Good Monday Morning!

Even with 4 consecutive weeks of mortgage interest rate decline, the housing market remains in decline nationally. Our current market is strange though and not like any other that I have witnessed in my 34 years as a Real Estate Broker in the Eugene and Springfield area. Yes, some homes that are on the market for sale just sit and dont sell in this market, but others sell quickly and some with bidding wars. Why is that? The reasons are many, but price is the number one reason and condition follows close behind. The other reasons are that some price ranges have more buyers looking and lower inventory. If you price your home competitively with this market and prepare your home for sale by making it very attractive to buyers, you may sell quickly and possibly create a buyer bidding war, even in this market. If you are considering selling your home, read the following article from "Realtor.com" that talks about why some homes sell while others sit in this market.

Homebuyers who are closely watching the correction in the real estate market might believe now is a good time to pounce. After all, homes are sitting on the market for longer, those maddening bidding wars have dried up, and wild offers over the asking price are things of the past, right?

Well, not exactly. It all depends on what they’re hoping to purchase.

Those searching for a home are seeing plenty of fixer-uppers, homes lacking curb appeal, and those in less desirable areas sitting on the market for longer and undergoing price reductions. But well-appointed, well-situated turnkey homes are still selling fast, often receiving multiple offers, and even selling over the asking price. It’s as if the housing slowdown hasn’t affected these properties much at all.

“If it’s a good home in the resale market, it’s selling quickly,” says Ali Wolf, chief economist of the building consultancy Zonda. “The buyer who is buying today is not the same buyer buying 12 months ago. If [they’re] paying this much, it needs to be a nice home.”

Competition for turnkey homes in good school districts remains fierce.

“If the house is perfect, the odds of someone else wanting it are high, too,” says Geena Peoples, an Austin, TX–based real estate agent with The Juice Group at Compass.

Home prices are still much higher than they were before the COVID-19 pandemic. And while mortgage rates have fallen a bit of late, they’re still substantially higher than they were at this time last year, jumping to just over 6% for 30-year fixed-rate loans, according to Freddie Mac. So buyers don’t have much room in their budget for costly repairs.

“In a market where costs are still high and buyers can be a little choosier, it makes sense they’re going to really zero in on the homes that are the most appealing,” says Realtor.com® Chief Economist Danielle Hale.

During the pandemic, just about everything was selling for more money than ever before because homebuyers didn’t have much to choose from. Even fixer-uppers in the right markets were hot commodities. Buyers and investors could snap up these properties and still be able to afford the work they needed.

“Back in 2021, you could list just about anything and there would be a line out the door,” says Peoples. She used to see dated homes with cracks in the foundation and the walls on the market, and buyers would still pounce on them.

But those days seem to have ended, at least for now.

Fewer buyers are seeking out fixer-uppers

Fixer-uppers have traditionally been popular with investors, who could get these homes at a discount, put some work into them, and then resell them at a hefty profit. And this popularity soared in the early portion of the pandemic. However, with home prices falling from their peaks over the summer, many investors are now increasingly pausing their purchases. If prices dip, even a little, they could lose money on their projects. And many of the larger iBuyers have either exited the market or aren’t buying as much at the moment. That’s left less demand for these properties.

So they’re staying on the market longer and sellers are having to drop the price on these homes or accept lowball offers.

“Buyers want those homes [only] when there is no other inventory out there,” says Matt Curtis, owner of his eponymously named brokerage in Huntsville, AL.

Even in today’s more challenging housing market, “anything that is staying on the market for more than 48 hours [without a booked showing] is in a less desirable location and definitely not in tiptop, showable condition, says Princeton, NJ–based real estate agent Debbie Lang. She works for Berkshire Hathaway HomeServices Fox & Roach Realtors.

She recently saw a home priced below $1 million that received eight offers.

What’s not selling are properties “that need a major renovation and updates, like a new kitchen or bathroom and major systems,” says Lang. “Buyers are always looking for improvements that have already been done.”

Those problems can be overlooked if the home is in a great location, such as near a train station or in a community with top-rated schools, she says. But buyers could get a discount on these properties.

Money isn’t the only obstacle to purchasing a home that needs some TLC.

On Cape Cod, a popular vacation destination on the Massachusetts shore, it can be difficult to get work done, says local real estate agent Doug Payson, with Kinlin Grover/Compass.

“Because of the supply chain issues, it’s often difficult to get materials. There’s also a shortage of workers,” says Payson. Meanwhile, “properties that you don’t have to do anything to are seeing, like, 12 offers.”

Price Matters

Even the ugliest, run-down, abandoned homes with the worst smells, located in the most undesirable areas, such as on a busy highway, will still sell—at the right price.

“Price will always overcome any objection,” says Salt Lake City real estate agent Justin Udy, of Century 21 Everest.

His brokerage will loan sellers up to $10,000 to renovate and improve their homes before putting them on the market.

You have to make it easy on the consumer to want to buy it,” he says.

Have An Awesome Week!

Stay Healthy! Stay Safe! Remain Positive! Trust in God!

THIS WEEKS HOT PROPERTIES FOR SALE!

