talks about the best direction for home buyers to take.

It's been two years since the Federal Reserve first began its tightening cycle with a series of rate hikes, effectively ending the pandemic-era housing boom. Since then, mortgage rates rose past 5%, 6% and 7% as home prices stayed stubbornly high – a combination that brought housing affordability to its lowest levels in decades.

The spring 2024 home-shopping season is upon us, and it brings with it a sense of deja vu: Just like in 2023, two-thirds of respondents who plan on buying a home in 2024 are waiting for rates to fall first, according to the second annual Homebuyer Sentiment Survey from U.S. News.

Between Feb. 28 and March 4, U.S. News ran a nationwide survey of 1,200 Americans who are planning to buy a home in 2024 using a mortgage. We asked respondents a series of questions to find out how the mortgage rate environment has impacted their homebuying plans. Here's what we found:

- Two-thirds of homebuyers (67%) are waiting for mortgage rates to drop before buying a home this year. Last year, an equal share of buyers said the same thing – but rates didn't budge. In fact, 67% of this year's buyers put off purchasing a home in 2023 because they were waiting for rates to fall.

- Among those who are holding out for lower rates, a quarter (26%) want to see them below 5% before buying, which isn't expected to happen in 2024 or even 2025. About half (49%) are willing to wait for more than six months for rates to come down.

- Three-quarters of current buyers (76%) plan on refinancing to a lower mortgage rate in the future. Additionally, more than a third (36%) are considering borrowing an adjustable-rate mortgage in order to get a lower rate. Both of these strategies come with risks: Those who "buy now, refi later" could be stuck with unaffordable monthly payments while they wait for rates to fall, and those who choose an ARM may be on the hook for higher payments in the future.

- The vast majority of homebuyers (91%) are at least "somewhat" stressed about buying a home this year, with a quarter (25%) saying they're "extremely" stressed about it. Just a quarter of buyers (26%) say there's enough for-sale housing inventory within their budget in the market where they're buying a home.

- Over half of 2024 home shoppers (52%) are planning on buying new construction, including 55% of first-time buyers and 45% of repeat buyers. Among them, 61% say they will use their builder's preferred lender, which often comes with added incentives like mortgage-rate buydowns and closing-cost credits.

Have An Awesome Week!

Stay Healthy! Stay Safe! Remain Positive! Trust in God!

THIS WEEKS HOT HOME LISTING!

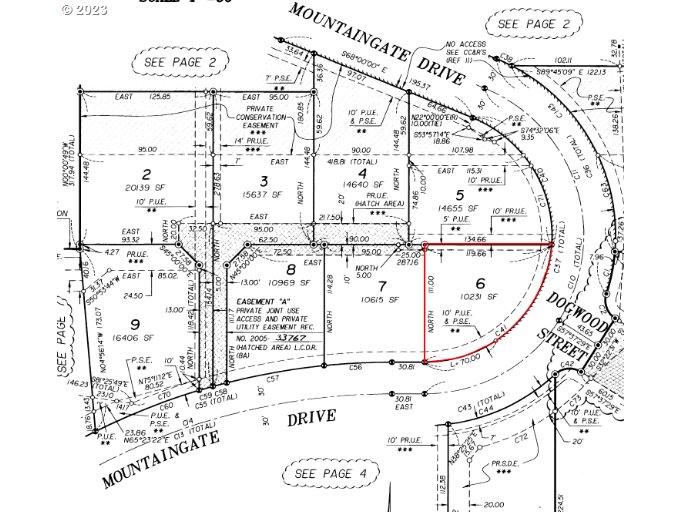

320 Mountaingate Dr, Springfield, OR

Price: $114,500 Acres: 0.23

Rare lot availability in the Mountaingate Community. Build your dream home here! Gorgeous mountain and valley views. Lot provides level driveway to garage opportunity, with potential for daylight basement opportunity in the rear of the lot. Nearby p...View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!