A Growing Number Of Renters Aren't Interested In Buying A Home

Good Morning!

Rents have crept up in most communities just as home prices have. In fact in many areas rents have increased at a higher rate than home prices. I find today that many of the renters are paying more money to rent than they would be spending on a home payment. By renting they are also losing out on some great opportunities such as depreciation and interest tax deductions. Renters are also just making the landlords payments and not building equity. Long term the buidling of equity in a home is one of the greatest wealth building opportunities for most people. The followng is an article from "Realtor.com" on a recent study of the current trend towards renting.

Rents have crept up in most communities just as home prices have. In fact in many areas rents have increased at a higher rate than home prices. I find today that many of the renters are paying more money to rent than they would be spending on a home payment. By renting they are also losing out on some great opportunities such as depreciation and interest tax deductions. Renters are also just making the landlords payments and not building equity. Long term the buidling of equity in a home is one of the greatest wealth building opportunities for most people. The followng is an article from "Realtor.com" on a recent study of the current trend towards renting.

A growing percentage of apartment renters aren’t interested in buying a home as affordability challenges take a bigger toll on American aspirations of homeownership.

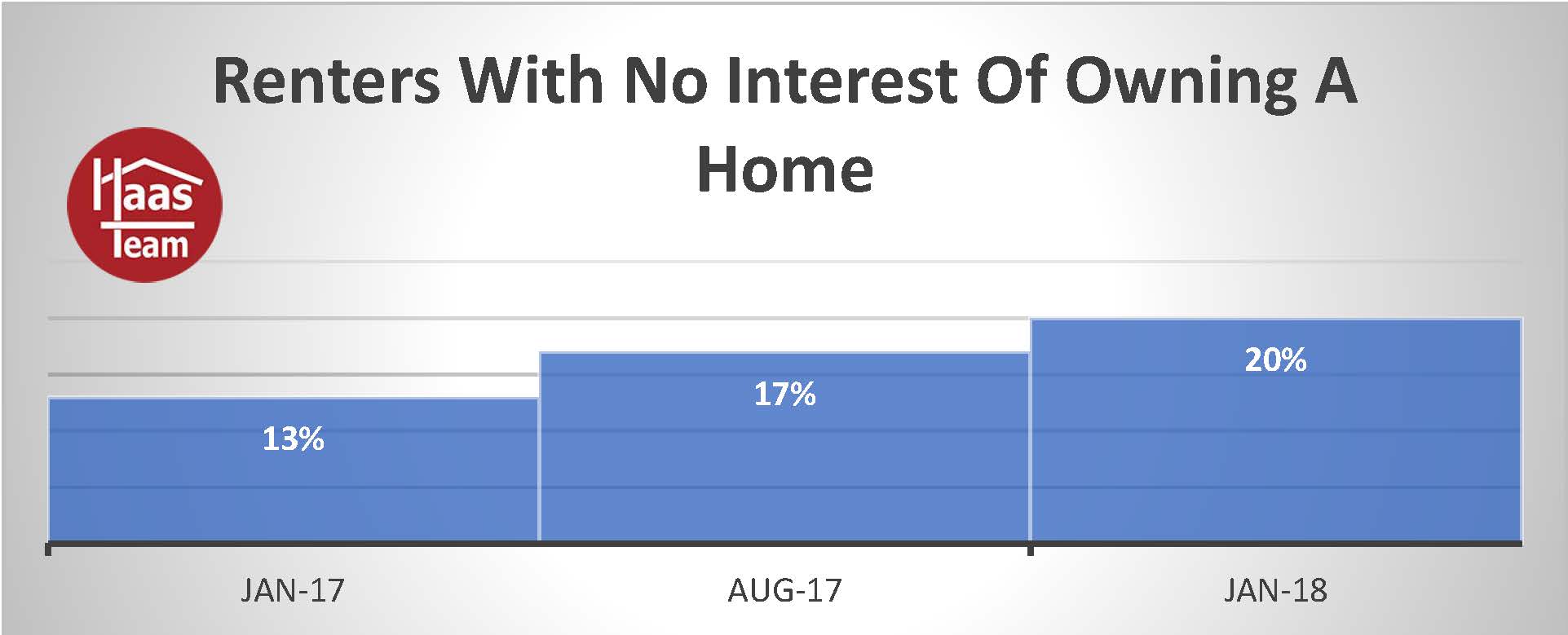

In all, 20% of renters said they have no interest in owning a home, up from 17% in August and 13% in 2016, according to results of a semiannual survey of renters by mortgage company Freddie Mac in January.

