Credit Score: How Low Is Too Low To Buy A Home?

Good Monday Morning!

Frequently, I get questions from would-be homebuyers in regards to credit scores and home purchases. There are requirements for any home loan on specific credit scores needed to obtain a loan. The following is a great article from "Realty Times" that explains the credit score process for home financing.

Frequently, I get questions from would-be homebuyers in regards to credit scores and home purchases. There are requirements for any home loan on specific credit scores needed to obtain a loan. The following is a great article from "Realty Times" that explains the credit score process for home financing.

When it comes to your credit score, how low is too low? The number you really need to buy a house.

We all know that when it comes to buying a house, there are a few things we need, like a down payment and a good enough credit score to qualify for a loan. But what does a "good enough credit score" really mean? Does your credit history have to be impeccable? Can you have a couple of boo-boos? And, if you do have issues on your report, how much of a hit will you take? Your credit score is "a number, roughly between 300 and 850, that summarizes a consumer's creditworthiness," said Bankrate. "The higher the score, the more able and willing a consumer is to repay a loan, lenders believe. The best mortgage rates and terms go to borrowers with credit scores of 740 and higher."

But most of us can't measure up to that number. Thankfully, we don't have to. There's room for lower scores - even really low scores - depending on the type of loan you're applying for, with a number of other factors (your income and work history, the amount of your down payment, the state of the economy) thrown in. Knowing where the bottom is will help you figure out how to proceed.

FHA loans

The advantage to a Federal Housing Administration (FHA) loan for many buyers is the low down payment. You may need only 3.5% down to purchase a home with this type of loan, which is backed by the government. But, you'll need a minimum 580 credit score if you're only planning to put 3.5% down. Can't meet that benchmark? You'll need more cash up front.

"If your credit score is below 580, however, you aren't necessarily excluded from FHA loan eligibility," said the FHA. "Applicants with lower credit scores will have to put down a 10 percent down payment if they want to qualify for a loan."

For FHA loans, your credit score can be as low as 500. But, "Those with credit scores between 500 and 579 are limited to 90 percent LTV," which leaves a lot of people out of luck.

Non-government-backed loans

The issue with FHA loans for many buyers: That pesky private mortgage insurance (PMI), which can add several hundred dollars to the monthly payment and is "required any time you put less than 20% down on a conventional loan," said My Mortgage Insider.

If you have a larger down payment, you may be able to avoid paying PMI by going with another type of loan - but only if you have the credit score. "To qualify for a conventional mortgage, a borrower generally needs a minimum credit score of 680 and at least 5 percent down," said Bankrate. "Many lenders require at least 10 percent down."

There may be more wiggle room in that credit score if you can come up with more money for a higher down payment. But, if it's too low, you'll likely be pointed right back to FHA loans. On the other end, a higher score will get you the best possible interest rates.

Subprime mortgages

Have a credit score below 500? You're officially in the "bad credit" zone. But, you may still be a candidate for a loan, even if you can't qualify by FHA standards, by going with a subprime mortgage. The word "subprime" still sends shivers down the spines of many people because loans extended to what many industry professionals considered to be unqualified applicants were largely blamed for the last housing crash. Accordingly, many of these opportunities dried up in the aftermath.

Today, though, subprime mortgages are available. Keep in mind that minimum credit scores will depend on the individual loan and lender, and each borrower's unique set of financial circumstances. And, you'll pay for the privilege of being extended a loan with higher rates and/or fees.

"Subprime mortgage lenders mostly use collateral like equity earned when considering a ‘refinance' or a more significant down-payment when talking about a ‘purchase money' transaction," said First Time Home Financing.

Private Money Lenders

If all other avenues fail, you may still be able to get a loan with your bad credit from a private money lender. These are individuals with money to spend who are looking for investments. Because your low credit score makes you risky, you'll be charged more for your loan.

"Your personal credit is usually a smaller factor in these types of loans. However, you should know that the interest rate on these loans is much higher - in the range of 10-15%," said First Time Home Financing. "If you really have bad credit, this could be your only option for the time being."

Have An Awesome Week!

