National Housing Market Update

Good Monday Morning!

Homes sales dipped in October and first time buyers sales were a big part of this slump. Competition caused by low inventories of homes in first time buyer price ranges was the primary cause. Here is information on our current national housing market with statistics from the National Association of Realtors.

A month-over-month dip in home sales last month caused real estate watchers to ponder—gasp—a potential cooling of the market. But on Thursday the National Association of Realtors® reported that sales are up again.

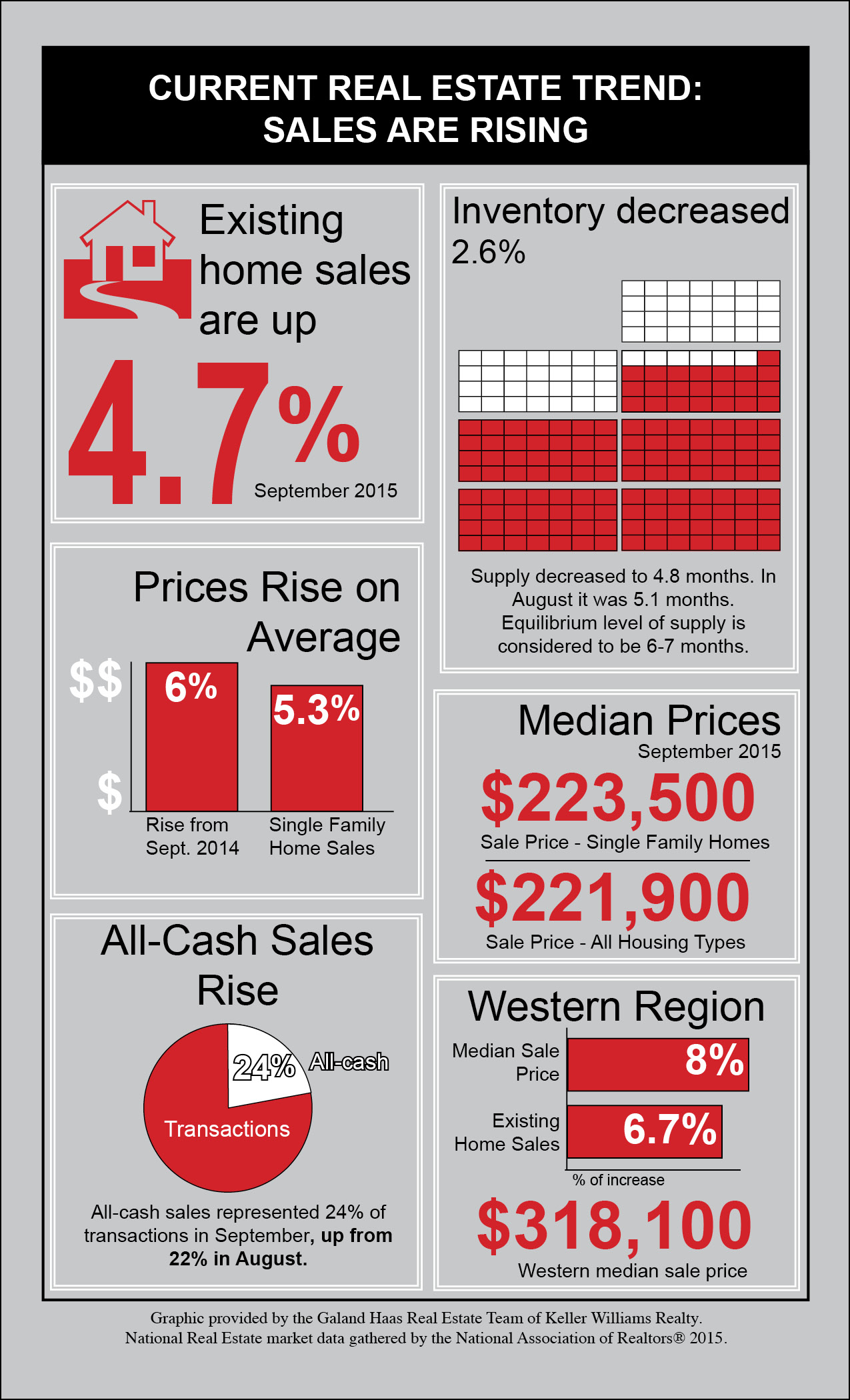

Existing-home sales—completed sales of single-family homes, townhomes, condominiums, and co-ops—rose 4.7% from August to September, reaching 5.55 million. That’s the 12th consecutive month to see year-over-year growth, and the second-highest peak since February 2007, when sales totaled 5.79 million.

The median existing-home price for all housing types was $221,900 in September, 6.1% more than September 2014. This is the 43rd consecutive month that we’ve had year-over-year gains. Single-family home sales increased 5.3%, with a median price of $223,500, while condo and co-op sales remained unchanged, with a median existing-condo price of $209,200.

