Federal Reserve Rate Increase Had Little Effect on Mortgage Rates

Good Monday Morning!

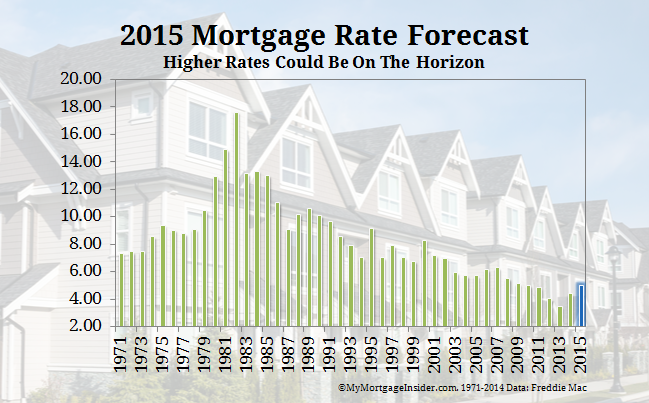

I am asked frequently these days about mortgage rates jumping due to the Feds recent increase in their rates. The fact is that the Fed's increase had little effect on mortgage rates and in fact mortgage rates have continued to decline since the Fed increase. If you want to purchase a home, now is the time. Our current low mortgage rate situation is not here to stay, but you need to take advantage of it. Here is an article from "Realtor.com" that explains our current situation with mortgage rates. It is an interesting read.

The Federal Reserve recently raised interest rates, U.S. stocks are tumbling and new worries about the Chinese economy seem to emerge daily. So go ahead and buy that house you’ve been looking at.

The Federal Reserve recently raised interest rates, U.S. stocks are tumbling and new worries about the Chinese economy seem to emerge daily. So go ahead and buy that house you’ve been looking at.

Well, not necessarily. But consider: all the worries about China that have battered the U.S. stock market in early 2016 have done the opposite for bonds. More money pouring into Treasurys has driven mortgage rates to a two-month low. A 30-year mortgage slipped to 3.92% in mid-January.

The housing market had already been steadily gaining ground even before the latest drop in rates. Indeed, it’s been one of the strongest parts of the economy over the past year. Sales of new and previously owned homes are likely to finish 2015 at the highest level since before the Great Recession.

What’s more, the number of permits to build additional homes is on track to reach an eight-year high.

The final housing numbers for 2015 will start to trickle in this week.

Work on new construction, known as housing starts, is forecast to rise to a 1.19 million annual rate in December from 1.17 million in the prior month. Starts will top the 1 million mark for the second straight year.

Six years ago, builders were producing fewer than 600,000 new homes a year.

Sales of existing homes, meanwhile, are expected to hit a 5.15 million annual rate in December and finish the year about 25% higher compared to the post-recession low.

Most economists predict new construction and sales will increase again in 2016, aided by a much improved labor market. Barring, of course, China bringing the rest of the world to a crashing halt.

“The U.S. economy added more than 200,000 jobs per month on average in 2015, and wage growth is picking up,” noted Stuart Hoffman, chief economist of PNC Financial Services.

In the past three years, the U.S. has produced 8.2 million new jobs to give more people entering their prime earning years the ability to buy a home.

The big wild cards are mortgage rates and home prices, both of which could deter buyers.

The Fed raised a key short-term rate in December for the first time in nearly a decade, and the central bank is widely expected to push rates even higher in 2016. Yet so far that hasn’t translated into upward pressure on long-term Treasurys or home mortgages. Right now investors are more worried about whether a slowing Chinese economy will hurt the rest of the world.

The higher cost of buying a home could act as another repellent. Prices rose in 2015 to levels last seen shortly before the onset of the Great Recession in late 2007.

An expected increase in home construction could make it easier for buyers, though. Permits for new construction in November, for instance, were almost 20% higher compared to the same month in 2014. A greater supply of homes for sale would help hold the line on prices.

While home builders remain optimistic, the same can’t be said for American manufacturers. Sales and profits have softened over the past year because of a strong dollar, weak global economy and a slump among energy firms that are among the biggest buyers of manufactured goods.

A monthly Philadelphia Federal Reserve report on the state of manufacturing is likely to show an industry still under siege in January.

Have An Awesome Week!

THIS WEEKS HOT HOME LISTING!

Price: $185,000 Beds: 4 Baths: 2 Sq Ft: 1645

Great townhouse! Townhouse with garage and yard. Four bedrooms and 2 bathrooms. Large kitchen, window shelves and seating. Fenced patio. Located one block from shops, school, park....

View this property >>

The Know Before You Owe disclosure form issued by The Consumer Financial Protection Bureau will go into effect on October 3, 2015. The rule provides for easier-to-use mortgage disclosure forms that clearly lay out the terms of a mortgage for a homebuyer.

The Know Before You Owe disclosure form issued by The Consumer Financial Protection Bureau will go into effect on October 3, 2015. The rule provides for easier-to-use mortgage disclosure forms that clearly lay out the terms of a mortgage for a homebuyer. Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers.

Economists predict that the soaring economy, improved job outlook and ebullient consumer confidence will cause the Federal Reserve to start raising overnight borrowing rates to banks. Mortgage interest rates will become volatile, and things can change quickly for consumers. 48808 MCKENZIE HWY

48808 MCKENZIE HWY