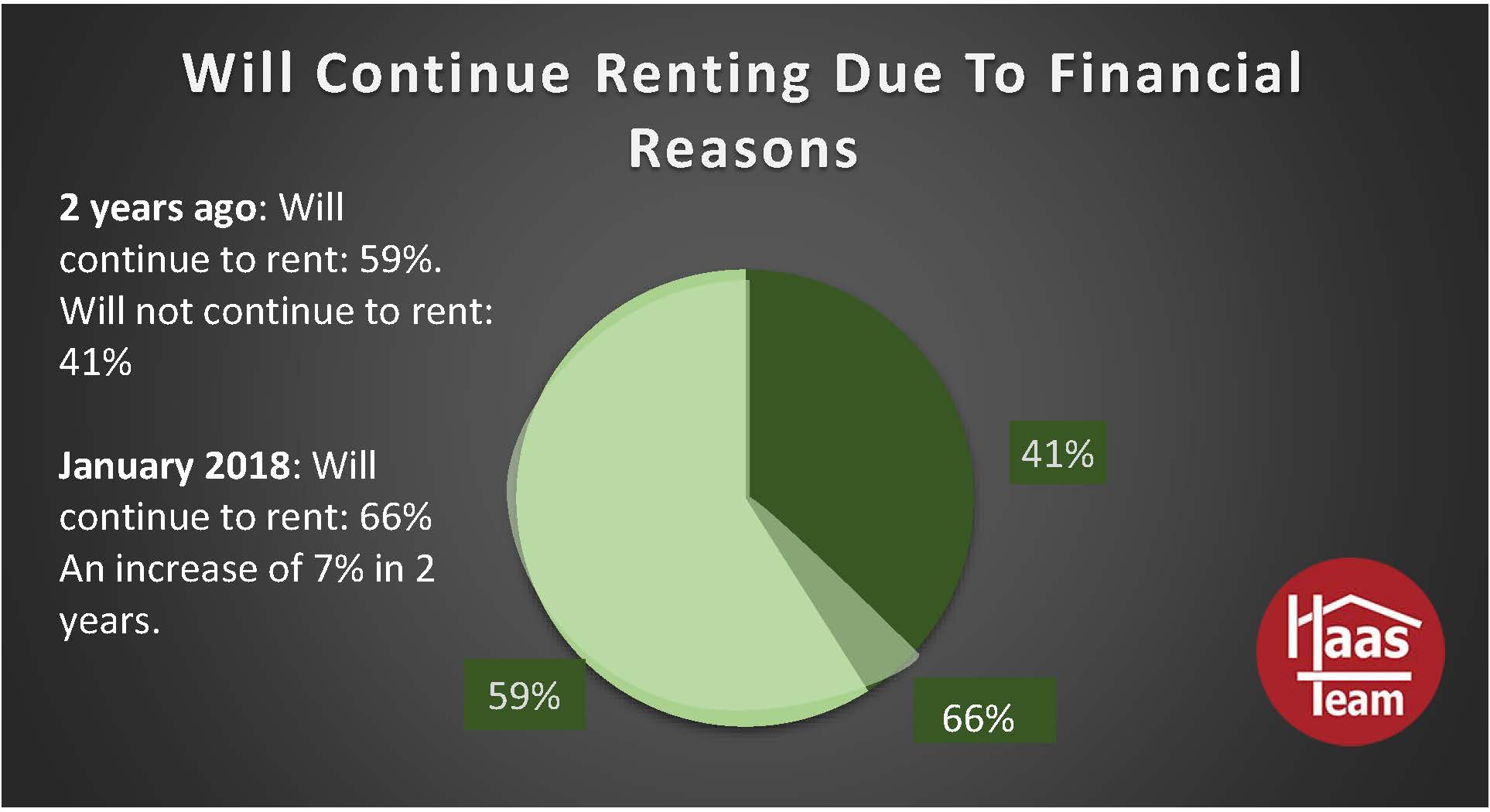

Two-thirds of renters who plan to continue renting said they are doing so for financial reasons, up from 59% two years ago, according to the survey.

“Housing is becoming less and less affordable. Renting is perceived to be the more affordable housing option,” said David Brickman, an executive vice president at Freddie Mac and head of its multifamily division.

“Housing is becoming less and less affordable. Renting is perceived to be the more affordable housing option,” said David Brickman, an executive vice president at Freddie Mac and head of its multifamily division.

The growing preference for renting comes even as the economy has strengthened and credit has loosened, in theory making homeownership possible for more people. Renters generally report being better off financially, with some 39% saying they have money to take them beyond the next payday, up from 34% in August, according to Freddie.