All-cash sales rose, too: They represented 24% of transactions in September, up from 22% in August. Short sales stayed on the market for an average of 135 days, but short sales and foreclosures are still down from a year ago—7% now and 10% then.

Why the reversal on sales in general? These are seasonally adjusted numbers, so they don’t reflect the typical fall slowdown. August sales, however, were affected by the stock market dips that shook buyers’ confidence.

“Sales are impacted by major stock market declines, since at least one in five buyers funds at least a portion of their purchase with stock or retirement funds,” said realtor.com® chief economist Jonathan Smoke. “But barring stock corrections that reflect real economic downturns—which we are not experiencing—homes sales typically return to the prior trend after stock values stabilize.”

But not all numbers were up: Inventory decreased 2.6% and is 3.1% lower than a year go. There’s a 4.8-month supply of unsold housing—in August, it was 5.1 months.

Maybe it’s counterintuitive—how can there be more sales when there’s less inventory?

It’s all that pent-up demand. Unfortunately for first-time buyers, all that competition has driven house prices up; you’re more likely to buy a home if you already have one.

“First-time buyers fell to 29% of sales in September after climbing to their highest share of the year in August (32%),” according to the NAR. “A year ago, first-time buyers represented 29% of all buyers.”

That’s the biggest surprise, Smoke said, but “despite that decline, we estimate from the monthly sales data this year that first-time buyers have been responsible for 45% of the growth in sales over last year.”

Whether the rise in existing-home sales continues depends on one thing: jobs. The 6% rise in prices is just about double the pace of wages. We need more, and better-paying, employment to keep sales up. That’s complicated by the fact that most future job growth is rooted in the relatively low-paying service sector. Sales may be up, but we’ll need inventory to rise with them.

Regional breakdown

Northeast: September existing-home sales rose 8.6% to an annual rate of 760,000, 11.8% above a year ago. The Northeastern median price was $256,500, 4% above September 2014.

Midwest: September existing-home sales rose 2.3% to an annual rate of 1.31 million, 12% above a year ago. The Midwestern median price was $174,400, 5.4% above September 2014.

South: September existing-home sales rose 3.8% to an annual rate of 2.21 million, 5.7% above a year ago. The Southern median price was $191,500, 6.2% above September 2014.

West: September existing-home sales rose 6.7% to an annual rate of 1.27 million, 9.5% above a year ago. The Western median price was $318,100, 8% above September 2014.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

52494 McKenzie Hwy

Price: $280,000 Beds: 3 Baths: 2 ∏ Baths: 1 Sq Ft: 1945

Riverfront retreat with many upgrades! Relax on over half an acre and 200ft of river frontage on a large partially covered deck overlooking the McKenzie with no neighbors across. Fenced with yard, garden and 2 driveways with room for RV/toy parking,...

View this property >>

Home-buying is multi-tasking on steroids. Are you up for the challenge?

Home-buying is multi-tasking on steroids. Are you up for the challenge?

Few things in life are more exciting than buying your first home. The feeling of turning the key for the first time (or clicking the garage door opener) is thrilling. You'll likely feel a sense of pride like never before. But getting to that point may be a challenge. And the challenges won't end once you move in.

Few things in life are more exciting than buying your first home. The feeling of turning the key for the first time (or clicking the garage door opener) is thrilling. You'll likely feel a sense of pride like never before. But getting to that point may be a challenge. And the challenges won't end once you move in. 2685 Valley Forge Dr

2685 Valley Forge Dr The Know Before You Owe disclosure form issued by The Consumer Financial Protection Bureau will go into effect on October 3, 2015. The rule provides for easier-to-use mortgage disclosure forms that clearly lay out the terms of a mortgage for a homebuyer.

The Know Before You Owe disclosure form issued by The Consumer Financial Protection Bureau will go into effect on October 3, 2015. The rule provides for easier-to-use mortgage disclosure forms that clearly lay out the terms of a mortgage for a homebuyer.

114 Hayden Bridge Way

114 Hayden Bridge Way Winging it on your own with a home purchase today is much harder than it has been in the past. It has never been more important to seek out a Real Estate professional who is an expert in the mortgage world, home values by neighborhood and area, home inventories, market trends and is a great negotiator. It's just as important to find a trusted Real Estate expert as it is to find the best lawyer or doctor. It can make a huge difference during the purchase process and it can pay you huge dividends down the road. Here is an article that was published in "Realty Times", that speaks to the importance of hiring a professional Real Estate expert for your home purchase.

Winging it on your own with a home purchase today is much harder than it has been in the past. It has never been more important to seek out a Real Estate professional who is an expert in the mortgage world, home values by neighborhood and area, home inventories, market trends and is a great negotiator. It's just as important to find a trusted Real Estate expert as it is to find the best lawyer or doctor. It can make a huge difference during the purchase process and it can pay you huge dividends down the road. Here is an article that was published in "Realty Times", that speaks to the importance of hiring a professional Real Estate expert for your home purchase.