Your Path to Homeownership

Good Morning!

With mortgage interest rates remaining historically low, the number of home buyers has accelerated over the past several years. If you or your family fit into the group of those thinking about a home purchase, here are some great tips to help you with the purchase of your home. This article was taken from Realty Times!

You're ready to make an offer on the home of your dreams. But before you do, make sure you're really ready. Ask yourself and your household members if this is the home for the next five or so years. Make sure everyone is on board with commitments to make it work, from putting off the dream vacation to putting in the elbow grease to clean, paint and do the yard work.

You're ready to make an offer on the home of your dreams. But before you do, make sure you're really ready. Ask yourself and your household members if this is the home for the next five or so years. Make sure everyone is on board with commitments to make it work, from putting off the dream vacation to putting in the elbow grease to clean, paint and do the yard work.

Have your real estate agent pull up the most recent sold comparables (CMA) within a reasonable radius of the home, so you can compare the home with other similar homes in terms of location, size, features, and amenities.

Next, consider the most current market conditions, so you can choose the right offer strategy.

In a buyer's market, discounts are common because there are fewer buyers, more properties for sale, and home prices are soft or falling so offers under list price are common.

In a seller's market, homes sell quickly for full price or higher because there are plenty of buyers and few homes for sale.

Whether you are in a buyer's market or a seller's market, your goal is to buy the home at a fair price. If you were the seller, what is the lowest possible price you'd accept?

To show the seller you're serious, include a copy of your lender's pre-approval letter, along with a cover letter summarizing your strengths as a buyer in terms of creditworthiness, flexibility in closing, and why you love this home. Include a copy of the comparables you used to show why your offer is a fair price for the property.

If the seller's home is offered at a reasonable price, don't waste time. Pay asking price or close to it. A home priced to sell will sell quickly and you'll lose it if you mess around.

Offering too little for a property is risky. If the seller feels insulted by your offer, you've lost the opportunity to negotiate. On the other hand, some sellers are simply unrealistic about their home's value. Maybe your offer will be their wake-up call. The seller will probably respond with a face-saving still-high offer, but at least they're negotiating with you.

If your offer is conditional, such as your need to sell another home before closing on the seller's, you'll have to find a way to sweeten the deal, such as a full-price offer. Few sellers will accept a discount and a contingency.

Your real estate professional will help you draft the offer with a price, estimated closing date and terms, including earnest money (a guarantee that you'll perform as a buyer in good faith,) final approval by your lender and your right to have an inspection. Your earnest money check will be forwarded to the escrow agent when your offer is accepted.

You'll have a brief period to get your home inspections completed. Your home inspector will go through the home with you and point out the condition and potential lifespan of all systems and appliances. You should only renegotiate when a problem wasn't obvious before, or when a system is found to be unsafe or not functioning.

Once you and the seller have agreed to terms, your offer is now a binding contract and you're on your way to owning a home!

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

33970 VAN DUYN RD

33970 VAN DUYN RD

Price: $995,000 Beds: 4 Baths: 2 ½ Baths: 1 Sq Ft: 2930

Live where the eagles fly. Gorgeous valley and coast range views from a serene lofted location in the elite Country View Estates gated community. An elegant, top quality home offering spacious rooms, built-ins, and beautiful views, including spectac...

View this property >>

2060 MCLEAN BLVD

2060 MCLEAN BLVD

3097 SUMMIT SKY BLVD

3097 SUMMIT SKY BLVD Just like anything that gets a lot of use, homes show wear and tear after a few years. Certain color schemes and decorative styles begin to look outdated. And there are some improvements that you may have put off as a new homeowner that you can afford to do now.

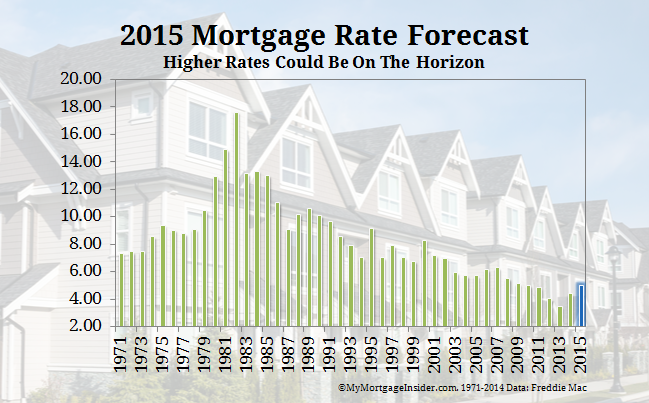

Just like anything that gets a lot of use, homes show wear and tear after a few years. Certain color schemes and decorative styles begin to look outdated. And there are some improvements that you may have put off as a new homeowner that you can afford to do now. Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers.

Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers. 48808 MCKENZIE HWY

48808 MCKENZIE HWY For most first-time buyers, it's better to accept that for dreams to come true, you have to do the groundwork. Yes, you will be far more independent than you would as a renter, but you will still have some very real responsibilities to make homeownership work. Here are the top three responsibilities you'll have as a homeowner.