THIS WEEK'S HOT HOME LISTING!

|

87807 BLEK DR

Delightfully spacious and bright! New exterior and interior paint, new vinyl windows, vaulted ceilings and skylights. Pellet stove in living room, kitchen with island and eating bar opens to dining and family room with slider. Master suite with 2 cl...View this property >>

|

Even in the hot sellers market that we currently have here in the Eugene and Springfield area, it is important to prepare your home for sale if you are going to put it on the market. Paying attention to detail and having your home in great condition can mean a quicker sale and far more money. Even in this market, I see homes sit out there and not sell. You still have to price your home right, but condition is an extremely important factor for most homebuyers. Here is an article from "Realty Time" that will give you some pointers on preparing your home for sale.

Even in the hot sellers market that we currently have here in the Eugene and Springfield area, it is important to prepare your home for sale if you are going to put it on the market. Paying attention to detail and having your home in great condition can mean a quicker sale and far more money. Even in this market, I see homes sit out there and not sell. You still have to price your home right, but condition is an extremely important factor for most homebuyers. Here is an article from "Realty Time" that will give you some pointers on preparing your home for sale. 755 Horn Ln

755 Horn Ln The low inventory of homes for sale that we currently have in our local Real Estate market has made home buying much more difficult. The current shortage of homes for sale has driven prices up and made our home purchase market very competitive, especially in the price ranges where most first time homebuyers are looking. It is easy to get caught up in this competitive market and pay too much for a home or purchase a home that may not fit your needs. In this market, the help of a knowledgeable homebuyer specialist Realtor is a must. They can help keep you from making mistakes that will haunt you down the road. It is also important to educate yourself about the current market and to not be forced into a rush purchase. The following article from "Realty Times" talks about how to deal with a home purchase during this market.

The low inventory of homes for sale that we currently have in our local Real Estate market has made home buying much more difficult. The current shortage of homes for sale has driven prices up and made our home purchase market very competitive, especially in the price ranges where most first time homebuyers are looking. It is easy to get caught up in this competitive market and pay too much for a home or purchase a home that may not fit your needs. In this market, the help of a knowledgeable homebuyer specialist Realtor is a must. They can help keep you from making mistakes that will haunt you down the road. It is also important to educate yourself about the current market and to not be forced into a rush purchase. The following article from "Realty Times" talks about how to deal with a home purchase during this market. 32538 Hatfield St

32538 Hatfield St  Here’s the good news: Sales of newly constructed homes rose in the beginning of the year. The bad news? It wasn’t enough to ease the housing shortage that is frustrating would-be home buyers across the nation.

Here’s the good news: Sales of newly constructed homes rose in the beginning of the year. The bad news? It wasn’t enough to ease the housing shortage that is frustrating would-be home buyers across the nation.