But home prices have risen strongly in recent years while rent increases have slowed, especially for luxury buildings in urban centers. The S&P CoreLogic Case-Shiller National Home Price Index rose 6.2% in January from the same month a year earlier, while the average apartment rent increased a more manageable 3.9% in the first quarter from a year earlier, according to real-estate research firm Reis Inc.

The preference for renting is being driven in part by baby boomers, who are more likely to have experienced some of the pitfalls of homeownership. Some 35% of baby boomers said they have no interest in owning a home, up from 31% in August and 23% two years ago, according to the Freddie Mac survey.

At the same time, concerns about affordability are most prevalent among younger renters. Nearly three-quarters of millennials said they are renting for financial reasons, up from 59% two years ago.

The survey was taken in late January, so it likely doesn’t reflect the full impact of the tax bill that passed in late December and shifted the equation in favor of renting for many households.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

Price: $595,000 Beds: 3 Baths: 3 Sq. Ft.: 3,488

Luxurious rural living! Serene tree views surround 1.79 acres. Every room has been updated! Tubular skylights, recessed LED lights, quartz and granite counters, solid oak floors, new tile floors and carpet, fresh interior paint and more. Master suite on main level. Large kitchen, formal dining, living plus family room, vaulted bonus room, laundry/mud room, 3 fireplaces. 4-car garage, RV parking, greenhouse, orchard...View property.

As we approach the Holidays, many people are focused on other things besides buying and selling homes. This can certainly work in your favor if you are a home buyer. The following is an article from "

As we approach the Holidays, many people are focused on other things besides buying and selling homes. This can certainly work in your favor if you are a home buyer. The following is an article from "

If you are considering a home purchase, your credit score is a huge part of this process. You credit score also impact many part of your financial life from what you pay for car insurance to your ability to get credit. The following is an article from "Realty Times' that goes over some great ideas on how to obtain the best credit score.

If you are considering a home purchase, your credit score is a huge part of this process. You credit score also impact many part of your financial life from what you pay for car insurance to your ability to get credit. The following is an article from "Realty Times' that goes over some great ideas on how to obtain the best credit score.

Seeing fewer for-sale signs now that summer is over? That can be great news for buyers who are looking to score a new home and buyers who want to get rid of their place and buy a new one. If you think you missed the boat on making your move this year, we're here to tell you why buying and selling in the fall can work for you.

Seeing fewer for-sale signs now that summer is over? That can be great news for buyers who are looking to score a new home and buyers who want to get rid of their place and buy a new one. If you think you missed the boat on making your move this year, we're here to tell you why buying and selling in the fall can work for you. Even in the hot sellers market that we currently have here in the Eugene and Springfield area, it is important to prepare your home for sale if you are going to put it on the market. Paying attention to detail and having your home in great condition can mean a quicker sale and far more money. Even in this market, I see homes sit out there and not sell. You still have to price your home right, but condition is an extremely important factor for most homebuyers. Here is an article from "Realty Time" that will give you some pointers on preparing your home for sale.

Even in the hot sellers market that we currently have here in the Eugene and Springfield area, it is important to prepare your home for sale if you are going to put it on the market. Paying attention to detail and having your home in great condition can mean a quicker sale and far more money. Even in this market, I see homes sit out there and not sell. You still have to price your home right, but condition is an extremely important factor for most homebuyers. Here is an article from "Realty Time" that will give you some pointers on preparing your home for sale. 755 Horn Ln

755 Horn Ln The low inventory of homes for sale that we currently have in our local Real Estate market has made home buying much more difficult. The current shortage of homes for sale has driven prices up and made our home purchase market very competitive, especially in the price ranges where most first time homebuyers are looking. It is easy to get caught up in this competitive market and pay too much for a home or purchase a home that may not fit your needs. In this market, the help of a knowledgeable homebuyer specialist Realtor is a must. They can help keep you from making mistakes that will haunt you down the road. It is also important to educate yourself about the current market and to not be forced into a rush purchase. The following article from "Realty Times" talks about how to deal with a home purchase during this market.

The low inventory of homes for sale that we currently have in our local Real Estate market has made home buying much more difficult. The current shortage of homes for sale has driven prices up and made our home purchase market very competitive, especially in the price ranges where most first time homebuyers are looking. It is easy to get caught up in this competitive market and pay too much for a home or purchase a home that may not fit your needs. In this market, the help of a knowledgeable homebuyer specialist Realtor is a must. They can help keep you from making mistakes that will haunt you down the road. It is also important to educate yourself about the current market and to not be forced into a rush purchase. The following article from "Realty Times" talks about how to deal with a home purchase during this market. 32538 Hatfield St

32538 Hatfield St

Hilltop Drive #1

Hilltop Drive #1

2445 Elysium Ave

2445 Elysium Ave

2511 Garfield St

2511 Garfield St