For most first-time buyers, it's better to accept that for dreams to come true, you have to do the groundwork. Yes, you will be far more independent than you would as a renter, but you will still have some very real responsibilities to make homeownership work. Here are the top three responsibilities you'll have as a homeowner. When you go shopping for homes, remember that you're vulnerable. Cupid may strike with his bow when you least expect it, causing you to fall in love - with the wrong house.

When you go shopping for homes, remember that you're vulnerable. Cupid may strike with his bow when you least expect it, causing you to fall in love - with the wrong house. 2670 Gay Street

2670 Gay Street Why would sellers deliberately sabotage their chances of selling their homes? It doesn't make any sense, yet it happens all the time.

Why would sellers deliberately sabotage their chances of selling their homes? It doesn't make any sense, yet it happens all the time. Price: $529,000 Beds: 4 Baths: 4 Half Baths: 1 Sq Ft: 5,568

Price: $529,000 Beds: 4 Baths: 4 Half Baths: 1 Sq Ft: 5,568 With the housing marketing beginning to heat up again in the Eugene and Springfield market area, the climate for selling a home has never been better. If yoiu are considering putting your home on the market, there are a few things controlled by you that can make a huge difference on how long it takes your home to sell and at what price your home sells at. The following is an article from "Realty Times" that goes over some home selling dont's.

With the housing marketing beginning to heat up again in the Eugene and Springfield market area, the climate for selling a home has never been better. If yoiu are considering putting your home on the market, there are a few things controlled by you that can make a huge difference on how long it takes your home to sell and at what price your home sells at. The following is an article from "Realty Times" that goes over some home selling dont's.

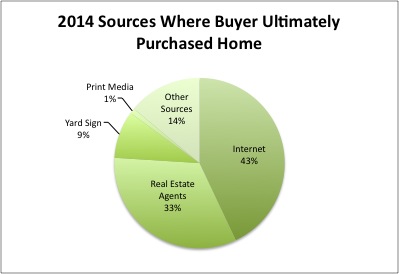

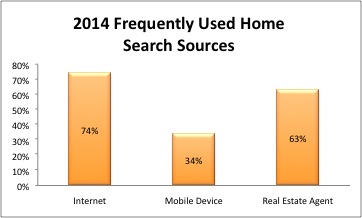

The most useful information for sellers and their agents is to be found in the section on the home search process. While the survey results are not significantly different from those of recent years, the trends continue. For example, this year 74 percent of buyers said that they used the internet frequently during the search process. In 2003 that number was only 42%. This past year 34% of buyers said that they frequently used a mobile or tablet application. That is a newer and growing phenomenon. 63% of buyers said that they frequently relied on a real estate agent for information.

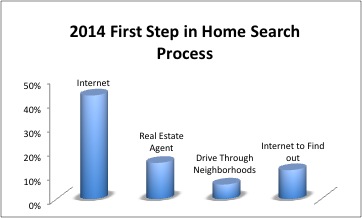

The most useful information for sellers and their agents is to be found in the section on the home search process. While the survey results are not significantly different from those of recent years, the trends continue. For example, this year 74 percent of buyers said that they used the internet frequently during the search process. In 2003 that number was only 42%. This past year 34% of buyers said that they frequently used a mobile or tablet application. That is a newer and growing phenomenon. 63% of buyers said that they frequently relied on a real estate agent for information. Forty-three percent of buyers went to the internet as the first step in the home search process. 15% contacted a real estate agent first, and 6% began by driving through neighborhoods looking for homes for sale. 12% first went online to find out about the process.

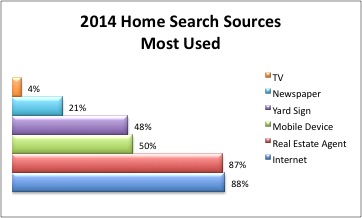

Forty-three percent of buyers went to the internet as the first step in the home search process. 15% contacted a real estate agent first, and 6% began by driving through neighborhoods looking for homes for sale. 12% first went online to find out about the process. Buyers use multiple sources of information in the process of looking for a home. Far and away the most used sources are on-line websites (88%) and real estate agents (87%). Mobile or tablet applications (50%) have replaced yard signs as the third most used source of information. Still though, 48% of buyers indicate that yard signs are one of their sources of information. Only 21% of buyers indicate that they used newspaper ads as an information source. A mere 4% garnered information from television.

Buyers use multiple sources of information in the process of looking for a home. Far and away the most used sources are on-line websites (88%) and real estate agents (87%). Mobile or tablet applications (50%) have replaced yard signs as the third most used source of information. Still though, 48% of buyers indicate that yard signs are one of their sources of information. Only 21% of buyers indicate that they used newspaper ads as an information source. A mere 4% garnered information from television.