1471 BARRINGTON AVE

1471 BARRINGTON AVE 114 Hayden Bridge Way

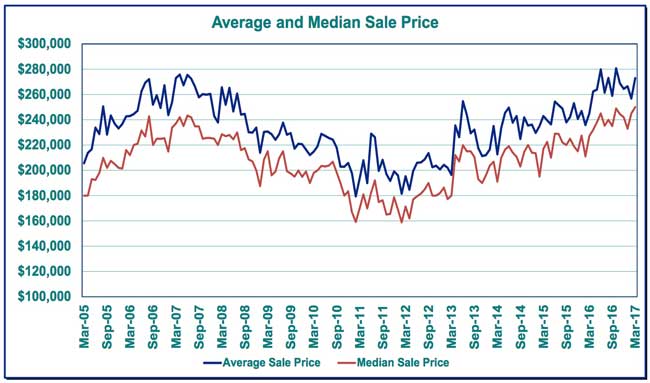

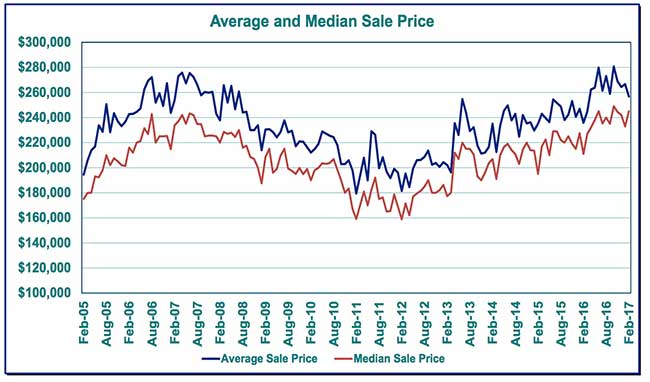

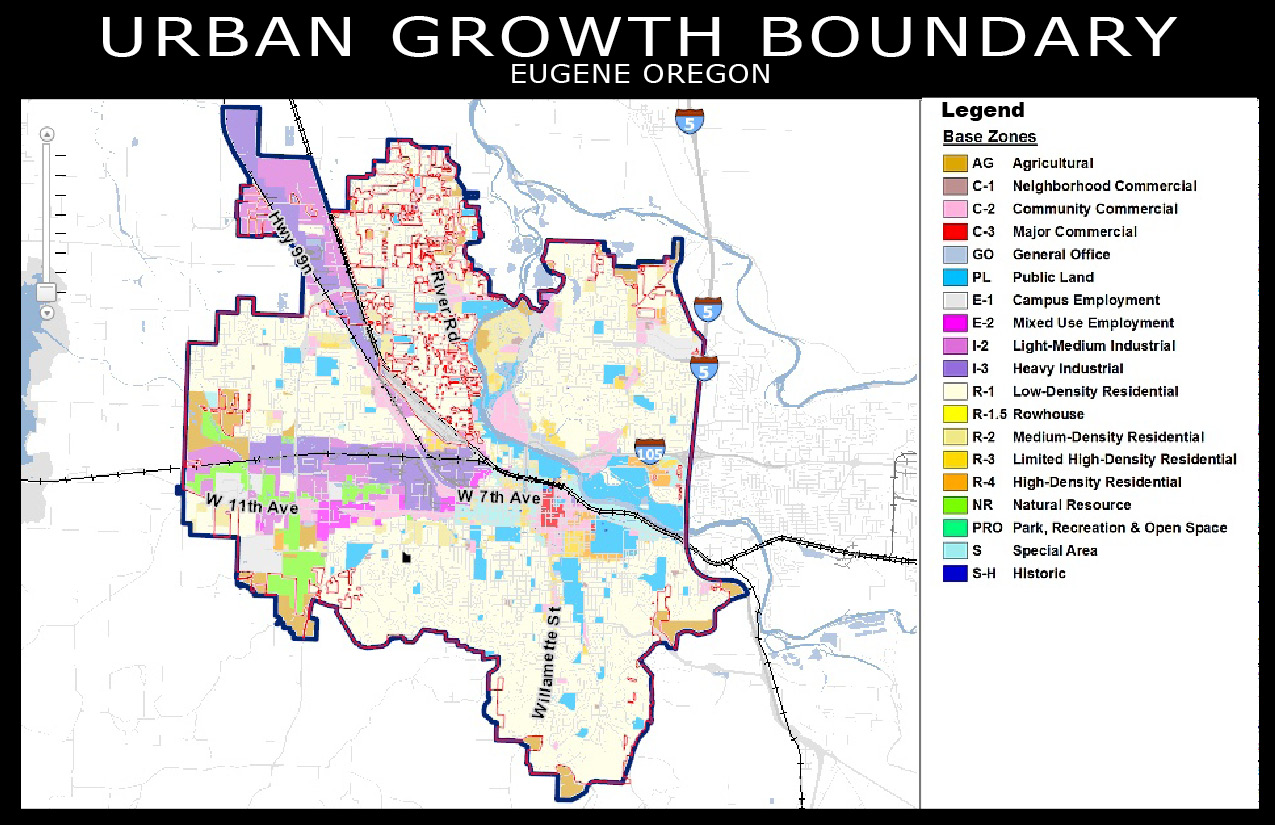

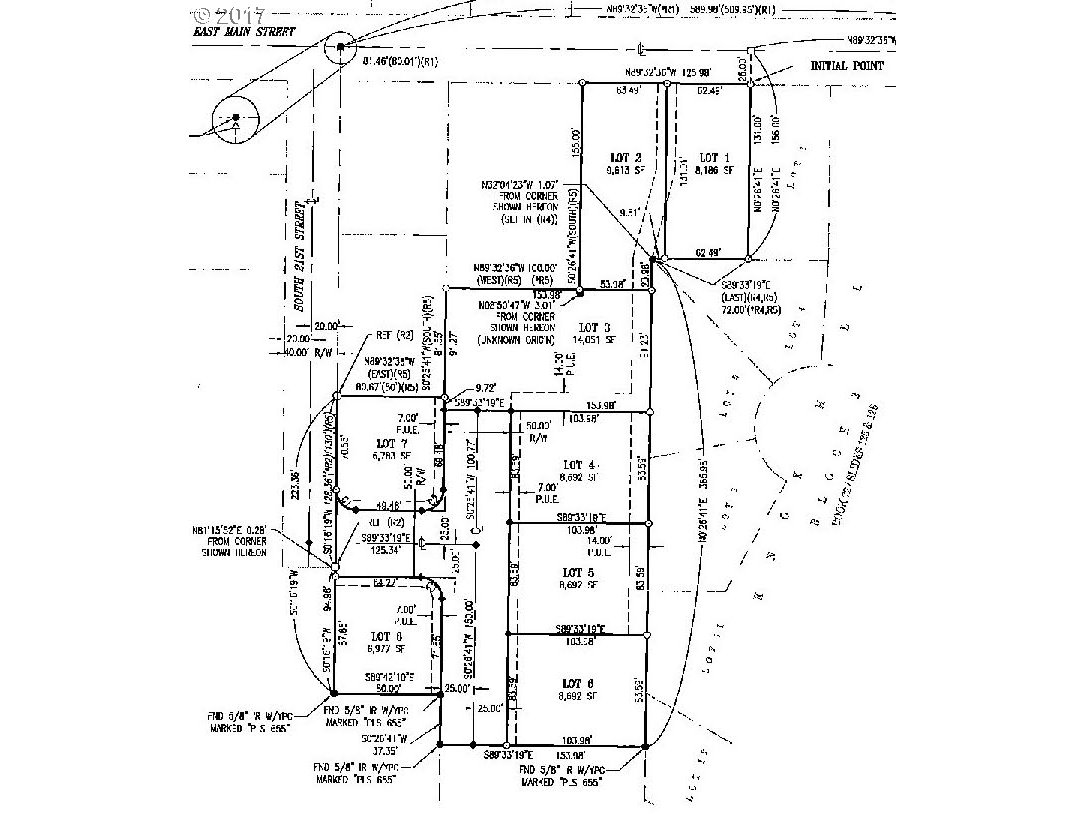

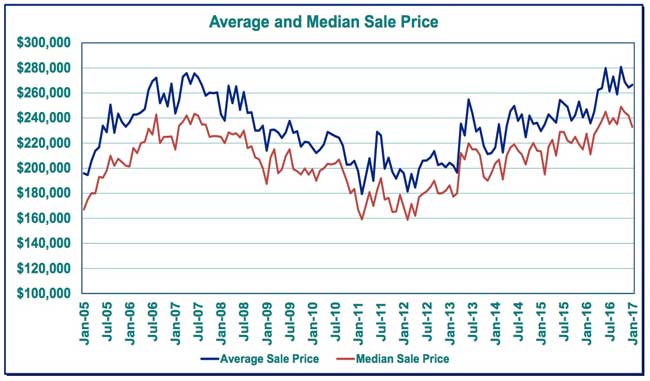

114 Hayden Bridge Way Eugene's recent housing market is currently seeing record low number of homes on the market for sale. In fact, the inventory right now is less than two months and second lowest in the nation. The price range of homes that is hardest hit by this shortage is those that are at or below the median sales price of around $265,000. This is the price range that most young families and first time home buyers are in. The housing shortage has created some severe problems in our area as the shortage continues to drive home prices higher, making them less affordable. Home price increases have outpaced the increase in income for our local area and as a result have actually pushed many first time home buyers completely out of the market or pushed them into price prices where there are low inventory and high demand.

Eugene's recent housing market is currently seeing record low number of homes on the market for sale. In fact, the inventory right now is less than two months and second lowest in the nation. The price range of homes that is hardest hit by this shortage is those that are at or below the median sales price of around $265,000. This is the price range that most young families and first time home buyers are in. The housing shortage has created some severe problems in our area as the shortage continues to drive home prices higher, making them less affordable. Home price increases have outpaced the increase in income for our local area and as a result have actually pushed many first time home buyers completely out of the market or pushed them into price prices where there are low inventory and high demand.

Hilltop Drive #1

Hilltop Drive #1

1004 Leopold

1004 Leopold