Local Market Activity for January 2017

Good Morning,

The January numbers are in for the Eugene and Springfield Real Estate market. Our current trend continues with higher home prices and a very low inventory of homes on the market for sale. Home prices are up over 8% over the past twelve months, which along with a slight bump in mortgage interest rates has made our local market the least affordable it has been in over three years.

Don't look for this trend to end quickly. If you are wanting to purchase a home this year, you may have more difficulty finding that perfect home. Many of the homes that we are currently finding for our buyers are homes that we have knowledge of before they hit the market. If you are serious about purchasing a home this year, your best bet would be to contact us, so that we can determine what you are wanting to purchase and then work to find you that home. It's harder, but we have been very successful at it.

January Residential Highlights

Lane County started the year a little cooler than last January. Closed sales (273) fared 5.0% better than in January 2016 (260) although falling 26.2% compared to last month in December 2016 (370).

Pending sales, at 318 for the month, ended 3.6% under the 330 offers accepted last January but were 27.7% ahead of last month in December 2016.

Similarly, new listings, at 320, ended 23.8% below last January (420) but showed a 48.8% increase from the 215 new listings offered last month in December 2016.

Inventory increased in Lane County to 2.1 months in January, with total market time decreasing by twelve days to end at 72 days.

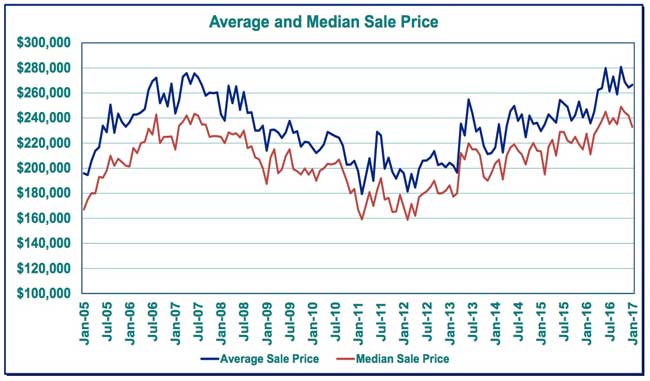

Average and Median Sale Prices

Comparing the average price of homes in the twelve months ending January 31st of this year ($264,800) with the average price of homes sold in the twelve months ending January 2016 ($244,400) shows an increase of 8.3%. The same comparison of the median shows an increase of 7.7% over that same period.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

Price: $257,500 Beds: 4 Baths: 3 Half Baths: 1 Sq Ft: 2715

A beautiful & luxurious home built along a wonderful park. This spacious home includes 2 master suites (1 upstairs & 1 downstairs), large kitchen, formal dining, open living room with gas fireplace, an upstairs bonus & plenty of storage throughout. ...View Home for Sale>>

Anyone who has been keeping in touch with either the local or national housing market trends knows that 2016 was a record year for home sales. 2017 is starting off totally different than the previous year, though. There are many questions as to what kind of Real Estate market 2017 will turn out to be. Here is an article from Realtor.com that talks about the direction that the 2017 housing market will most likely take.

Anyone who has been keeping in touch with either the local or national housing market trends knows that 2016 was a record year for home sales. 2017 is starting off totally different than the previous year, though. There are many questions as to what kind of Real Estate market 2017 will turn out to be. Here is an article from Realtor.com that talks about the direction that the 2017 housing market will most likely take. 1615 Taney St

1615 Taney St The number of for-sale listings fell again in December to the lowest level since 1999, according to the National Association of Realtors. There were just 1.65 million homes for sale at the end of December, which at the current sales pace would take only about 3 ½ months to exhaust. A normal, balanced market has about a six-month supply. This, as the busy spring market is already on the verge of starting. "To say early buyer demand is strong in early 2017 is an understatement — it is titanic. Redfin data shows that buyers are out touring in droves, ready to pounce on new listings that fit the bill," said Nela Richardson, chief economist at Redfin. "The only thing missing is homes for sale to satisfy demand because there just aren't a lot of homes available to buy right now. We are in a real estate black hole until those listings show up again."

The number of for-sale listings fell again in December to the lowest level since 1999, according to the National Association of Realtors. There were just 1.65 million homes for sale at the end of December, which at the current sales pace would take only about 3 ½ months to exhaust. A normal, balanced market has about a six-month supply. This, as the busy spring market is already on the verge of starting. "To say early buyer demand is strong in early 2017 is an understatement — it is titanic. Redfin data shows that buyers are out touring in droves, ready to pounce on new listings that fit the bill," said Nela Richardson, chief economist at Redfin. "The only thing missing is homes for sale to satisfy demand because there just aren't a lot of homes available to buy right now. We are in a real estate black hole until those listings show up again." 1471 Barrington Ave

1471 Barrington Ave

1499 Larkspur Avenue

1499 Larkspur Avenue