Market Activity for June 2015

Good Monday Morning!

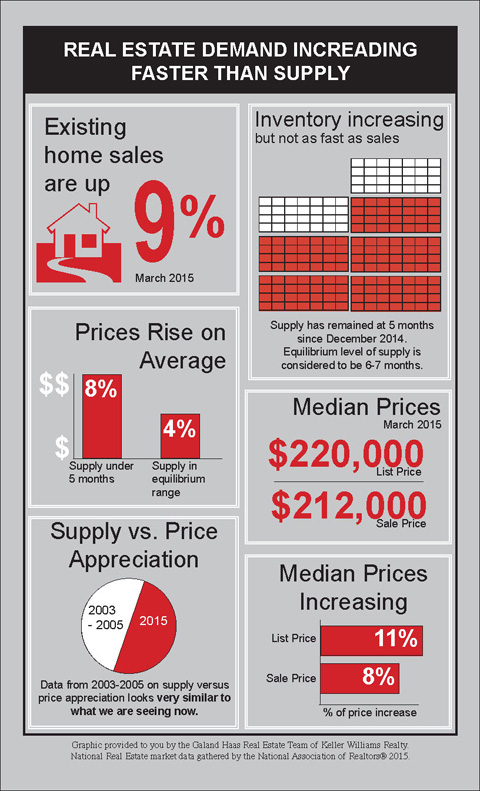

The Real Estate market in the Eugene and Springfield area continues to soar. June was a record breaking month for home sales. At the same time the inventory of homes continues to decline, making the Eugene and Springfield area a strong sellers market. Most of this hot sales action continues to be in the lower and mid range areas. Sales of upper end priced homes continue to be sluggish. This is something that is more unique to Lane county as many parts of the country are seeing a hot market even in the upper price ranges.

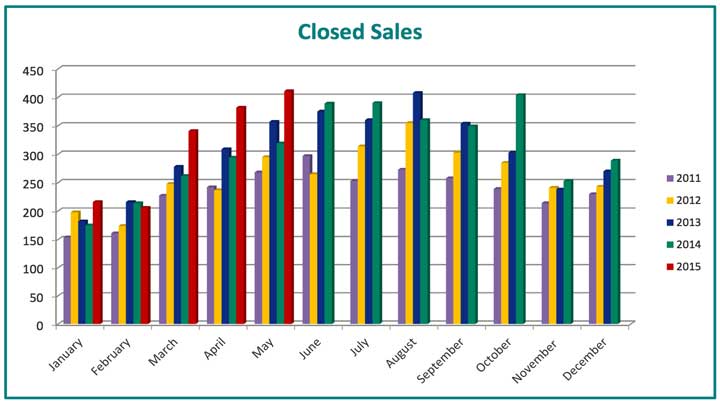

June was another great month for closed sales in Lane County. The 536 closings outpaced last month (411) by 30.4% and last June (389) by 37.8%. It was the strongest June for closings in Lane County on the RMLSTM record—the previous June record of 508 was tallied in 2004.

Pending sales (557) outpaced last June’s 428 by 30.1% and edged out last month’s 552 accepted offers by 0.9%. New listings (680) similarly outpaced last June’s 641 by 6.1% and May 2015 (672) by 1.2%.

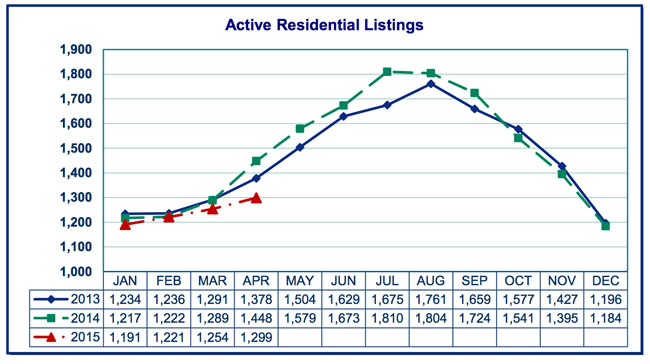

Inventory in Lane County decreased to 2.6 months in June. Total market time decreased to 73 days in the same period.

Year to Date Summary

Activity is up during the first six months of this year compared to the same period last year. Pending

sales (2,695) are up 29.9%, closed sales (2,164) are up 28.0%, and new listings (3,594) are up 12.0% this year compared to the first six months of 2014.

Average and Median Sale Prices

Comparing 2015 to 2014 through June of each year, the average sale price rose 3.0% from $234,300 to $241,300. In the same comparison, the median sale price rose 4.3% from $210,000 to $219,000.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

2511 Garfield St

2511 Garfield St

Price: $435,000 Beds: 3 Baths: 2 Half Baths: 1 Sq Ft: 3908

Spacious custom home w/ tree views! Beautiful 3 levels offer amazing treetop views from lg private master ste which occupies entire upper level. Grand KIT w/ very lg cook island, eat-bar, cherry cabs, corian counters & Wilsonart lam flrs that lead t...

View this property >>

2060 McLean Blvd

2060 McLean Blvd 28135 Spencer Creek Rd

28135 Spencer Creek Rd

4181 N Clarey St

4181 N Clarey St

185 Crest Drive

185 Crest Drive