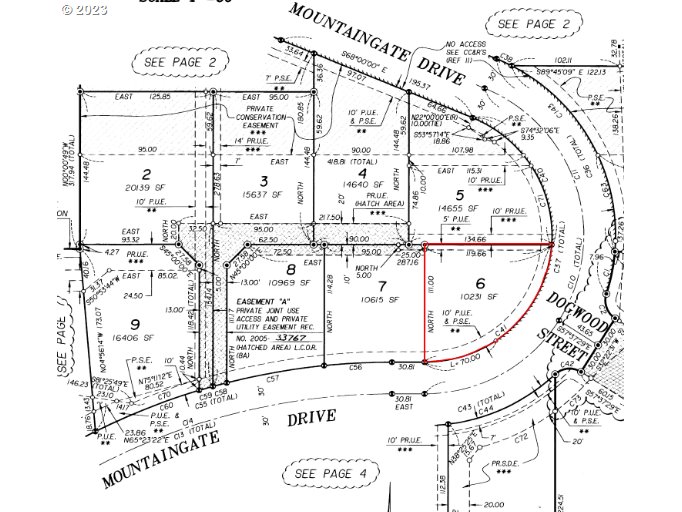

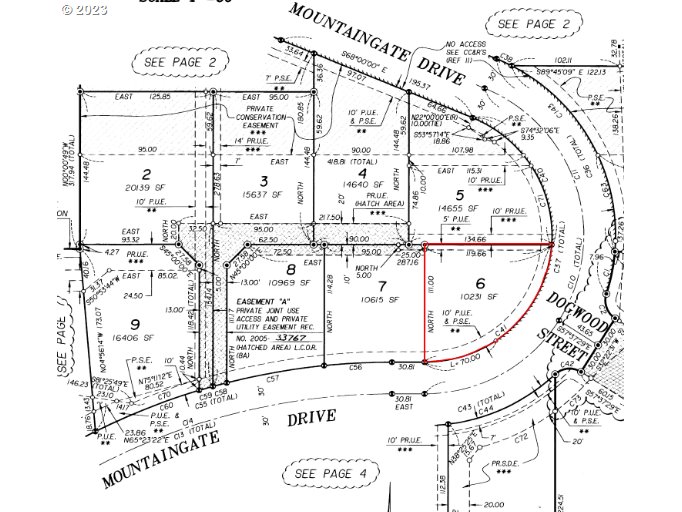

320 Mountaingate Dr, Springfield, OR

320 Mountaingate Dr, Springfield, OR

Price: $125,000 Acres: 0.23

...View this property >>

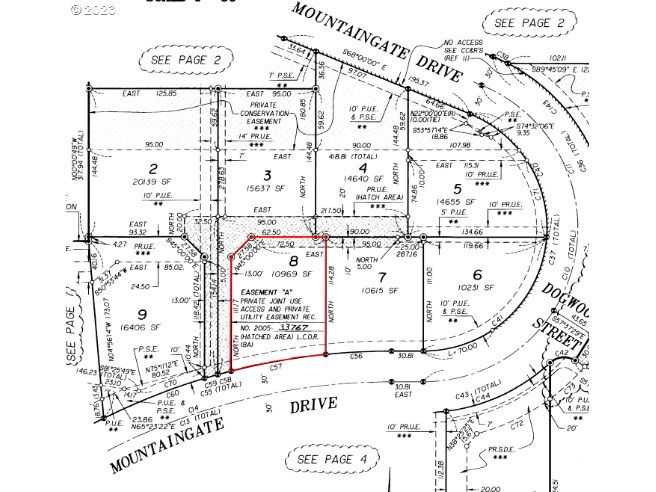

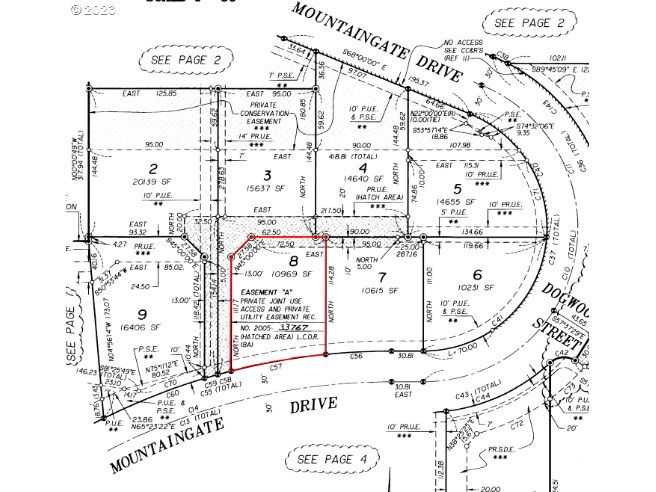

340 Mountaingate Dr, Springfield, OR

340 Mountaingate Dr, Springfield, OR

Price: $140,000 Acres: 0.25

...View this property >>

AND HERE'S YOUR MONDAY MORNING COFFEE!!

260 54th Street, Springfield, OR

260 54th Street, Springfield, OR

320 Mountaingate Dr, Springfield,

320 Mountaingate Dr, Springfield, 340 Mountaingate Dr, Springfield,

340 Mountaingate Dr, Springfield, 91710 Burton Dr, Mckenzie Bridge,

91710 Burton Dr, Mckenzie Bridge,